If you bought shares in a stock, index fund or exchange traded fund specifically because it regularly pays out dividends, how much money could you expect to earn in dividends each year from your investment?

That's the problem we're taking on with our latest tool, which you'll find below - if you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version of the tool on our site. For dividend and stock price data, we'll point you to Dividend.com, where if you enter the ticker symbol, company name or fund name into that site's search function, you can quickly get the data our tool needs to do its math.

Got all that? Ready... set... go!

Now, here's an interesting question: if you are counting upon making money from owning dividend paying stocks, can you afford the situation where your dividend payments might be slashed?

That's a real question to consider. For the S&P 500, the annual payout of dividends during the Great Recession peaked at $28.85 per share in September 2008, before proceeding to fall by 24% all the way to $21.90 per share during the next six months to $21.90 per share in March 2009.

Trailing twelve month dividends payouts from the S&P 500 didn't rise back above $28.85 per share mark for another three and a half years, when they finally surpassed that level in September 2012. [If you want to pull the historical data for the S&P 500, please check out our tool that puts the S&P 500 At Your Fingertips!]

If you want to weather that kind of storm, you might consider adopting a personal finance strategy where you only count on 65% to 75% of your annual dividend payments, which would pretty much see you through the worst that the U.S. stock market has ever put investors through.

Otherwise, when Mr. Market takes a hard turn south, you could very well find yourself in for a very hard ride if you were counting on getting a fixed amount of dividends.

Labels: dividends, investing, personal finance, risk, tool

Just two months ago, we asked if new home sales in the U.S. were topping out. Based on the just released data for October 2017, we can now say the answer to that question is "not quite yet". The following animated chart, showing the history of the effective market cap of the new home sales market in the U.S. from December 1975 through the preliminary data for October 2017, shows why we think that.

In nominal terms, the spike in new home sales in October 2017 says that the answer is clearly "no", with the trailing twelve month average of the market cap for new home sales climbing in both September and October 2017 to reach $19.10 billion after having recently hit the bottom of a trough at $18.35 billion in August 2017. After adjusting for inflation, we find that the answer is also no, but is less clearly so, with the trailing twelve month average for October 2017 hitting $19.28 billion in constant September 2017 U.S. dollars, just barely ahead of the previous peak of $19.20 billion reached in June 2017.

Now, here's the interesting thing - when we were observing the potential topping for the market capitalization of new home sales two months ago, the data didn't yet incorporate much of the effects of either Hurricane Harvey in Texas or Hurricane Irma in Florida. A good part of the increase that we're seeing in the two months since may be attributed to the recovery from those natural disasters, which is inflating the nation's overall new homes sales figures.

That is to be expected with post-disaster insurance claims being settled, which is allowing for an increase in new home sales contracts in hurricane-impacted regions, where we are seeing a particularly strong surge in new home sales in the U.S. Census Bureau's South region, which includes both Texas and Florida.

In upcoming months, that situation should stabilize back to more normal levels. And with the Federal Reserve set to start new rounds of interest rate hikes, it will be interesting to see to what extent those actions will have on the health of the market for new homes in the U.S.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 28 November 2017.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 28 November 2017.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100[Online Application]. Accessed 28 November 2017.

