Has a housing bubble formed in London's real estate market?

Depending upon who you ask, you will likely get one of two different responses. Either: "Yes, and it threatens the UK economy" or "No, and what's more, housing prices in London ought to be even more expensive!"

Now, since we've long since established ourselves as having special expertise in this area, the answer is an unequivocal, yet qualified, "yes".

To understand why we've come to that conclusion, let's start by considering what we would expect a nonbubble-driven housing market to look like. In such a market, we would expect to find a very close coupling between the typical sale prices of homes and the typical incomes earned by those who might purchase them. If we were to make a graph of the relationship between home prices (on the vertical axis) and incomes (on the horizontal axis), we would expect to find a very linear relationship between the two, with home sale prices being directly proportionate to incomes.

In a nonbubble-driven market, a linear relationship between home sale prices and incomes would also be observed over time, where in theory, we would expect both dwelling sale prices and incomes rising and falling in step with each other. In practice, because changes in home sale prices and incomes aren't fully synchronized with each other, we would observe somewhat of a "stair-stepping" pattern, with a series of linear but largely parallel trends in housing prices with respect to incomes being observed.

When a housing bubble has formed however, the linear relationship between typical home sale prices and typical incomes breaks down as they become decoupled from each other.

We found two key sources for information about the trends of housing prices and incomes in London, England. The first is the monthly and quarterly series of tables for the Housing Price Index [Excel spreadsheet] published by the U.K.'s Office of National Statistics, specifically Table 15, which presents both new dwelling sale prices and the mean household incomes of those who purchased them. The second is the ONS' Annual Survey of Hours and Earnings from 2002 through 2013, where we obtained the mean annual wage incomes earned by individuals in London for each of these years.

Using the quarterly data presented in our first source, we calculated the rolling four-quarter average for both new dwelling sale prices and purchaser household income, which allows us to address any seasonality in the data. For the annual average wage data provided by our second source, we assigned the given value to the second quarter of each year, then interpolated intermediate quarterly values between them. The results of our calculates are presented visually for the periods from 1993-Q1 through 2014-Q1 below:

All data in this chart is presented in nominal terms of current year Great Britain pounds (GBP), with no adjustment for inflation. We're focusing on new dwelling sale prices, since these values, almost by definition, apply to the margin of real estate markets, which gives us greater insight into the economic conditions for the market.

Our next chart examines the relationship between the average rolling four-quarter average of new dwelling sale prices and the average annual wage incomes earned by individuals in London for the years where we have that data, from the second quarter of 2002 through the second quarter of 2013:

This chart confirms that new dwelling sale prices and the average annual wage income earned by individuals in London are fully decoupled from one another. We can observe that decoupling fully in the trend for London's housing prices from 2010-Q1 through 2013-Q2, where housing prices have skyrocketed while the average wage incomes earned by individual Londoners first rose slightly up through 2011-Q2, which has fallen since.

The phenomenal growth in London's new dwelling sale prices over this period is such that these dwellings can only be affordable for those individuals with increasingly large incomes or for those homeowners who can combine multiple incomes.

Our next chart however shows that there is some degree of rationality in London's real estate market. Here, we're showing the trend for average new home sale prices versus the average household incomes of those who have been purchasing them in the period from 1993-Q1 through 2014-Q1:

To us, this chart indicates that London's real estate market is behaving rationally, since the patterns we observe in the chart are consistent with what we would expect to see in a property market that is not being influenced by a bubble, which we described earlier.

That's why we would describe London's real estate market as being bipolar in nature. It would seem, on first glance, that it both is and is not experiencing an economic bubble.

What tips the scales in our thinking however is that what we do observe, with the escalating incomes of those who are purchasing property at ever-escalating prices, is consistent with the kind of sales-mix distortions that we've observed in both the first and second U.S. housing bubbles.

London's new dwelling sale prices are increasingly only affordable for those with the highest incomes, which tells us that the city's new home builders are largely only addressing the demand for those buyers and abandoning the potential market for home buyers with average incomes, which would explain the U.K's apparent "two-speed" housing market. That supply constraint then is likely a significant factor behind the current escalation in prices.

We therefore find that London's real estate market is indeed experiencing bubble conditions. We find the bubble's origins in the nation's economic recovery beginning in the first quarter of 2010, however its key period of inflation has occurred in the period since 2011-Q2, approximately as mortgage rates in the U.K. hit their lowest level on record. Combined then with an influx of very high income earning refugees fleeing the confiscatory income tax policies being implemented in several European nations (Greece, Spain, France, etc.) since that time, we think that these factors can go a long way to explaining what has caused the prices for London's real estate to grow so much and so quickly.

And not to mention so bipolar. The inflation of a housing bubble in such a limited geographic area is really a fascinating spectacle.

Labels: real estate

What is the difference between having armed school officials/resource officers on site and relying upon police officers at a station just over two miles away when it comes to protecting the lives of students at a public school when there is a mass shooting incident?

Because of a recent incident at a public high school in Troutdale, Oregon on 10 June 2014, we are now able to answer that question and to directly compare the outcome of that situation with the tragedy that occurred in Newtown, Connecticut on 14 December 2012.

Here's the basic background for the Troutdale, Oregon shooting:

Authorities just wrapped up an 11:15 a.m. news conference where they shared the latest developments in the shooting at Reynolds High School.

Police identified the shooter as 15-year-old Reynolds High School freshman Jared Michael Padgett. Padgett exchanged gunfire with officers, then apparently shot himself, authorities said. He used an AR-15 type of rifle, owned by his family, that he obtained after removing it from its secured storage place, said Troutdale Chief Scott Anderson.

