Today, we're going to demonstrate that the policies of multiple agencies of the U.S. federal government are responsible for enabling criminal disability fraud in the United States, with the cost of the fraud accelerating the pending insolvency of Social Security's Disability Insurance Trust Fund, which will put the program's legitimate beneficiaries at high risk of having their benefits cut after the fund has been exhausted.

Current projections indicate that the Social Security trust fund for disability will be fully depleted in 2016, just four years from the present. The projections from the previous year had indicated that would not happen until 2018. The large shift in the timing of the projected trust fund depletion toward the present in just a year's time indicates a strongly deteriorating fiscal situation for the government "safety net" program.

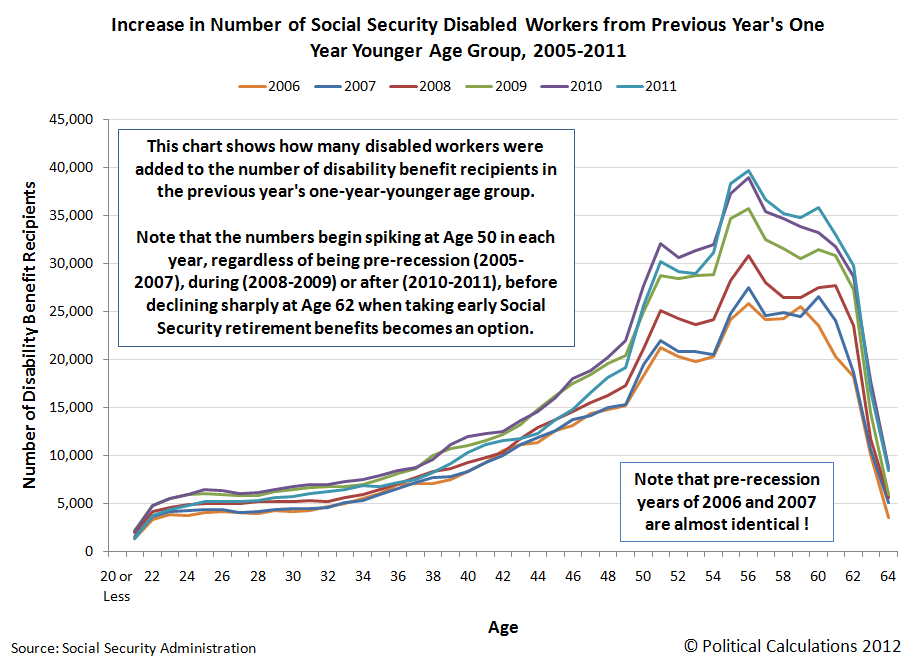

In Part 1 of our series, we discovered that the U.S. Social Security Administration has effectively established a "no-challenge" policy for disability insurance claims made by applicants over the age of 50, which allows these individuals to obtain Social Security disability benefits far more easily than individuals Age 49 or younger. This arbitrary policy is what enables these individuals to receive Social Security disability insurance payments, even though they might not otherwise be able to obtain those benefits if they were held to the same standards as those under Age 50.

We observe the likely greater incidence of disability fraud as we more closely examine the surge in the number of Social Security disability beneficiaries in the years since 2007, which coincide with the Great Recession. Here, we found that approximately 695,000 more individuals have been added to the nation's government disability rolls during this time than the level that would be consistent with those of pre-Great Recession years.

The chart above, showing the number of "surplus" or "excess" Social Security disability beneficiaries added in each year since 2007, indicates that the recession is the driving factor behind the increased number of individuals obtaining government disability payments, as the timing of the surge coincides with the expiration of government unemployment insurance benefits for individuals who were negatively impacted by the economic contraction, which officially ran from December 2007 through June 2009. The nation's sluggish economic recovery accounts for the decline in the number of surplus or excess Social Security disability program beneficiaries measured in 2011.

That connection between unemployment insurance benefits and disability insurance benefits brings us to where outright fraud is taking place today:

As many as 117,000 Americans simultaneously collect unemployment benefits and federal disability each year, a form of double-dipping that investigators say costs taxpayers $850 million annually and should be ended.

To understand why such "double-dipping" constitutes fraud, please note the following general requirements for each program:

- To receive unemployment insurance benefit payments, claimants must state that they are able to work.

- To receive disability insurance benefit payments, claimants must state that they are unable to work.

While there can be some small overlap in the detailed eligibility requirements for these programs that would legitimately allow a handful of individuals to receive benefits from both simultaneously, the vast majority of individuals currently receiving both unemployment insurance benefit payments and disability insurance payments do not fall within that narrow category and are therefore committing acts of fraud. In general, legitimate beneficiaries of these social safety net programs can draw funds from one program, or the other, but not both at the same time.

That multiple government agencies are involved in enabling this form of fraud is confirmed because the U.S. Department of Labor is responsible for administering the unemployment insurance program, while the Social Security Administration administers the Disability Insurance program. But worse than that is the reason why the fraud has been allowed to continue:

The reason for the double-spending, investigators at the Government Accountability Office reported this week, is good old-fashioned lack of communication.

Put simply, the Labor Department that funds unemployment benefits and the Social Security Administration that funds disability payments don't compare notes, leavings tens of thousands of Americans each month to collect two checks from a stretched-thin government treasury.

It would seem that the bureaucrats and politicians who are responsible for overseeing these programs learned nothing from the failure of government agencies to share information among themselves that enabled the criminal terrorist murders of 2,996 Americans on 11 September 2001 to proceed unchallenged.

This time however, the Government Accountability Office's report indicates that the annual savings that might be realized by ending this kind of fraud adds up to $850 million.

That's a savings of roughly 1 dollar out of each $1400 that is currently projected to be consumed in the nation's projected deficit of 1.21 trillion dollars for 2012! And it would be painless, because the people who are honestly playing by the rules would not be affected!

This is exactly the sort of thing that should be a no-brainer for a fiscally responsible politician - it's as close to low-hanging fruit as there is to be found anywhere in the U.S. federal government's budget. We wonder if any political candidate will rise to the occasion of acting to end the government's practices and policies that enable such costly fraud.

Labels: crime, insurance, national debt

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.