Labels: real estate

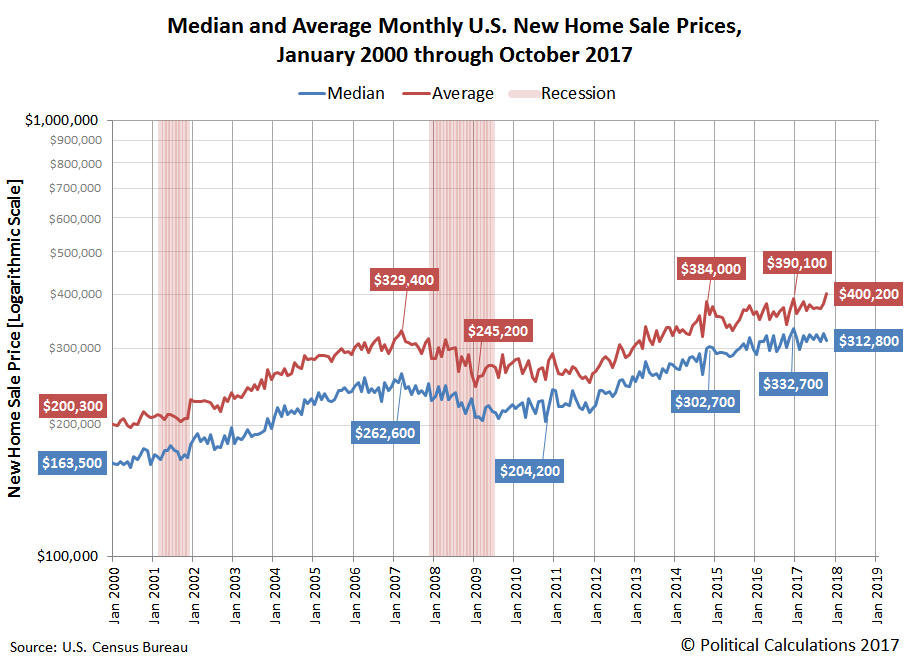

The just released data for October 2017 is preliminary, but if it holds, the average sales price of a new home in the United States exceeded $400,000 for the first time.

The average new home sale price spiked upward by $19,100 in October 2017 to reach a new record value of $400,200. At the same time, the median new home sale price declined by $12,100 to $312,800 for the month.

While these figures represent preliminary data that will be revised three more times over the next three months before being finalized, they do suggest that October 2017 saw a significant increase in the number of sales of modestly-priced new homes combined with a limited number of very high priced homes. Bill McBride offers some additional insight into what drove the month's sales numbers:

There was clearly some rebound following hurricane Harvey. Sales in the South were up sharply in both September and October, from August, and at the highest level since October 2007. Some contracts in the South, that would have been signed in August, were probably delayed until September and October. Also some people who lost homes, might have signed contracts for new homes in September and October (New home sales are counted when contracts are signed).

Overall, the preliminary sale price data also suggests that a new peak in relative unaffordability for new homes sold in the U.S. may have been reached in October 2017. The ratio of the trailing year averages of median new home sale prices and median household income has hit an all time high value of 5.463, which slightly eclipses the level of the previous peak of 5.460 in August 2017, which is based on revised new home sale price data for that month.

Reference

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [Excel Spreadsheet]. Accessed 27 November 2017.

Labels: real estate

Over the last two weeks, the S&P 500 continued its slowly upward trajectory and set new record highs, closing above 2,600 for the first time ever on the Friday following Thanksgiving 2017.

From our perspective, investors appear to be closely focused on the distant future quarter of 2018-Q2 in setting current day stock prices.

There's an important caveat to note at this point however. Following the release of the minutes from the Fed's Federal Open Market Committee meeting on 31 October-1 November 2017 meeting, which confirmed that the Fed is all but set to announce a hike in short term U.S. interest rates at the end of its' 13 December 2017 meeting, the CME Group's FedWatch tool is now indicating that there is over a 50% probability that the Fed will move to hike short term U.S. interest rates again by the end of the first quarter of 2018, rather than waiting until the end of 2018-Q2 as the futures for the Federal Funds Rate had previously indicated.

| Probabilities for Target Federal Funds Rate at Selected Upcoming Fed Meeting Dates (CME FedWatch on 15 September 2017) | ||||||

|---|---|---|---|---|---|---|

| FOMC Meeting Date | Current | |||||

| 100-125 bps | 125-150 bps | 150-175 bps | 175-200 bps | 200-225 bps | 225-250 bps | |

| 13-Dec-2017 (2017-Q4) | 0.0% | 91.5% | 8.5% | 0.0% | 0.0% | 0.0% |

| 12-Mar-2018 (2018-Q1) | 0.0% | 49.2% | 46.0% | 4.7% | 0.1% | 0.0% |

| 13-Jun-2018 (2018-Q2) | 0.0% | 24.0% | 46.0% | 26.0% | 3.9% | 0.2% |

| 26-Sep-2018 (2018-Q3) | 0.0% | 14.4% | 36.5% | 33.4% | 13.3% | 2.3% |

With investors shifting their focus to that nearer-term future quarter, our dividend futures-based forecasting model suggests that the future trajectory for the S&P 500 will likely shift downward toward the lowest alternative future trajectory shown in our spaghetti forecast chart above.

On top of that, we're also coming up on another one of those periods where the echo of past volatility in U.S. stock prices will affect the accuracy of our forecasting model, which is a consequence of our model's use of historic stock prices as the base reference points from which we project future stock prices. Since the duration of this upcoming echo effect is comparatively short, rather than add a new forecast range to the chart, we'll simply note that we expect that our standard model's forecast will overshoot the actual trajectory of the S&P 500 during the next two weeks, absent a new noise event for the U.S. stock market.

With that said, let's catch up with the major market-moving headlines that caught our attention over the last two weeks.