The shooting, which left 14-year-old Reynolds High School freshman Emilio Hoffman dead, and teacher Todd Rispler grazed by a bullet, occurred just as students were heading into their first period Tuesday morning.

Other news reports indicate that Padgett was armed with "an assault rifle, a handgun and nine ammunition magazines", so the incident had the real potential of reaching the same death toll as did the Newtown, Connecticut shooting. That tragic incident resulted in the deaths of six adults and twenty children before the shooter, Adam Lanza, was finally confronted by armed police officers who had just arrived from their station, which was just 2.3 miles away, roughly eleven minutes after the shootings began. Lanza committed suicide with a self-inflicted gunshot after being confronted by the armed police officers.

By contrast, the incident at Reynolds High School in Troutdale, Oregon ended very differently:

Troutdale school resource Officers Nick Thompson and Kyle Harris were at Reynolds High School when Tuesday's shooting occurred, Multnomah County Sheriff Dan Staton said.

"As soon as this happened, they were there in less than a minute," Staton said. "Had they not been there, it could have been a lot worse."

One of the first dispatches to police was at 8:07 am: In the boy's locker room, two shots, one person down.

Troutdale Police Chief Scott Anderson credited the two resource officers -- the first responders -- and two other local officers who formed a tactical team -- for preventing further carnage.

"I believe their quick response saved many of our students' lives," Anderson said. "For that, our community and I thank you."

And so, we're left with the following raw numbers to describe the difference in outcomes between both tragic events:

- Difference in Distance for Armed Responders to Travel to Confront Suspect: 2.2 miles (2.3 miles at Newtown, approximately 0.1 mile at Troutdale).

- Difference in Elapsed Time for Armed Responders to Confront Suspect After First Shots Fired: 10 minutes (11 at Newtown, approximately 1 at Troutdale).

- Difference in Elapsed Time for Shootings to End After Suspect Was Confronted by Armed Responders: Less than one minute.

- Difference in Number of Fatalities: 25 (26 at Newtown, 1 at Troutdale).

- Difference in Number of Non-Fatal Injuries: 1 (2 at Newtown, 1 at Troutdale).

- Difference in Total Economic Cost for Fatalities and Non-Fatal Injuries to Community: $247,396,766 ($257,405,794 at Newton, $10,008,998 in Troutdale).

- Difference in "Lifetime" Costs for Training and Staffing Two Armed School Resource Officers On Site at Public School: $11,170,860 ($0 at Newtown, $11,170,860 at Troutdale).

- Ratio of Benefits for Avoided Deaths and Injuries to Costs of Training and Staffing Armed Resource Officers On Site at Public Schools: $22.15 to $1.

We estimated the lifetime cost of staffing two armed school resource officers at a public school to make more of an apples-to-apples comparison in the benefit-cost analysis above. The $11,170,860 would represent the cost of training and total compensation (salary, benefits, pension) of a dedicated armed school resource officer based on the annual costs estimated by Ned Hill over 60 years (typically, a 20-30 year career followed by 30-40 years of very generous pension benefits.

In reality, it would be much more affordable and cost effective for most communities to augment the public safety training of a number of school employees who have other, primary responsibilities at the schools, such as school administrators.

The bottom line however is that sharply reducing the reaction time of armed responders to confront an armed suspect is the key to realizing the benefits for a community - and that holds even if the offender behind such an event that can result in a large number of casualties isn't armed with a gun.

Labels: crime

We've seen contradictory signs this year, as our model of how stock prices work has sometimes indicated that yes, the past does matter, and has more often indicated that no, the past does not matter.

We think we now sort out the mystery of when the past matters and when it doesn't, which we'll address as if we were solving another crime.

Another crime?

Yes, crime. Like solving a crime, we need to consider the means, motive and opportunity that investors have for making a particular investment decision on any given trading day. Let's take each of these factors in order....

Means

To be a viable as a suspect in a criminal investigation, we need to determine if a person either has or has had the means of committing the crime. When we apply that concept to the stock market, we need to consider the means by which either a large number of small investors or a smaller number of large investors could significantly affect stock prices today.

Well, that's easy to answer: it takes money. Now here's the thing - most investors don't have the huge sums of cash sitting in the places they would need it to be in order to to make the entire stock market jump on demand. Being investors, a lot of their money is tied up in, you guessed it, investments. And it takes both effort and time to be able to free it up and move it to the accounts where it would need to be to implement new investment decisions in the stock market today.

This is where the past matters. If the actions of investors in the past are such that when they put money into certain investments, such as bonds or options contracts, that come due after a set period of time, they pretty much cannot touch that money again until it becomes available when either the bonds mature or the options contracts expire. In the situation where the events of the past led to a significant amount of money being "parked" in such alternative investments, that can create the situation in the present where a large amount of money suddenly becomes available on the anniversary of a given event, where it might then be directed toward other investment alternatives. Or not.

What happens next depends upon motive and opportunity....

Motive and Opportunity

Investors typically have one basic motive in making an investment decision: to maximize their overall returns.

Sometimes, that means directing their money toward investments that provide positive returns. Sometimes, that means directing their money away from investments that provide negative returns, for the sake of limiting their losses.

In both situations, the choice that gets made is based on the perceived opportunities available in the present. We've seen the situation where, on the anniversary of a negative noise event in the market, investors saw little opportunity in directing the money that was being freed up toward stocks, with the resulting low demand pulling stock prices lower.

The nearly opposite situation has just played out, where investors, not seeing any reason to repeat their actions from the previous year, instead bid up stock prices on the anniversary of another negative noise event as the large amount of money that was parked elsewhere a year earlier became available to support new investment decisions.

