How do small firms compare with big businesses where health care insurance is concerned?

To find out, we've mined the Kaiser Family Foundation's 2009 Annual Survey of Employer Health Benefits, which breaks the data down by plan type. And since the Kaiser folks didn't present their data graphically within their report, we've gone the extra mile to fill the gap in their coverage to do that for you!

| Health Insurance: Single Coverage at Small vs Large Firms | |

|---|---|

|

|

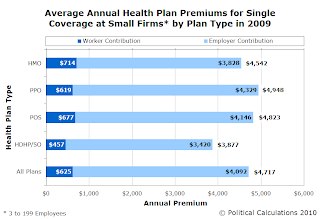

What we find is that on average, the health insurance at large firms for single individuals is more expensive than than typically found at small firms, which we see carries across all types of health plans. Likewise, we see that the portion of premiums paid by workers versus the share of health insurance paid by their employers is also less across the board for all types of plans.

In terms of the types of plans themselves, we find that High Deductible Health Plans with Savings Options (HDHP/SO) is the least expensive regardless of firm size. Interestingly, Health Maintenance Organizations (HMOs) are the second most inexpensive kind of plan for small firms, while these plans are the most expensive for large firms.

The narrowest difference between small and large firms for single coverage are Point of Service (POS) plans, whose total costs are within $29 of one another. Preferred Provider Organizations (PPOs), whose total cost is within $35 of one another. For both types of plans however, we see that employees at small firms are much more likely to have to cover a smaller portion of these plan costs than their peers at large firms.

The average cost of health insurance plan for single coverage in 2009 was $4,824.

| Health Insurance: Family Coverage at Small vs Large Firms | |

|---|---|

|

|

We see many of these same patterns repeated for family coverage, although here, we find one major difference: the employees at large firms pay a lot smaller portion of the cost of their health insurance premiums.

The differences can be significant. For example, for HMO plans, we find that while the total premium for a large firm costs $1,638 more than at a small firm, the employee of a small firm pays $1,825 more out of their own pocket to cover their share of that cost. The smallest difference is that for HDHP/SO plans, where a family coverage plan costs $1,626 more at a large firm than at a small one, while a worker at a small firm pays $490 more out of their pocket to cover their share of that plan than a worker does on average at a large firm.

We'll close by observing that the average cost of a health insurance plan for family coverage in 2009 was $13,375.

Labels: health care

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.