- Monday, 13 November 2017

- Tuesday, 14 November 2017

- Wednesday, 15 November 2017

- Fed's Evans will go into December meeting with open mind

- Fed should signal tolerance for higher U.S. inflation, Evans says

- Central banks can't fight rise in asset prices explicitly: Fed's Evans

- Strong U.S. economy calls for December rate hike: Fed's Rosengren

- Weak oil weighs on stocks; data puts focus on rate hikes

- Thursday, 16 November 2017

- Oil extends losing streak on U.S. oversupply issues

- [Despite very long track record of being wrong on this very issue.... ] Fed's Mester says not troubled by low inflation, confident it will pick up

- Fed's Kaplan: overshooting employment goal could trigger rate hike

- Which really means: Fed's Kaplan: falling unemployment may trigger rate hikes

- Fed's Williams calls for global rethink of monetary policy

- Fed's Williams says price-level targeting fits current framework

- Fed's Williams says December rate hike 'perfectly reasonable'

- Wall Street rallies powered by Cisco, Walmart; House tax vote supports

- Friday, 17 November 2017

- Monday, 20 November 2017

- Tuesday, 21 November 2017

- Oil rises, but capped as caution sets in ahead of OPEC meeting

- U.S. homes sales accelerate; supply still a constraint

- Stocks rally on growth, earnings outlook; bonds slip

- No impact to major U.S. stock market indices, but interesting: China clamps down on online micro lending; U.S.-listed shares plunge

- Wednesday, 22 November 2017

- Friday, 24 November 2017

Over at The Big Picture, Barry Ritholtz succinctly summarized the pluses and minuses for the U.S. economy and markets for both Week 3 and Week 4 in November 2017.

It's the age old American dilemma of what to do with the remains of the bird following the Thanksgiving holiday, while not doing any more to continue sending your Body Mass Index in the wrong direction. This year, we're featuring Cooking Light's recipe suggestions for what to do with all that's left behind!

Turkey burnout is insidious. One minute your bird is beautiful and fragrant, floating majestically to the table, its crisp skin glistening. You could eat every last bite all by yourself. But in a twinkling―or, to be exact, after a couple of servings―the feast loses its luster. By the time the candles have been snuffed, the good china put away, and the wine glasses washed, what's left of your 20-pounder looks like just one more responsibility. Worse, the week ahead looms with the dreary prospects of turkey hash, turkey supreme, and turkey a la king. For a moment, you consider getting a really big dog.

Not to sound unsympathetic, but snap out of it! Strip that bird straightaway with a sharp knife, and quickly refrigerate the white and dark meat in separate airtight containers (for up to five days or freeze for up to two months). Don't labor over the bones and fatty "parson's nose," telling yourself you'll boil them down into soup stock―you know you won't be in the mood for that anytime soon. Toss 'em, and be done with it. Feel better? You should. You've cleared the slate for a fresh approach to this versatile, forgiving meat and stocked a ready-to-use supply.

These recipes give your leftovers a new life, without ever resorting to a turkey-noodle surprise.

Cooking Light's recipe suggestions include:

- Curried Turkey Soup

- Chutney-Turkey Salad on Focaccia

- The Classic Hot Brown

- Cheddar Cheese Sauce

- Creamy Triple-Mushroom Bisque with Turkey

- Fiery Turkey-Pâté Crostini

- Devil in Your Pocket

- White Turkey Chili

And of course, we would be remiss if we didn't pass along the FoodSafety.gov's instructions for how to safely handle all the leftovers. Enjoy!

Labels: food, thanksgiving

For many Americans, Thanksgiving dinner might be the single largest, most calorie-laden meal that they consume all year. And since 36% of American adults and 17% of American youths would qualify as obese according to the Centers for Disease Control, a large number of Americans would benefit from some preplanning for what they'll eat during Thanksgiving dinner.

That's why this year, we're introducing a tool to help you add up calories that you might consume from a traditional Thanksgiving menu *before* you even sit down to begin this year's feast, using data from the USDA's Food Composition Database.

To use it, you just need to indicate the number of servings for each menu item that you'll be consuming at this year's Thanksgiving. Then just click the "Calculate" button to estimate how many calories your body will need to process! (If you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version of the tool at our site.

Playing with the tool, you'll quickly find that the biggest hitters are the dessert items, where having slices of apple, pumpkin *and* pecan pie will easily spike the calorie count for your Thanksgiving meal by more than 1,000 calories.