Reasonable Expectations

Where our model is concerned for the anniversary of short term noise events, we should then expect to see stock prices deviate from our forecast trajectory over the duration of the historic events. When that happens, we should expect to see stock prices converge once again with those forecast trajectories after the anniversary of those events have passed. At least, in the absence of current day noise events for stock prices.

Our consideration of what we've described as the echo effect, and the echo filtering technique we developed, was in large measure a response to what we recognized would be a factor of such historic events on the apparent accuracy of our model's forecast of stock prices because it incorporates historic stock price data as the base reference points from which it its projections of the future are made.

Over the last several months, we found that our initial method of filtering for the echo effect provided a small benefit at best for our forecasts, particularly in the early portion of the period after we first began testing it out. To be worthwhile to continue developing, it would need to provide better results for the accuracy of our forecasting than what we might gain by simply expanding the expected range of values within which we would reasonably expect stock prices fall during periods where we know that the echo effect will be significant.

It has now failed that test several times in the last month and a half. Which is why we pulled the plug on it this past Monday.

For us, it's back to the drawing board in our effort to chase down the echo-driven half of the deviation between what our basic model of how stock prices work would forecast and what actual stock prices turn out to be.

How much does the illicit sale of heroin really contribute to the nation's GDP?

Proving once again that we're willing to tackle really strange questions, we thought we'd take a stab at it, following the same approach that nations like Italy, Ireland and specifically the United Kingdom have taken in seeking to inflate the reported values of their countries' Gross Domestic Product.

Because when politicians are desperate to claim more economic growth to try make themselves look good, it's time to look the other way when it comes to accounting for the economic impact of things that the politicians have outlawed to try to make themselves look good.

Of course, the problem with the things that politicians have outlawed, such as heroin, is that it can be very difficult to get accurate business statements from the people who are engaged in the outlawed trade, such as heroin dealers. For some strange reason, many of those who are engaged in such trades aren't willing to fully detail the figures related to their illicit businesses on their income tax returns or in their quarterly financial statements.

So economists in nations seeking to record a positive benefit for illegal activities have to estimate how much those illegal activities add to their GDPs. In the U.K., that meant going back to the findings of a study of heroin use in the nation in 2003, then adjusting for changes in the quality and price of heroin over time, as well as the number of heroin users.

For example, in 2003, a benchmark study found there were 36,000 heroin users in the U.K., who could buy a heroin product that was cut by dealers to be 33% "pure" heroin on average, which the United Nations reports would cost the equivalent of $100 U.S. dollars per gram. Altogether, total heroin sales in the U.K. were estimated to total some 1.349 billion GBP, or because most nations will likely have figures only in the millions, let's call that 1,349 million pounds.

Six years later, in 2009, the number of heroin users had increased to 38,000, the amount of "pure" heroin in a typical "retail" sample of heroin had increased to 43%, and the cost had fallen to the equivalent of $69 U.S. dollars per gram.

Once you know all these numbers, we can mathematically chain them together to estimate how much heroin sales "contributed" to the economy of the United Kingdom in 2009. In fact, let's do those maths now using the special-purpose ready reckoner we've built to do the job below....

If you're reading this article on a site that republishes our RSS news feed, click here to access a working version of this tool!

You'll note that we mixed the units of currency in the tool above, mainly since the estimated cost data for heroin is easily obtainable in terms of U.S. dollars per gram. However, the nature of the math is such that international exchange rates do not need to be taken into account, and our tool's output will be presented in terms of the value of the national currency for which you entered for the estimate of the value of heroin sales for your nation of interest.

For our default data, which applies to the United Kingdom, that contribution of heroin to that nation's GDP is expressed in terms of its own currency [GBP].

In doing that math for the data we have for the year 2009, we find that the contribution of heroin sales in the U.K. totaled up to a disappointing 754 million pounds, just 55% of what heroin sales contributed to the U.K. economy six years earlier, as even though its quality and consumer base increased and its price fell, the relative quantity of heroin demanded by U.K heroin users declined.

But, for a politician looking to boast of how well the nation's economy performed under their leadership in that year, that extra 754 million GBP would be like bringing the 754 million pounds that U.K. tourists charged while on holiday in other nations in 2009 back into the home economy. Brilliant!

Labels: crime, economics, gdp, math, tool

In January 2014, we raised concerns that Health Net, a Woodland Hills, California-based health insurer, had engaged in predatory pricing in the state of Arizona with the low quality health insurance policies it sold to the state's health insurance consumers through the federal government-run Affordable Care Act "marketplace".

That predatory pricing has harmed Arizona consumers in two ways. First, the company's plans featured extremely "narrow networks", sharply limiting the number of doctors and hospitals from whom consumers could obtain discounted health care, which subsequently turned out to be far more narrow than indicated by the information that the company provided to consumers on the federal government's ACA exchange. Beyond that, Health Net as been the target of numerous consumer complaints, as the company's staff frequently fails to process claims in a timely manner. The following complaint posted by "Fuchsia" of Prescott, Arizona on Consumer Affairs' web site on 16 May 2014 is representative of many of the complaints that the company's customers have filed against the insurer describing the low quality of service it is providing:

Health Net is either actively defrauding us or they are just too incompetent to live. Either way, they should be barred from selling ACA plans at the very least, and should probably not be allowed to operate at all. I echo all the other comments about how extremely frustrating it is to get straight answers from this company. EVERY time we call we get different answers. But even more frustrating is trying to get them to provide the services they have contracted to provide. I need to see out-of-network doctors for my particular health issue, which means I have to pay practitioners up-front and then submit the bills to Health Net.

