We were shocked, shocked to find that Nobel prize winning economist Paul Krugman positively endorsed a portion of our work last week on his New York Times' blog. Let's pause a moment and soak that experience in, as Krugman considers the inflation-adjusted stock market returns spanning several recent U.S. presidential administrations:

Look back at stock returns under recent presidents, which is easy using a clever gadget at Political Calculations. Taking real, dividend-inclusive annual returns on the S&P 500, I get:

Reagan: 10.08%

Bush I: 10.16%

Clinton: 14.35%

Bush II: minus 5.81%

Don't worry, it won't go to our heads. NewsBusters' Jeff Poor saw to that as he demoted our work from being clever to just being a location on the World Wide Web:

Krugman uses a "clever gadget," also known as a Web site, which is able to calculate S&P 500 returns over periods of time.

Poor then used our apparently not-so-clever web site to find the inflation-adjusted stock market returns spanning the terms of several recent Speakers of the U.S. House of Representatives:

But this sort of "economic shorthand" could be applied to anything to make a partisan case, which Krugman is trying to do. Based on his same criteria, you could make the case that the S&P 500 has done much better when the U.S. House of Representatives has been controlled by a Republican versus a Democrat over the same time frame:

Tip O'Neill (D) (Jan. 1981-Jan. 1987): 12.61%

Jim Wright (D) (Jan. 1987-June 1989): 7.33%

Tom Foley (D) (June 1989-Jan. 1995): 6.31%

Newt Gingrich (R) (Jan. 1995-Jan. 1999): 27.62%

Dennis Hastert (R) (Jan. 1999-Jan. 2007): 0.57%

Nancy Pelosi (D) (Jan. 2007-present): minus 11.05%

Whatever. Leaving the politics out of it, both Krugman and Poor are making a rather huge error in their assumptions: that the point-to-point rates of return for the stock market between any two arbitrary points in time is representative of how it behaved in between. To be fair, that kind of linear thinking can work a lot of the time, but not always.

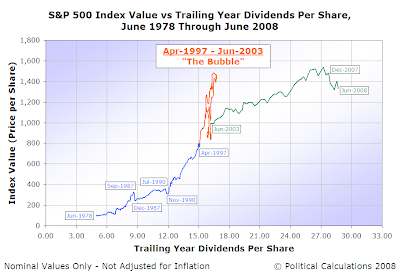

Here, if you were to choose any two points along the blue portion of the data spanning within the period from June 1978 through April 1997 and connect the dots, the straight line connecting them might be an okay depiction of how stock prices changed with respect to their underlying dividends per share during that time. The same might also be true for any two points you might choose in the period shown by the green portion of the data, which covers the time from June 2003 to June 2008 (at least up to December 2007!)

But if you're going to choose endpoints where either endpoint falls anywhere between April 1997 to June 2003, or if the points you choose include this data in the middle, you've flunked the test for linearity. Duke professor Robert Nau describes the impact if the assumption that a straight line describes data doesn't hold:

If any of these assumptions is violated (i.e., if there is nonlinearity, serial correlation, heteroscedasticity, and/or non-normality), then the forecasts, confidence intervals, and economic insights yielded by a regression model may be (at best) inefficient or (at worst) seriously biased or misleading.

Looking at Krugman's presidential stock market return data, we see exactly that. Since Bill Clinton's term of office concluded shortly after the Dot-Com Bubble peaked in August 2000, the rate of return between January 1993 and January 2001 is highly inflated because of the effect of the bubble. Likewise, since George W. Bush's presidency began with the stock market at such an unsustainably elevated level, it was virtually guaranteed that stock returns during his presidency would be lackluster in comparison.

Is there a better way to measure how the stock market performed over a defined period of time? One that incorporates all the data in between the endpoints of that period?

Ideally, what we would want would be to calculate the average rate of return for investments of any length in between the starting and ending points of the period in question. But, depending upon how long a period we're talking about, that can be a very large number of calculations to have to run.

Alternatively, we could see how a series of investments made at regular intervals during the course of a period have performed at its endpoint. The returns we would calculate using this approach would be similar to what a real life investor, say an individual who invests in an S&P 500 index fund through their 401(k) or 403(b) defined contribution retirement plan, would see.

It's not perfect, but we do have a tool that can do the math. Our Investing Through Time S&P 500 investment simulator can find out how much a series of equal investments made each month between any two points in time would be worth at the end (adjusted for inflation, indexed to the final month of the period), as well as calculate what the effective rate of return would be.

Doing that for all the presidential administrations going back to 1948, which contains the period of time we've identified as the modern era for the U.S. stock market, we found the following:

| Stock Market Performance, U.S. Presidential Administrations, 1949-2009 | ||||

|---|---|---|---|---|

| President | Period | Money Invested During Period | Investment Value with No Dividend Reinvestment (Rate of Return)* | Investment Value with Fully Reinvested Dividends (Rate of Return)* |

| Harry S Truman (D) | January 1949 - January 1953 | $4,800 | $6,133.04 (5.32%) | $7,226.04 (10.77%) |

| Dwight D. Eisenhower (R) | January 1953 - January 1961 | $9,600 | $13,559.17 (4.41%) | $16,469.01 (6.98%) |

| John F. Kennedy / Lyndon B. Johnson (D) | January 1961 - January 1965 | $4,800 | $5,896.63 (5.28%) | $6,342.49 (7.21%) |

| Lyndon B. Johnson (D) | January 1965 - January 1969 | $9,600 | $5,015.40 (1.10%) | $5,363.30 (2.81%) |

| Richard M. Nixon / Gerald R. Ford (R) | January 1969 - January 1977 | $9,600 | $5,257.42 (-1.87%) | $9,484.52 (-0.15%) |

| James E. Carter (D) | January 1977 - January 1981 | $4,800 | $4,967.29 (0.86%) | $5,524.46 (3.58%) |

| Ronald W. Reagan (R) | January 1981 - January 1989 | $9,600 | $13,429.84 (4.29%) | $16,316.72 (6.86%) |

| George H. W. Bush (R) | January 1989 - January 1993 | $4,800 | $5,434.07 (3.15%) | $5,838.54 (5.02%) |

| William J. Clinton (D) | January 1993 - January 2001 | $9,600 | $16,535.93 (7.03%) | $18,162.69 (8.30%) |

| George W. Bush (R) | January 2001 - January 2009 | $9,600 | $6,742.05 (-4.32%) | $7,247.19 (-3.45%) |

| All | January 1949 - January 2009 | $72,000 | $147,888.67 (1.21%) | $586,693.67 (3.56%) |

While these rates of return provide a better sense of the average "temperature" of the investing climate during each of the post-World War II presidencies, they still don't tell us much about the highs and lows, volatility, or events surrounding and even driving the market during the periods in question. For that, we'll point you to our quick overview of stock market history and mathematics, with the links in that post taking you to a more detailed history of market events.

As for the corresponding data for the U.S. Speakers of the House of Representatives, well, we'll leave that as an exercise for Jeff Poor, who we believe is clever enough to find the web site he'll need to do the math.

Labels: math, politics, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.