You should also keep an eye on your bread stuffing, candied yam and mixed nut consumption, since these items aren't far behind. Please also note that Green Bean Casserole does not appear on this menu. That is not an accidental omission - we believe that green bean casserole is just wrong, where it doesn't belong on any table, anywhere, ever.

There's just one more thing to consider, and that's how our Thanksgiving meal calorie estimate compares with the USDA's estimates of the daily calorie requirements for someone of your age and activity level. As you may have found from using our tool, it's a very easy thing for a Thanksgiving meal to exceed an entire day's worth of calories.

Hopefully, this tool has provided you with the information that you need to have all the tasty goodness that you want in reasonably sized servings at this year's feast. Have a happy Thanksgiving!

Labels: food, health, thanksgiving, tool

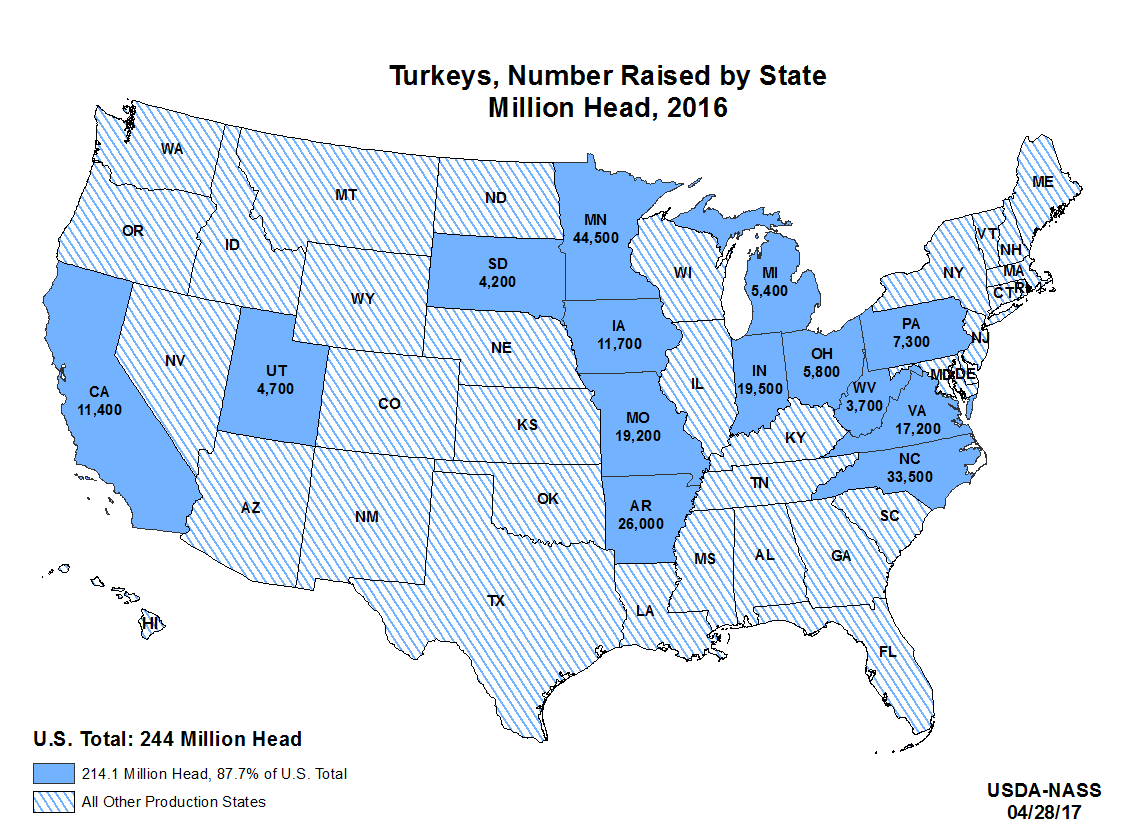

Want to know how many turkeys were raised on U.S. farms and where those farms are?

You've come to the right place! First up, the following chart shows how many millions of U.S. turkeys have populated U.S. farms in each year from 1970 through 2017.

The following map indicates the 14 states in which nearly 88% of those turkeys lived in 2016!

Are you ready to meet this year's flock?

Just in case you came to this post searching for information about the population or demographics of Turkey, well, go here instead....

Labels: demographics, thanksgiving

Some key statistics about U.S. farm-raised turkeys in 2017:

- Turkeys breed in the spring, their twenty-eight-week growth cycle coinciding perfectly with Thanksgiving.

- Turkey consumption has grown from 6.4 pounds/person in 1960 to 16.8 pounds/person in 2017.

