Welcome to this special Saturday, August 30, 2008 edition of On the Moneyed Midways, the only place you'll find the best posts from the best of the past week's money and business-related blog carnivals!

Welcome to this special Saturday, August 30, 2008 edition of On the Moneyed Midways, the only place you'll find the best posts from the best of the past week's money and business-related blog carnivals!

Oh, who are we kidding! If you're a longtime reading of OMM, you already know that "special" is our marketing word for "late"! And if you're a new reader, well, now you know too!

The best posts from the past week await you below!...

| On the Moneyed Midways for August 30, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How Eating Baked Beans Saves Me Over 1500 Dollars a Year | Engineer a Debt Free Life | A lot of madsow's co-workers give him weird looks for his fondness for eating cold baked beans, but he's laughing all the way to the bank at the rate of $30 per week! |

| Carnival of Personal Finance | Leaving the Workforce at 29: Where Do I Go from Here? | My Dollar Plan | Madison DuPaix is really 29 and really about to retire. And yet, she wonders how she's going to handle the transition. Absolutely essential reading! |

| Carnival of Real Estate | What the Surprising Strength of the U.S. Dollar Is Doing to Mortgage Rates | The Mortgage Reports | Dan Green notes that mortgage bond rates are tracking along with the U.S. dollar, which is not only benefiting today's mortgage shopper, but is likely to benefit tomorrow's too. |

| Cavalcade of Risk | Banking on Continued Risk in Lending Markets | The Aleph Blog | David Merkel charts the tightening underway in U.S. credit markets and discusses what that means for banks and borrowers. |

| Festival of Frugality | Don't Go to a Private University | Blueprint for Financial Prosperity | Jim takes on his role of devil's advocate in arguing that private colleges, like Harvard, aren't worth the premium you pay for the supposed advantage you might gain in networking there! |

| Festival of Stocks | American Water Works Co. Inc. (AWK) - Flooding Impacts Earnings | ZachStocks | Zach, who holds a short position in the stock, makes the case that American Water Works is likely to go lower in the near future. |

| Money Hacks Carnival | 10 Tips To Becoming a Make Money Online Sheep | Swollen Pickles | Are you finally ready to MAKE MONEY ONLINE? Swollen Pickles tells you the 10 things you need to do to become an MMO sheep. Baaaaa! |

| Carnival of Money Stories | On Money, Personal Finance and Being Judgmental | Tough Money Love | Mr. Tough Money Love justifies swinging his handy clue-by-four in The Best Post of the Week, Anywhere! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

I know what you're thinking - that I'm on my way to Dayton today! Well, I'll neither confirm nor deny that, but I will verify that On the Moneyed Midways will have a special Saturday edition this week!

Labels: carnival

What do you think you would see if you animated the trajectory of the S&P 500 during the course of the Great Stock Market Bubble of the late 1990s?

Well, if you're us, and you've previously drawn upon the work of both Copernicus and physicist Niels Bohr to describe insights into the nature of the stock market, seeing the phenomenon of Brownian motion should almost be expected!

As a quick review, Brownian motion is best described as the random motion of particles suspended in a fluid that is caused by the particles beng struck by individual molecules or atoms within the fluid itself. A rather famous paper by Albert Einstein back in 1905 proposed a method by which it would be possible to confirm the existence of atoms and molecules that relied upon the phenomenon to do so. In fact, Jean Baptiste Perrin built upon Einstein's theoretical work in this area to finally experimentally confirm the discontinuous nature of matter in 1913, for which he eventually won the Nobel Prize in Physics in 1926.

Here's a computer simulation that illustrates Einstein's explanation of Brownian motion, but if you prefer not to enable Java, here's a YouTube video of another computer simulation demonstrating the phenomenon:

Now, how does all that matter to the stock market?

It's long been established that changes in stock and bond values are best described as being a kind of Brownian motion, which is represented in the randomness apparent in how their values change over time.