So far I have submitted 11 claims and exactly 2 of them have been processed. It has been three months since I submitted some of these claims and they are supposed to process claims within 30 days. I know for a fact that they received some of these claims, because they were IN THE SAME ENVELOPE as the 2 claims they did process. It is obvious to me that they decided to stop processing my claims because I had reached my deductible and if they processed any more claims they would have to reimburse me.

It is not that they are denying my claims, they are completely ignoring my claims. I have submitted my claims two or three times and they have still not been processed. The customer service reps can never give me any information about why my claims are not being processed, they just tell me to resubmit. Health Net owes me about $1500 dollars. I need that money in order to pay for more health care. Given that, and given the amount of stress they have caused me, this so-called "health" insurance company is actually harming my health. I would gladly join a class-action lawsuit against this company.

The second way in which the company's predatory pricing is harming Arizona consumers is because of Health Net's role in setting the benchmark in the state for the amount of the Affordable Care Act's tax credit subsidies for which consumers are eligible. By undercutting its competitors by such a very large margin, Health Net succeeded in denying Arizona consumers the level of subsidies they might otherwise have received that would make the other company's higher quality health insurance offerings more affordable for the state's consumers purchasing health insurance through the Healthcare.gov web site.

According to the Arizona Republic, the combination of the company's very low health insurance prices and the very low subsidies for which Arizona's consumers were eligible thanks to Health Net's pricing strategy gave the company an extremely strong market position, as Health Net captured at least one out of four Arizona consumers who purchased health insurance through the state's ACA "marketplace".

But more significantly, we now have a strong indication that the company's health insurance plans were priced well below the company's cost of providing its "hallmark" level of low quality coverage:

The company that sold the least expensive and among the most popular Affordable Care Act health insurance plans in Arizona will raise the plan's average rates nearly 14 percent next year.

Health Net of Arizona wants to charge $31 more each month, bringing average monthly premiums to $256 for its HMO plan for individuals, according to paperwork the insurer filed with the Arizona Department of Insurance. The actual rates are based on a person's age, community and whether they use tobacco.

That's a very significant price hike - especially for plans that would have been the most affordable for very low income earners, who will likely have no alternative to paying the increase.

In fact, if we revisit an old antitrust case developed by the U.S. Department of Justice against American Airlines for predatory pricing activity back in 2000, we can see that many of the DOJ's findings against American Airlines at the time would be valid in the case of Health Net's alleged predatory pricing scheme in 2013-2014:

As the airline with the largest scope of operations at DFW, American has significant advantages over other competitors or potential competitors in DFW routes in attracting passengers and charging higher prices. This advantage has variously been called "origin point presence" advantage, "OPP" advantage, "origin point dominance" or "frequency dominance" by American, and has been described by American as follows: "a carrier which achieves substantial advantage over its competition in terms of frequency and scope of service at any airport, hub or spoke, . . . will invariably obtain a disproportionate share of the traffic and revenues for the flights originating at that airport."

Frequency dominance or origin point presence advantages are reinforced by marketing programs including frequent flyer programs and travel agent commission overrides. American's investment in establishing its DFW hub involved a large sunk investment, and another airline with similar cost structure would also have to make large investments to build a similar hub at DFW.

American generally enjoys higher margins where it does not face low fare competition. American's internal analyses recognize that fares and yields in Southwest and LCC-competitive markets are significantly lower than fares and yields where American does not compete with Southwest or other LCCs. Thus, American calculated that its revenue per available seat mile in DFW-ATL increased by 14% after the 1996 ValuJet crash caused that LCC to exit.

For Health Net, "origin point presence" would be analagous to the role it established as the dominant player in the only "marketplace" (or "hub") where Arizona consumers could purchase tax credit subsidy-eligible health insurance policies, where its market share is reinforced by the company's strategy of setting the benchmarks for the amount of tax credit subsidies available to consumers.

Meanwhile, two other health insurers in Arizona have filed paperwork indicating that they will be increasing their premiums during the next enrollment period. Here, Cigna is increasing its premiums by 14.4% and Humana is increasing its premiums by 25.5%. From a consumer standpoint, Humana's very large increase suggests that the company may be facing an issue with adverse selection and has entered into something of a death spiral where much sicker patients are specifically choosing it for access to their higher quality physician and hospital networks. Humana's very large premium increase would largely go to covering the much higher health care expenses of its pool of insured customers.

And so, we find that Health Net's strategy of using narrow networks and other perverse business strategies, such as providing deliberately poor customer service in processing claims for out-of-network coverage, effectively limits the ability of consumers to obtain higher quality health care is also predatory in effect. Health Net's strategy would appear to involve driving less healthy consumers away from its low quality coverage toward higher quality health insurance coverage instead, which in turn, creates an adverse selection situation at their competitors. That adverse selection issue then puts their competitors at an even greater competitive disadvantage, which if left unchecked, would ultimately push them out of the market.

None of this can end well for consumers.

Labels: economics, health care, insurance, risk

We're pleased to announce today that the filtering technique we developed to cope with the "echo effect" in our model of how stock prices work has finally and definitively failed.

We're pleased to announce today that the filtering technique we developed to cope with the "echo effect" in our model of how stock prices work has finally and definitively failed.

Really. We hated it. The only reason we put up with it for so long was because of the early success we had in applying it.

But fortunately, it finally turned out to be a dead end, which means that we can now uncomplicate our math and pursue other means of dealing with the echo effect.

To briefly recap the situation for those who have only recently discovered our brand of analysis, our model of how stock prices work use historic stock price and dividend data as the base reference points from which we project current and future stock prices. Since we first discovered the fundamental relationships behind our model in December 2009, we've been fairly successful in anticipating the future trajectories that stock prices might follow.