- Pound for pound, turkey is the least expensive meat and is a low-fat meat alternative to beef and pork.

- We eat more than 46 million turkeys on Thanksgiving.

- The average weight of a turkey is now over 30 pounds; it was 15 pounds in 1930.

- Turkeys have been transformed by breeding into a fast-growing bird, efficiently converting feed to food.

- Turkeys are so large they require artificial insemination to reproduce.

- Industrial turkey production is year-round, producing turkey bacon, sausage, burgers and those large turkey legs found at Disney World.

- Industrialization has problems, such as stressing the animals, who no longer regulate their food intake and mimic us, overeating too often. Their deaths may be humane but remain disturbing to those (sub)urbanites who remain disconnected from their sources of food.

Those stats are a little outdated - the preliminary data that we have from the U.S. Department of Agriculture indicates that the average live weight of a farm-raised turkey in the United States is now a little over 31 pounds (14 kg) in 2017.

Which brings up a question that perhaps should now be asked: "What is the biological limit for how big a turkey can get?"

Labels: technology, thanksgiving

It's Thanksgiving Week 2017, and here at Political Calculations, that means that we'll be devoting the whole week to exploring the centerpiece of this uniquely American holiday in keeping with our annual traditions.

But that doesn't mean that we won't be discussing things like the stock market either - we'll just be loading it up with a healthy serving of Thanksgiving turkey.

Let's get started by doing just that, where we'll update the chart showing our favorite spurious correlation of all time - the apparent relationship that exists between the average live weight of U.S. farm-raised turkeys and world stock prices. The following chart updates that relationship through this point of time in 2017!

If you're the type of person who believes that they can divine the future from any synchronous patterns you identify on charts showing apparently strongly correlated data like this - and the correlation here is indeed strong with an R² of 0.9717 - you should be very worried about the potential for a stock market crash in the near term, seeing as the chart shows that every time that the MSCI world stock index has risen higher than the proportionately scaled average live weight of U.S. farm-raised turkeys, a major correction hasn't been far behind.

We'll also tell you that even after detrending the data to account for the rising linear trends for both data series, the correlation doesn't disappear as you might suspect would happen for a fully spurious correlation. Instead, the R² drops to 0.5315, which might be considered to be a moderately-strong correlation.

And yet, we're happy to confirm that the apparent correlation is genuinely spurious. It's total garbage - the growth of the average weight of turkeys raised on farms in the U.S. is not, in any way that we can identify, connected to the growth of global stock prices.

If you want proof of how worthless this apparent relationship is, just consider that we first featured the spurious correlation between the average live weight of U.S. farm-raised turkeys and global stock prices back in 2014 - and as yet, the major sustained correction in stock prices that would seem to be imminent from this apparent relationship has not occurred.

So when you see charts showing these kinds of seemingly-correlated relationships, take them with a strong grain of salt! You should, at the very least, be able to identify some connection that logically links the two data series being compared. Without such a connection, you're likely just looking at something that, while it might be fun to consider, probably doesn't have much bearing upon or connection to the real world.

Speaking of which, since we've opened the door, if you're reading this article on a site that republishes our RSS news feed that also allows comments, please share your links to examples of fun-but-false correlations. At the very least, the exercise might help you avoid the social disaster minefield that you would find yourself in if you're foolish enough to start talking up politics at this year's Thanksgiving feast by arming you with better and more interesting discussion topics.

Update: If you like puzzles and would like to take on an extra challenge over the holiday, you might consider looking into our detrending observation, where the trends that need to be subtracted from both series to properly detrend them are perhaps not linear ones!

Labels: junk science, stock market, thanksgiving

Back in June 2014, we were among the first to observe in near real time that China's economy had cooling to the point where it could be considered to be in recession, which we based on a unique combination of trade and environmental data. The recessionary conditions that we observed persisted from 2014 through mid-2016, when they finally began to reverse. We noted at the time that both trade data and the measurements of carbon dioxide emitted into the atmosphere indicated that the Earth's economy was cooling during that period.

In January 2017, the outgoing Obama administration claimed that the global economy was growing while carbon emissions were flat, an apparent decoupling between the two that directly contradicted our observations.

On 13 November 2017, we got a stunning vindication of our observations from the Global Carbon Project, which released its latest updates and measurements for worldwide carbon emissions, via the Financial Times, which reported the following (emphasis ours):

Stronger Chinese economic growth will push global greenhouse gas emissions to a record high in 2017 after remaining flat for three years, dashing tentative hopes of a turning point in the world’s efforts to curb climate change.