In this case however, the changes in stock and bond prices are affected by the unseen forces of buying and selling in the markets. In the case of a stock market bubble, or other disruptive event in the market, instead of progressing in an orderly fashion as we've previously established, that order breaks down and would appear to result in unadulterated Brownian motion. We've illustrated this using the animated chart below for the S&P 500, showing the average monthly index value against its corresponding trailing year dividends per share during the period from April 1997 through June 2003, the timeframe for the Great U.S. Stock Market Bubble:

The final dark line in the animation indicates the reemergence of order in the stock market after June 2003. Here's our original chart indicating the dates for a number of the points:

Pretty cool!

Labels: dividends, investing, SP 500, stock market

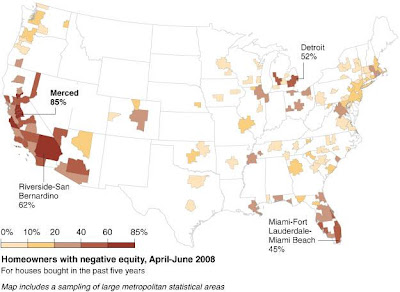

Sound Politics' Jim Miller found a pretty interesting correlation in the incidence of where homeowners have the greatest amount of negative equity and the predominant political affiliations in those areas. We thought it might be fun to show those maps together in the same post!

The first map, showing the percentage of homeowners with negative equity in April-June 2008 for U.S. metropolitan statistical areas, was created by Hannah Fairfield of the New York Times as a reference for an article about the aftermath of the housing bust in the central valley of California:

The second map, which was created by David Leip, shows the degree to which voters in the U.S. voted in favor of a particular political party, by county. Note that in this map, blue represents voter preference for the Republican Party, while red indicates voter preference for the Democratic Party:

Here's how Jim interpreted the apparent correlation:

In general — please note that I said, in general — the areas that have the highest levels of negative equity are the areas that vote Democratic, that elect Democrats to state legislatures and city councils.

There are exceptions. The heavily black areas along the Mississippi river and the Hispanic areas along the southern border vote Democratic, but do not have problems with declining equity (or even equity, some might quip). But on the whole the declining equity map is also a map of Democratic strongholds, Los Angeles and other urban areas on the West coast, the Twin Cities, Chicago, Detroit, New York, and so on.

Allowing for those exceptions, the negative equity map looks like a map of Obama's supporters, except for southern blacks.

Why might this be so? Here's my speculation, and it is no more than speculation, but it is consistent with a number of academic studies. Democrats, especially culturally left Democrats (latte-sipping, arugula-nibbling Democrats, as opposed to beer-drinking, hot-dog-eating Democrats), regulate housing markets, causing shortages. These shortages cause prices for homes and condominiums to rise rapidly. Once prices have been rising rapidly for several years, many begin to believe that they will always rise, and soon you have a bubble, with speculators trying to make quick profits, and home buyers trying to beat price increases. Eventually, the bubble pops, the prices drop, and the foreclosures start.

As it happens, there are a number of exceptions, including Merced County in the central valley of California, which was a central focus of the New York Times article. Here's how Jim accounted for it:

(Unfortunately for my thesis, the county that they chose to illustrate the negative equity problem, California's Merced, gave more than 56 percent of its vote to George W. Bush in 2004. But the housing bubble seems to have been mostly created by people from outside the county, and the land rules in Merced, as in the rest of California, are mostly set by the legislature, which has been run by Democrats for years.)

We'll note that would also apply for the Riverside-San Bernandino metropolitan area as well, which has the second highest percentage of negative equity homes in the U.S.

As for why that might be, the answer might be found in that there are fewer obstacles to new building and construction in these areas of California than in those areas that strongly trend toward the Democratic Party. Our best guess is that the relatively higher level of restrictive housing codes in these political strongholds pushed sharply inflated levels of development into these comparatively less regulated areas.

That effect might also account for the higher incidence of negative equity among homeowners in Maricopa County in Arizona, which has seen a great deal of in-migration from California residents seeking greater affordability and a relatively higher standard of living in recent years. Here though, the effect of the fallout hasn't been as great as Arizona doesn't restrict new development to the same extent as does California, which prevented housing prices from rising as much.