But not perfect. Half of the issue we have is attributable to what we've described as noise events - the random onset of non-fundamental factors that cause stock prices to temporarily deviate away from the main trajectories they might otherwise follow.

We're okay with that kind of noise event. We know enough about them now to be able to extract some interesting insights into what drives stock prices while they endure.

The other half of that issue is attributable to the effects of the noise events of the past, which we refer to as echoes. Because our math incorporates historic stock price data, a portion of the alternative trajectories it projects is driven by the path that stock prices took in the past. And that's where the echo filtering technique we've been testing out since November 2013 is now coming up short, because it's falling well short of compensating for the biggest noise event of 2013: The Bernanke Noise Event, the first and most significant noise event that drove volatility in stock prices in 2013.

For clarity - the shaded gray region on the chart represents the trajectory our model predicted stock prices would follow in 2013. The major deviations from that general trajectory are noise events, where we've also identified their specific causes.

Now, let's look at our alternative futures chart for the second quarter of 2014, where we're showing what our non-filtered method predicts, since that is running closer to the actual path that stock prices are taking than our echo-filtered forecast. Note especially the difference between what our model forecasts and the actual trajectory that stock prices have taken in the last week, as we've run into the anniversary of the Bernanke Noise Event:

Our model's forecast during this period is echoing the trajectory that stock prices followed during the Bernanke Noise Event - but clearly, that event from the past is not affecting today's stock prices.

Nor should it. If we've learned anything, it's that stock prices are primarily driven by future expectations - the main challenge in forecasting them is identifying which expectations of the future are driving them. That's also not to say that the events of the past cannot influence today's stock prices, but the way in which they might is not what you might expect, which is something that we'll need to explore separately.

As best as we can tell, there is no new positive noise event currently acting in the stock market, so the deviation between our model's projected values and the actual value of the S&P 500 is fully attributable to the echo effect from the Bernanke Noise Event - an event that ran from 19 June 2013 through 19 July 2013, which marks the point in time at which stock prices resumed following their fundamental-driven trajectory after their major deviation from it.

If we sneak a look at what our model would forecast at the one-year anniversary of the end of the Bernanke Noise Event, if investors continue to focus on the expectations associated with 2014-Q4 in setting today's stock prices, we would reasonably expect to see the S&P 500 reach values near 2100.

But then, that would require no new noise events to send stock prices off to some other level. In the meantime, as the future plays out, we'll be playing with other methods for dealing with the echo effect from past events in our model.

It's often assumed that the kind of technology that automates the jobs that low income earners can do will come to replace the people who do those jobs. But is that really true?

The answer to that question is that it depends. The reason it depends is because new technologies can impact more than just the cost of labor for employers. They can also be used to generate more revenue than could be achieved without the use of the technology, allowing an employer to grow their business by enough of a margin so that no jobs need to be cut, or can even be added to facilitate the business' growth.

With that in mind, consider the arrival of thousands of table-based tablets at many U.S. restaurants, where the early indications is that they boost restaurant revenue by a large enough margin that the restaurants that have incorporated the technology have no plans to trim their wait staffs. Via Core77:

I learned a few things as a waiter in the '80s and '90s. One was that spiked hair and a fanny pack was not a good look. The other was that a server's job isn't just to take the orders and sling the chow—our job was to sell. Bigger checks meant bigger tips, and the manager was constantly coaching us on which high-margin specials to push, which desserts we needed to move, what the exciting new beer we had on tap was.

Well, now the Chili's Grill & Bar chain has found that, surprise surprise, tablets are better than humans at selling. "When your server is a screen, you spend more money," as The Atlantic puts it. Since installing over 55,000 tablets at tables, the restaurant has found that diners order more appetizers and desserts and even leave bigger tips by going along with the default tip setting, which is of course jacked up. They also tie the kids up with unlimited on-screen games that run $0.99.

The tablets are manufactured by a company called Ziosk, the self-styled "industry leader for tabletop menu, ordering, entertainment and payment" for restaurants. (But they are not without competition, see below.) Ziosk reckons the tablets, which flash attractive-looking food photos to entice diners to click, boost appetizer sales by 20% and desserts by 30%. They also shave about 5 minutes off of each meal, presumably because one never needs to flag a waiter down. Add it all up and these babies essentially pay for themselves, as the company claims: "The Ziosk platform is a revenue center, not a cost center for the restaurant and our offering is 'less than free.'"

Perhaps the most important thing to consider about the happy situation where technology adds revenue to a business without slashing jobs is that this development has taken place in an economic environment where the wages earned by the people whose jobs might be displaced by this particular technology, waiters and waitresses, have been stable.

According to the Bureau of Labor Statistics, in 2012, the median wage earned by the 2,362,200 people working as waiters and waitresses in the U.S. was $8.92 per hour.

Requiring less than a high school education, that puts the typical wages earned by many waiters and waitresses at a level that's consistent with the statutory minimum wages that apply across the U.S. And that's where the efforts by politicians to force increases in the minimum wage can significantly change the math for employers.

To the extent that the increase in revenue generated as a result of the adoption of the new technology might offset the increase in minimum wage levels, the minimum wage increases could have little impact on the job security of today's restaurant wait staffs.

But if those increases in labor costs exceed the amount of additional revenue that might be generated from adopting the automated table ordering technology, employers could be forced to adopt a number of cost cutting strategies to absorb the increase in costs, which can negatively impact their lowest wage-earning employees, even if they are not laid off from their jobs:

While attending an event at a SeaTac hotel last week, I met two women who receive the $15/hour minimum wage. SeaTac has implemented the new law on Jan. 1. I met the women while they were working. One was a waitress and the other was cleaning the hallway.