A new report by the Global Carbon Project, an international research consortium, predicts that carbon dioxide emissions from fossil fuels and industry will rise 2 per cent this year. The report was released at the UN climate change meeting in Bonn on Monday....

This year’s rise is especially disappointing as it follows three years of almost no growth in emissions despite a world economy expanding at a steady clip. In 2016, emissions were flat even though the world economy grew 3.2 per cent. One explanation for the uptick is that China’s economic slowdown in the middle part of this decade was more pronounced than official figures suggested.

Earlier this year, the government of China's Liaoning province acknowledged that they had outright fabricated fiscal and economic growth data over a period of several years, coinciding with the tenure of the province's Communist party chief Wang Min, who ran Liaoning from 2009 to 2015. The FT speculates that Liaoning was far from the only province that engaged in that practice, where they identified four other provinces in northern and eastern China that also appear to have been reporting inflated economic figures.

Which brings us to a remarkable bit of evidence that we came across on NASA's Black Marble web site, which recently updated its nighttime map of Earth, providing us with the ability to compare images captured in 2016 with ones captured four years earlier in 2012. We've animated the nighttime map of Southeast Asia, which flips between 2012 and 2016 below.

If you look closely at the map, you'll see the nighttime lights brighten in areas that experienced economic growth between 2012 and 2016, such as along the coast of Viet Nam, and dim in the areas that experienced recessionary conditions between those two years. Pay very close attention to what happened between 2012 and 2016 in northern and eastern China....

The correlation between Night Time Lights (NTL) and economic activity has been found to be a "good proxy" for assessing economic development, particularly in countries that lack high quality economic data reporting.

The evidence is accumulating that the period from 2014 through mid-2016 was not as good as China's official statistics have previously indicated. Given the importance and sheer size of China's economy, it's remarkable that its relative economic health can be both seen from space and measured in the Earth's atmosphere thousands of miles away from its territory.

Labels: environment, recession, trade

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings. Today's snapshot of the trailing year earnings per share for the S&P 500 reveals that the stock market's earnings have continued rebounding off their 2016-Q3 bottom, where the S&P 500's earnings per share now exceed their previous 2014-Q3 peak. Even by the most conservative measure, the long earnings recession for U.S. firms is finally over!

Looking into the future, the outlook for earnings per share in the near term has dipped slightly since August 2017, but has brightened in the more distant future of the second half of 2018.

Data Source

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. Updated: 8 November 2017. Accessed: 15 November 2017.

On 20 December 2016, shares of General Electric (NYSE: GE) peaked at a closing value of $32.25 per share. Since then, through the close of trading on Tuesday, 14 November 2017, GE's share price has fallen by nearly 44% to $17.90 per share.

We think that GE's stock price has further to fall before it bottoms.

Here's why. Based on a simple relationship between the company's share price and its forward year dividends per share, we find that GE's share price is elevated above the level that investors have valued the company's shares for its given level of dividends payouts since 2009, when GE last announced a dividend cut.

The relationship in the chart above was developed using the company's share price on the dates it announced changes in its dividend payouts to the public with and the company actually paid out in dividends during the following 12 month period. The exception is the announcement for 13 November 2017, where we've projected that the company will sustain its newly lowered dividend payment of $0.12 per share over the next year.

What we find is that the company's share price when it announced its latest dividend cut on 13 November 2017 was elevated well above the trend line established by the relationship between the company's share price and forward year dividends per share for all its previous dividend change announcements since February 2009.

What that result suggests is that the company's share price has further to fall. Based on this first cut analysis, we would anticipate GE's share price continuing to fall to the $14-$16 per share range in the near future.

To build the case that is likely to happen, what we really want is more data points. We'll revisit this analysis soon where we'll incorporate data from GE's dividend declaration dates to build up the sample for our simple linear regression analysis.

Update 19 November 2017: We've followed up to include stock price and forward year dividend data from GE's dividend declaration dates. The updated chart, in which we've also connected to dots to trace GE's stock price trajectory versus its expected future year dividends per share, doesn't change very much from what we found in our original, more limited, sampling.

We do however observe an important shift in the relationship between GE's stock price and its future dividends per share during 2015. Here, on 10 April 2015, GE announced that it was selling off real estate and other assets associated with its GE Capital unit. In addition to clearing the path to where GE Capital would be taken off the U.S. government's "Too Big To Fail" list on 29 June 2015, freeing the company from additional regulatory costs and burdens that had been imposed upon it after the financial crisis of 2008. More importantly, the move also provided a lump sum of cash that GE's board of directors used to help fund a buyback of $50 billion worth its shares.