Labels: development, economics, politics

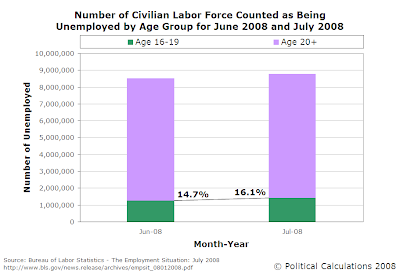

When it comes to the employment prospects for U.S. teenagers in the current economy, the effect of increasing the federal minimum wage is rather like throwing a switch. All it would seem to take for the government to throw hundreds of thousands of those Age 16 to 19 out of work is a 70 cent per hour increase in the legislated minimum pay rate!

When it comes to the employment prospects for U.S. teenagers in the current economy, the effect of increasing the federal minimum wage is rather like throwing a switch. All it would seem to take for the government to throw hundreds of thousands of those Age 16 to 19 out of work is a 70 cent per hour increase in the legislated minimum pay rate!

We've previously looked at how the most recent cycle of increasing unemployment rates has coincided with significant increases in the U.S. federal minimum wage, finding that the minimum wage hikes are disproportionately affecting teenage workers. Teenagers, it would seem, have borne the greatest burden of the increased level of unemployment in the U.S. as they make up such a large share of workers paid at the lowest levels.

Since we previously only considered the situation through the end of 2007, we thought it might be interesting to see what we would find if we ran some back-of-the-envelope numbers using data from the latest Employment Situation report.

Until the job numbers for August 2008 are released, this report provides the earliest look at the impact that the latest increase of the minimum wage would have on the United States' youngest jobholders. Since the minimum wage was just increased on 24 July 2008 to $6.55 per hour from $5.85 per hour, this report would capture the leading immediate reaction of employers to the newest legislated minimum wage increase.

The federal minimum wage was previously increased from $5.15 per hour to $5.85 per hour just a year earlier on 24 July 2007.

Since June 2008, Table A-1 of the report indicates that the number of people in the civilian labor force counted as unemployed has increased from 8,499,000 to 8,784,000 in July 2008. For those Age 16-19, the number of unemployed has increased from 1,253,000 to 1,415,000. As a percentage of those counted as unemployed, the unemployment share of those Age 16-19 spiked upward from 14.7% to 16.1%:

Looking now at the numerical change in the total number of people counted as unemployed between June 2008 and July 2008, we find an increase of 285,000. Meanwhile, for those Age 16-19, we find an increase of 162,000. In percentage terms, 56.8% of the increase in the number of unemployed from June to July 2008 is represented by the increase in the number of unemployed teenagers:

What's amazing is that this report only covers one week of the latest minimum wage hike! One wonders what August will bring for the teen unemployment numbers!...

Labels: minimum wage, unemployment

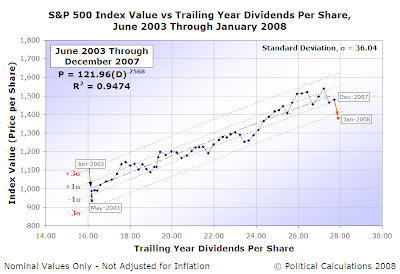

Today, we're applying our wrongly-applied but perhaps very useful "control charting" technique to map out the trajectory of the S&P 500 from December 1991 to the present. Our first chart is one we've shown previously, which shows the overall movement during this period:

Let's now take a closer look at each of the periods we've identified in this chart.

The Build-up To the Bubble

In December 1991, the stock market recovered from the recession of 1991 and resumed a largely stable upward trajectory until the onset of the great stock market bubble began in April 1997:

This period in the stock market was largely characterized by low volatility, which is reflected in the low standard deviation of 19.92, which represents the typical difference between the observed stock and dividend value and our central tendency described by the mathematical formula given in the chart.

We note two periods of interest. First, the microrecession of September 1994 through March 1995. Here, we see first see an acceleration of dividends per share accompanied by declining stock prices as investors anticipated a major slowdown in the growth of sustainable corporate earnings over the period from September 1994 through December 1994. That was followed by a quarter defined by slowly rising stock prices without any growth in trailing year dividends per share as corporate earnings stalled out. Upward growth in both stock values and dividends per share resumed beginning in March 1995.