“Are you happy with the $15 wage?” I asked the full-time cleaning lady.

“It sounds good, but it’s not good,” the woman said.

“Why?” I asked.

“I lost my 401k, health insurance, paid holiday, and vacation,” she responded. “No more free food,” she added.

The hotel used to feed her. Now, she has to bring her own food. Also, no overtime, she said. She used to work extra hours and received overtime pay.

What else? I asked.

“I have to pay for parking,” she said.

I then asked the part-time waitress, who was part of the catering staff.

“Yes, I’ve got $15 an hour, but all my tips are now much less,” she said. Before the new wage law was implemented, her hourly wage was $7. But her tips added to more than $15 an hour. Yes, she used to receive free food and parking. Now, she has to bring her own food and pay for parking.

But if those kinds of adjustments are not enough for the typical restaurant operating with very low profit margins to stay in business, in this case, the automated technology could very well enable the restaurants that adopt it to cut their wait staffs without negatively impacting their service to customers. And that would be in addition to adopting the other kinds of cost cutting strategies being employed in cities that have significantly raised their minimum wages.

The bottom line is that new technologies do not inevitably mean that the jobs that people do will disappear. It's other factors, such as arbitrary changes in the minimum wage level, that drive changes in the rationale for how the new technologies will be applied and whether people will experience any negative impacts as a result.

Or as we said at the beginning: it depends.

Image Credits: U.S. Securities and Exchange Commission: Tim Horton's 2014 Investor Conference Slides.

Labels: jobs, minimum wage, technology

As expected, and at least through 17 June 2014, the day before the Fed's next policy statements, the S&P 500 was indeed reverting to its mean:

Or rather, the S&P 500 was reverting to the mean trajectory it has established since order resumed in the U.S stock market after 4 August 2011. But we think that may have come to an end and that the index will begin diverging away from the mean now that we're past the Fed's statements and Janet Yellen's press conference. More on why we're thinking that next Monday....

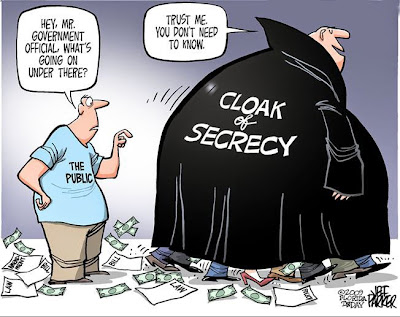

How does the absence of transparency in government cost taxpayers' money?

That question arises today because of a news article in the New York Times, which reports that up to two million of the individuals who enrolled for health insurance coverage through the federal government's or their state's Affordable Care Act (ACA) "marketplace" are in for a very rude surprise when they file their income tax returns in April 2015.

The Obama administration is contacting hundreds of thousands of people with subsidized health insurance to resolve questions about their eligibility, as consumer advocates express concern that many will be required to repay some or all of the subsidies.

Of the eight million people who signed up for private health plans through insurance exchanges under the new health care law, two million reported personal information that differed from data in government records, according to federal officials and Serco, the company hired to resolve such inconsistencies.

The government is asking consumers for additional documents to verify their income, citizenship, immigration status and Social Security numbers, as well as any health coverage that they may have from employers. People who do not provide the information risk losing their subsidized coverage and may have to repay subsidies next April.

Depending upon the household income of those who bought health insurance through the ACA exchanges, the amount of subsidies that they might need to repay when they file their 2014 income tax returns could be hundreds or thousands of dollars.

This particular problem arises for one, and only one reason: the desire of the Obama administration and the authors of the Patient Protection and Affordable Care Act (PPACA) to conceal just how much the health insurance policies that might be purchased through the federal and state government-run "marketplaces" really cost from consumers.

To use these exchanges, health insurance consumers were required to enter their household income and other personal information before they were even allowed to view their options for health insurance coverage. When that information was finally presented to them, the costs of the policies were reduced by the government's estimate of their tax credit subsidy - making their premiums appear to be more affordable than they really are.

Behind the scenes, the Department of Health and Human Services is paying out the full amount of the tax credit subsidies it has approved for each consumer directly to the health insurance companies that sold policies on the government-run exchanges.

Those payments are what create the income tax liability for those consumers whose personal and income data may have discrepancies that can negatively impact their eligibility to benefit from the subsidies being paid on their behalf. If they are not eligible for some or all of the tax credit subsidy that has been paid to health insurers by the federal government, affected consumers will be responsible for paying that money back to the federal government.

The sad part of all this is that if the Obama administration and authors of the PPACA (popularly known as "Obamacare") had been willing to be honest with consumers and transparent about the true cost of health insurance on the ACA exchanges, all the tax liability risks for these consumers and the potential loss of insurance coverage could have been avoided.

A much more effective approach would have been to only indicate the full cost of the health insurance options available to Obamacare consumers, who would be fully responsible for paying the full cost of the policies they purchase. Since the subsidies for Obamacare are provided in the form of an income tax credit, subsidy-eligible consumers could then have lowered the income tax withholding on their paychecks to account for the tax credit.

The advantage of this approach for these consumers is that they would not now be at risk of losing their health insurance coverage. They might still have an issue with the size of the tax credit, but they could avoid losing their health insurance.

This approach would also have largely eliminated the need to even have a Healthcare.gov and state government-run "marketplaces".

But no. That would have meant providing full transparency into the full cost of the subsidy tax credit-eligible health insurance coverage available on the government-run "marketplaces", which was the last thing that either President Obama or the authors of the PPACA wanted given its opportunities for graft.