The reduction of regulatory costs and also its significant reduction in its number of outstanding shares helped boost the stock price with respect to its future year dividends per share - in effect, putting that relationship onto a parallel, elevated track, which is suggested in the chart above.

As for our outlook for GE's share price, we still believe that it still has further to fall, but not quite as far as our earlier analysis indicated, where we would now put the bottom into the $15-$17 range.

GE's Dividend Change Announcements from 2009 through 2017

Extracted from contemporary news sources. These announcements frequently preceded the company's official dividend declarations.

- 27-Feb-2009 - GE slashes dividend by two-thirds - this was the largest-ever dividend cut in U.S. history.

- 26-Jul-2010 - General Electric (GE) raises dividend; 15 other companies follow suit

- 21-Jan-2011 - GE earnings rise 31%, shares jump

- 21-Apr-2011 - GE beats earnings forecasts, raises dividend

- 9-Dec-2011 - GE Raises Dividend for Fourth Time Since 2010

- 14-Dec-2012 - GE hikes dividend by 12 percent, boosts stock buyback plan

- 13-Dec-2013 - General Electric's Dividend Growth

- 15-Dec-2014 - General Electric (GE) Hikes Quarterly Dividend by 5%

- 9-Dec-2016 - General Electric Boosts Dividend 4.3%

- 13-Nov-2017 - General Electric slashes dividend by 50% as new CEO tries to turnaround 125-year-old conglomerate - this was the eighth largest-ever dividend cut in U.S. history.

Data Sources

Dividend.com. General Electric. [Online Database]. Accessed 14 November 2017.

Previously on Political Calculations

We began developing this form of analysis earlier this year! Here are the previous posts in the series....

Labels: dividends, forecasting, stock market

On Monday, 13 November 2017, before the opening bell, General Electric (NYSE: GE) finally faced up to the reality that it wasn't going to escape having to cut its dividend for the second time since the Great Depression. That made the company's stock price action for the day very different from what the company experienced just a few weeks ago, on Friday, 20 October 2017, when investors thought they were going to see a dividend cut, but were surprised when the company didn't follow through at that time.

This is a cool chart because it reveals not just how investors reacted to the news of no dividend cut on 20 October 2017 and also to the news of GE's 50% dividend cut on 13 November 2017, but also how investors anticipated the move during the days in between, as GE's stock price declined by 12.17% before dropping by another 7.17% on the day of the dividend cut announcement. GE's stock price fell by 19.34% during just those 16 trading days.

That final decline came after a 25.11% decline in GE's stock price in the preceding 10 months since 23 December 2017. GE's total decline since that date now exceeds 40%, which puts the company's stock price decline on par with its just announced 50% dividend cut from $0.24 per share to $0.12 per share.

Meanwhile, all that occurred as the S&P 500 has risen by 14.33%.

For GE, the slashing of its dividend comes with the news that the company itself will become much smaller. And yet, analysts don't believe that the restructuring that GE's CEO John Flannery also announced on 13 November 2017 goes far enough.

GE kicked off the morning by announcing a 50 percent cut to its quarterly dividend, a major, if necessary, step for a company that prides itself on the payout and caters to a large number of individual investors. Looking at GE's projected 2018 numbers released just a few hours later, however, it's not clear the company cut deep enough.

The reduced dividend still costs about $4 billion annually. And while GE's targeting $6 billion to $7 billion in industrial free cash flow next year, that's based on a "cherry-picked definition", says Cowen & Co.'s Gautam Khanna. The real number appears to be close to zero if you account for pension and capital expenditures as other industrial companies would, he says.

To be able to sustain their dividend payments to their shareholders, companies need to have one of two things going for them: positive earnings (profits) that grow over time and/or sufficient cash flow. Without either, future dividend cuts become inevitable, where the expectation of those cuts will lead investors to pull down stock prices until they arrive or until the company's management can turn their earnings and cash flow situation around.

At this writing, it doesn't look like GE has quite found its bottom yet, which is why a good number of GE's more dividend-minded stock owners are selling their shares and are buying the stocks of other dividend-paying companies whose business outlooks are brighter.

“People who were in GE for their dividend may be looking for a better place to put their money,” said Kim Forrest, senior equity research analyst at Fort Pitt Capital Group in Pittsburgh.

Utilities .SPLRCU and consumer staples .SPLRCS rank among the sectors with the highest dividend yield on the S&P 500. They were also the largest percentage winning sectors on Monday.