The next significant movement we see in the chart occurred between June 1996 and July 1996, as the stock market underwent a significant correction, with the stock movement just exceeding two standard deviations, which we've previously suggested potentially coincides with or precedes a breakdown in the established order existing in the stock market.

In this case, that didn't happen. Both stock prices and dividends per share resumed a stable upward trajectory following this event.

At the time, the Federal Reserve speculated that the move was initiated by investors considering the likelihood of an increased in the Federal Funds Rate after a stronger than expected jobs report was released for June 1996. Ever optimistic, the New York Times speculated that the economy was about to plunge into recession.

In both cases, we believe we see purportedly smart people attempting to assign "rational" explanations to a random event. While a large move in the relative prices of stocks with their underlying dividends per share suggests that something might be afoot, it takes more than a single two-standard deviation shift to mark the breakdown of order in the market. Given random variation, we should expect to occasionally see such a movement without a corresponding breakdown in overall stability. As we see in this case, the trajectory of the market stayed well within its defined limits.

Speaking of the overall breakdown of stock market stability, the final observation we have in this chart is the breaking of order coinciding with the onset of the stock market bubble beginning in April 1997. Using the "control limits" we've defined, we observe that this move represents enough of a movement away from the previously established order to constitute a break in that existing order.

The Bubble

The stock market bubble that ran from April 1997 into June 2003 is pretty much well defined by anything but order! As such, we didn't even attempt to incorporate central tendency curves on this chart, but rather to try to map out the bubble's path over time:

When the Bubble began inflating in April 1997, it came with the expectation of increasing corporate earnings that would support significantly higher stock prices. Stock prices raced ahead and were initially supported by increased earnings, which makes the launching of the bubble a rational event.

What happened next however could not be described as holding to any sort of rationality. The real break between stock prices and the dividends per share that traditionally underlie their valuations began in July 1998 as stock prices first declined by more than 1000 points until October 1998, when they suddenly surged by more than 1000 points in one month's time as investors began the irrational ride of their lives.

That ride continued until a more rational order was able to be re-established in the stock markets in June 2003 - and to be honest, we have a pretty hard time following the trajectory until it reached that point ourselves!

Order Resumes

While we've previously commented upon the events of the period from June 2003 to December 2007, we'll observe here that the eventual break in order established during this period was preceded by two separate two-standard-deviation downward shifts before the observed order definitively broke down in January 2008. This final breakdown in order coincided with the shift outside the "control limits" defined by typical variation of stock prices observed during the period:

By our measures, a real breakdown in established stability in the stock market coincides with changes in the expectations that investors have for what they believe to be the market's sustainable earnings, as represented by their dividends per share.

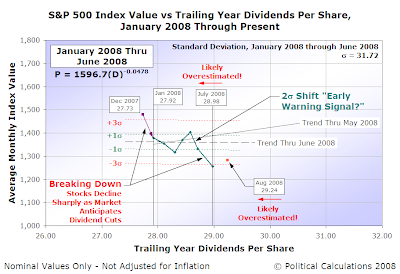

The Market in 2008, So Far

Through this point in 2008, the comparative decline in stock valuations with respect to their underlying dividends per share would appear to be largely rational. Investors have bid stock prices down in expectation of reduced levels of sustainable corporate earnings, which have occurred largely in step with actual cuts in corporate earnings. We see this in the seemingly orderly series of downward steps that we've observed to date, as the market steps down, proceeds forward, then steps down again:

What's made the period unique is that much of this activity has been largely contained within the financial and banking sector of the market. We observe this in that even though many of these institutions have acted to reduce their dividend payments as their earnings have declined, other companies outside this sector have had stronger than expected increases in their sustainable earnings stream, which has so far offset the declines of the financial sector.

Meanwhile, the decline in stock prices may be largely accounted for by the decline in the valuations of the stocks of companies within the financial and banking sector, which entered the period with rather large market capitalizations, reflecting the disporportionate representation of these companies within the S&P 500.