Finally, if you discover that you are among the consumers at risk for this tax liability, we do have a tool that you can use to estimate how you might need to change the income tax withholding on your paycheck to minimize the pain when you file your 2014 income tax returns in 2015.

We're just sorry that the Obama administration's claimed commitment to transparency in government never extended to the signature achievement of Barack Obama's presidency.

Image Credit: U.S. State Department, U.S. Embassy in Costa Rica.

Labels: health care, insurance, risk, tool

How close do dividend futures come to matching the actual values for quarterly dividends per share that are reported for the S&P 500 by Standard & Poor?

We have two primary sources for dividend futures data for the S&P 500: the CBOE's four quarterly dividend futures options contracts (DVMR, DVJN, DVST, DVDE) that are set to expire in the months that mark the end of each calendar quarter and IndexArb's bottoms-up estimation of the dividends per share that will be paid out between the date that a given quarter's dividend futures contract will expire and the present.

We'll limit our comparison to each quarter since 2010-Q1, since that marks the time when the CBOE introduced its dividend futures options contracts. The chart below shows how each of our sources compares to the actual amount of dividends that were reported by S&P for each quarter since 2010-Q1.

Overall, we find that the CBOE's final projection of what a given future quarter's dividends per share will be ranges within 5.4% to the low side and 4.9% to the high side, with the overall average overstating what Standard & Poor reports the actual amount of quarterly dividends to be by 0.4%.

By contrast, IndexArb's final projection of what a future quarter's dividends per share will be runs from 7.1% to the low side and 4.9% to the high side, while averaging 1.9% to the low side from the values recorded by S&P. That discrepancy is primarily due to how IndexArb estimates dividend futures data, as the amount of dividends per share that will be paid out between the present and the end of the indicated quarter, where the quarterly dividends that will be paid for a given quarter is found by subtracting the value presented for the preceding quarter from the value presented for the quarter of interest.

Further complicating the issue, once the preceding quarter has ended, there is no good way to use IndexArb's dividend futures data to find out how the dividends that will be paid out by the end of the current quarter might be changing. Consequently, IndexArb's final projection of the amount of dividends that will be paid for a given quarter is made some three months earlier, before the dividend futures contract for the preceding quarter expires.

That means that IndexArb's final projection for a given quarter's dividends per share misses the changes that might occur for the current quarter's dividends once it becomes the current quarter - and really represents what investors expected three months earlier. Since most companies tend to increase their dividends over time, that's why IndexArb's final projection for future dividends runs to the low side of the actual value.

By contrast, one can find the quarterly dividends that will be paid out for the CBOE's dividend futures by dividing the presented value for the quarter by 10. It doesn't get much easier, and the CBOE's dividend futures for the current quarter run all the way to the end of the dividend futures contract for the quarter.

The downside to the CBOE's dividend futures is that it periodically experiences price anomalies - where occasionally low trading volumes for the dividend futures option contracts can cause some havoc with the indicated value of dividend futures. Typically, those kinds of anomalies last no more than a week, until options traders recognize the money-making opportunity associated with the discrepancies. The most recent anomaly occurred on Monday, 10 June 2014, affecting the DVMR, DVST and DVDE dividend futures contracts, and lasted just one day.

There are other issues that drive differences between the dividend futures and actual dividends. Probably the most significant is what we call "term mismatch", which is the situation where the dividend futures run according to the options contracts that expire on the third Friday of the month ending a quarter, while the data that S&P reports goes all the way through the final day of the calendar month ending the quarter. A recent example of how term mismatch works can affect the observed difference between dividend futures data and S&P's reported dividend data be seen in the data for 2013-Q4 and 2014-Q1.

The last issue we'll note is that the weighting of the components of the S&P 500 also contributes to the differences between dividend futures and actual dividends per share. This might be considered to be part of the term mismatch issue, but is something that can play a role given how and when S&P determines how the dividends paid by the index' component companies are weighted to produce their dividends per share figure.

Overall however, we find that the dividend futures data comes out to be remarkably close to the official values produced by Standard & Poor. And that's your quick guide to the data that defines what investors expect for the future in the stock market!

Previously on Political Calculations

- Whither Dividend Futures - we've discussed our data sources for dividend futures before, but we didn't measure how close they come to actual dividends!

The stock market, as measured by the S&P 500, behaved fairly predictably in the week ending 13 June 2014. From all appearances, it would seem that investors are presently focused on the expectations associated with the fourth quarter of 2014 in setting today's stock prices. Which is both good and bad:

It's good in the sense that focus on this quarter would correspond to the best case scenario for investors. It's bad in that anything that might cause investors to shift their forward-looking focus to another point of time in the future would coincide with falling stock prices.

Analyst's Notes

Behind the scenes, we're starting to get a read on what the expectations are for 2015-Q2, but we won't have a more complete picture until after the dividend futures contracts for the second quarter of 2014 expire on 20 June 2014. For all practical purposes, the expectations associated with 2014-Q2 are no longer affecting stock prices.

Looking at our alternative futures chart above, which presents the most likely trajectories that the S&P 500's index value will track when investors are collectively focused on a particular future quarter, we see that stock prices in the most recently ended week pretty closely tracked the trajectory defined by a focus on 2014-Q4 on Monday through Thursday, but not on Friday.

That kind of deviation we see on Friday, 13 June 2014 is often the result of a combination of current day noise and the artifacts of the historical data we use in the math to develop each one of these trajectories (we've quantified that combination of noise and artifacts to some extent, which we show as the range about each basic trajectory that really represents where we expect stock prices to track).