We call that the conveyance effect, which occurs when investors act to sell their shares of a particular stock that is a component of a market capitalization-weighted stock market index and use the proceeds to buy shares of other companies within the index, with the result that the value of the index itself rises.

It happens all the time with the continual changes in the market cap weightings of individual stocks within an index, but usually not quite so visibly, where we have to thank the reaction of investors to a significant market event involving one of the more heavily weighted stocks of an index like the S&P 500 for making it obvious enough to be captured in a regular financial news report.

Previously on Political Calculations

Labels: dividends, stock market

On Wednesday, 8 November 2017, the S&P 500 (Index: INX) closed at an all time new record high closing value of 2594.38, before going on to fall back a bit to end the week at 2582.30.

Along the way, the index set an all new intraday high on Tuesday, 7 November 2017 of 2597.02. The new highs marked a now one-year long rally for stock prices in the United States, coinciding with the positive market reaction to the surprise defeat of Hillary Clinton in the 2016 presidential elections and the end of expectations that failing Obama-era economic and fiscal policies would continue.But for us, that wasn't the most interesting thing that happened during a fairly uneventful week. Just over two months ago, we identified a specific range in which we expected that the S&P 500 would fall during each day of the last two months, provided that investors would largely remain focused on the distant future quarter of 2018-Q2 in making their investment decisions. And then it happened, where we've opted to mark the occasion by showing the trajectory of the S&P 500 over the span of 2017-Q3 and 2017-Q4 through the close of trading on 10 November 2017 in the following chart.

The thing that prompted us to make the unique forecast was the need to have to cope with echo effect of the past volatility of stock prices on our dividend futures-based model for an extended period of time, which arises from our use of historic stock prices from 13 months, 12 months and 1 month earlier as the base reference points from which we project future stock prices. There was, of course, no guarantee that investors would maintain their focus on 2018-Q2 during all that time, nor was their any guarantee that the U.S. stock market wouldn't be affected by a major noise event either in a new outburst of current-day volatility, but our assumptions remained valid and our forecasting results speak for themselves.

Let's next take a closer look at where we are in the current quarter of 2017-Q4.

The key to understanding what our model is communicating is to know how far ahead in time investors are focusing their forward-looking attention. In these spaghetti charts, once you've identified which point of time in the future investors are looking, our model can put you within 3% of the indicated trajectory associated with that future quarter, where currently, investors continue to appear to be focused on 2018-Q2, which currently coincides with what will likely be the timing of the Fed's first rate hike in 2018, following an almost certain lock for a rate hike to be announced in December 2017.

We said earlier that Week 2 of November 2017 was largely uneventful for the S&P 500, and as you can see from the following short list of headlines that caught our attention during the week that was, that may be an understatement....

- Monday, 6 November 2017

- Tuesday, 7 November 2017

- Wednesday, 8 November 2017

- Thursday, 9 November 2017

- Friday, 10 November 2017

- Oil prices slide after U.S. drillers add rigs

- Doubts about Trump tax cuts weigh on Wall Street

- Plans to cut U.S. taxes matter to the world's stock markets - who knew?!: Global stocks dip on U.S. tax reform doubt; no respite in havens

Elsewhere, Barry Ritholtz summarized the week's positives and negatives for the U.S. economy and markets!

Update 13 November 2017, 8:12 AM EST: General Electric (NYSE: GE) pulled the trigger before the opening bell and cut its dividend in half, to 12 cents per share. This is a stock to watch today, although it looks like that investors somewhat anticipated the action since our last comments on the topic. Here's a short list of our recent coverage:

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

![Animation: Trailing Twelve Month Average New Home Sales Market Capitalization, Not Adjusted for Inflation [Current U.S. Dollars] and Adjusted for Inflation [Constant September 2017 U.S. Dollars], December 1975 - October 2017 Animation: Trailing Twelve Month Average New Home Sales Market Capitalization, Not Adjusted for Inflation [Current U.S. Dollars] and Adjusted for Inflation [Constant September 2017 U.S. Dollars], December 1975 - October 2017](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi3KzWeJ7Acj7C1KuG06oCeVU1FysqvH-9OYZdcG2WqaJEOFH7EwYITrKNiQS4afwjBtu3-NUTk3G8p2hzR0mY7dHSDGStXrjRbR2zJA9D8sz_McAiK4oI1s6GGWKEi0AsvAw2S/s1600/animation-ttma-new-home-sales-market-cap-nominal-and-inflation-adjusted-197512-201710.gif)

/>

/>