For 13 Friday 2014, the apparent deviation between forecast trajectory and actual path for the S&P 500 is mainly the result of historical artifacts in the data for the forecast. As such, in this situation, we should expect that the S&P 500 would follow the short term trend indicated by all the other forecast data points around it rather than follow the exact trajectory of the forecast.

At least, until an outburst of current day noise or other event that might cause investors to suddenly shift their focus to a different point of time in the future would force stock prices to follow a different path. And if you think about it, it is the random occurrence of those kinds of factors that are really the thing that drives the stock market's large scale randomness over time.

Picking up on our previous post's theme of asking if you're in the wrong social network with respect to homicides, we thought we might revisit two earlier findings we had that might shed some light on whether restrictive gun laws make sense for a community.

In this case, the first earlier finding was based on a comparison of the homicide rates for Canada, which has restrictive gun laws, and the portion of the U.S. population that most closely matches the demographics of Canada's population. We found that for a standard populuation of 100,000 people in both nations, Canada's more restrictive gun laws would appear to prevent one homicide.

The second finding came about through a similar analysis of assault rates in both Canada and the U.S., where we found that Canada has 337 more nonfatal, nonsexual assaults per 100,000 members of its population than does their most demographically-similar peers in the U.S.

If there is a trade-off between homicides and assaults, where fewer homicides achieved through restrictive gun laws leads to greater numbers of assaults through the loss of the population's ability to deter violence with firearms in self-defense applications, did Canada make the right choice?

Thanks to research that details the costs of crimes per offense in the U.S., we can now answer that question! The chart below shows what the costs of various crimes, including homicide (murder) and (aggravated) assault:

Using these values for Canada, the avoidance of a single homicide would save nearly $10 million (in terms of 2014 U.S. dollars) per each 100,000 members of its population. Meanwhile, Canada's additional 337 assaults compared to the U.S. would appear to be costing Canadians $39,712,417 per each 100,000 members of its population. Or rather, Canadians are bearing the costs of $4 in additional assaults that wouldn't otherwise occur for every $1 they benefit from fewer murders.

We'll leave it to the Canadians to decide why they might think that one-sided trade-off makes them better off where homicide and assault rates are concerned.

Labels: crime

We've noted before that most murder victims in the United States are often demographically-related to their murderers, but did you know that they would also appear to be even more closely linked on their social networks?

A new study of gun violence in Chicago, led by Yale sociologist Andrew Papachristos, reveals that a person's social network is a key predictor in whether an individual will become a victim of gun homicide, even more so than race, age, gender, poverty, or gang affiliation.

"Risk factors like race and poverty are not the predictors they have been assumed to be," said Papachristos, "It's who you hang out with that gets you into trouble. It's tragic, but not random."

The study, co-authored with Christopher Wildeman from the Yale Department of Sociology, likens gun violence to a blood-borne pathogen. In the analysis, published Nov. 14 in The American Journal of Public Health, Papachristos notes that crime, like a disease, follows certain patterns. People in the same social network, he said, are more likely to engage in similar risky behaviors—like carrying a firearm or taking part in criminal activities—which increases the probability of victimization.

The abstract of Papachristos and Wildeman's paper puts some numbers behind what they found:

Combining 5 years of homicide and police records, we analyzed a network of 3718 high-risk individuals that was created by instances of co-offending. We used logistic regression to model the odds of being a gunshot homicide victim by individual characteristics, network position, and indirect exposure to homicide. Results. Forty-one percent of all gun homicides occurred within a network component containing less than 4% of the neighborhood’s population. Network-level indicators reduced the association between individual risk factors and homicide victimization and improved the overall prediction of individual victimization. Network exposure to homicide was strongly associated with victimization: the closer one is to a homicide victim, the greater the risk of victimization. Regression models show that exposure diminished with social distance: each social tie removed from a homicide victim decreased one’s odds of being a homicide victim by 57%.

The bottom line: the more space there is between you and a criminal, the better.

Other Food for Thought

In some U.S. cities with high murder rates, such as Milwaukee, Baltimore, Chicago (the current U.S. homicide capital), New Orleans, Philadelphia, San Francisco, Washington D.C., and even smaller towns like Flint, Michigan, a very large percentage of the victims of firearm-related homicides have criminal records, which means these homicides really involve criminals killing criminals.

Meanwhile, about 1 out of 8 homicide offenders serving time in U.S. prisons have been diagnosed with mental illnesses.

One might reasonably wonder then if what we have is not so much an inadequately-controlled firearm problem as it is an inadequately-controlled criminal and mentally-ill population problem. And maybe the real question you need to answer with respect to your own personal safety is who do you know who falls in both categories?

References

Andrew V. Papachristos and Christopher Wildeman. (2013). Network Exposure and Homicide Victimization in an African American Community. American Journal of Public Health. e-View Ahead of Print. doi: 10.2105/AJPH.2013.301441. [Abstract].

Image Credit: Cyber Crime Review.

Labels: crime

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

![Annual Expenditure for Owned Dwellings vs Annual Income Before Taxes for Various Income Ranges Reported in the Consumer Expenditure Survey, 1984-2011 [Constant 2011 U.S. Dollars]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhF7faIUv5V7yWwDRWKBwDOJY6ude_h-qC4TraG-FZHjJSXeE6cvOaU23__vHzU8a-4sp6koV7v7u7uxR6dzQEP5CKOSoT9aY8D9HGGyTcDJitgGppXRvim_I-GUem_wESCQb9N/s1600/CEX-annual-expenditure-owned-dwellings-vs-annual-income-before-taxes-1984-2011-constant-2011-usd.png)