We expect that pattern to continue as the market sorts itself out. We just wish it would get itself sorted out faster....

Labels: dividends, SP 500, stock market

Welcome to the Friday, August 22, 2008 edition of On the Moneyed Midways, the blogosphere's exclusive review of the best posts found in the best of the past week's money and business-related blog carnivals!

Welcome to the Friday, August 22, 2008 edition of On the Moneyed Midways, the blogosphere's exclusive review of the best posts found in the best of the past week's money and business-related blog carnivals!

The 2008 Olympics provided a common theme linking many of the week's business and money-related blog carnivals. Most often, we're leery of themed carnivals as normally, themed carnivals provide almost unlimited opportunities for unlimited disaster. Fortunately though, the Olympics turn out to be a good theme, since the carnival hosts took more time to pick out the week's gold medal winners!

The good news is those gold medals were properly awared about half the time! ;-) Like the real Olympics, we believe a number of the "winners" were really ineligible for the week's top awards. Unlike the real Olympics and the impotent IOC, we could and did do something about it....

The final results are below....

| On the Moneyed Midways for August 22, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Consider This Likely Future Tax Benefit of Early Mortgage Payoff | Tough Money Love | Everyone thinks that owning a home (or really, having a mortgage) allows you to reduce your income taxes. Mr. ToughMoneyLove says that's the wrong way to think about it and shows how paying off that mortgage would reduce your income taxes more! The Best Post of the Week, Anywhere! |

| Carnival of Personal Finance | What Michael Phelps and the US 4x100 Freestyle Relay Team Taught Me About Debt | One Caveman's Financial Journey | The Caveman extracts the lessons that might be learned about handling debt from the central moment of the 2008 Olympics. |

| Carnival of Real Estate | A Six-Figure Income and Impeccable Credit Doesn't Insulate You From Tightening Mortgage Guidelines | The Mortgage Reports | Dan Green uncovers the scope of a building credit crunch from a Fed survey that reveals that 80% of U.S. banks are now making it much harder for "prime" borrowers to get a mortgage than they did a year ago, and offers advice for those who will be homeshopping in the next six months. |

| Festival of Frugality | How to Get Something for Nothing | I Pick Up Pennies | Abby revels in the highly labor-intensive art of mooching and a lifestyle of deferred gratification. |

| Festival of Stocks | What Could a Stronger Dollar Do? | College Analysts | James Cullen considers how a rising U.S. dollar would reshape both the economy and his portfolio. |

| Money Hacks Carnival | Free Money from the U.S. Mint | My Dollar Plan | Absolutely essential reading! Madison DuPaix reports on a brilliant strategy for exploiting the U.S. Mint's misguided marketing strategy for putting more U.S. dollar coins in circulation that puts more money in your pocket while keeping the undesirable dollar coins out of it! |

| Carnival of Money Stories | The Age of No Negotiation | Your Money Relationship | Adam tells the story of his unsuccessful attempt to buy a bike that was on sale, finding it out of stock, then offering to pay more money to buy another bike if the store would extend the sale discount for it. Absolutely essential reading for providing a lot of things to consider from all points of the interaction! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Late August presents a serious challenge to the relationship between men and women all over the world, as late summer presents a serious overlap of many of the world's major sports. Whether it be baseball, pre-season football, the start of Premier League soccer, professional golf, world class tennis, or just the latest rounds of NASCAR or ultimate fighting, there are more sports going on now than at any other time of the year, all combining to distract the serious male sports fan from allegedly paying enough attention to the women in their lives.

Late August presents a serious challenge to the relationship between men and women all over the world, as late summer presents a serious overlap of many of the world's major sports. Whether it be baseball, pre-season football, the start of Premier League soccer, professional golf, world class tennis, or just the latest rounds of NASCAR or ultimate fighting, there are more sports going on now than at any other time of the year, all combining to distract the serious male sports fan from allegedly paying enough attention to the women in their lives.

And then, to top the regular menu of late summer sports off, every four years you have the siren's call of the Olympics too!

So how can the male sports fan obtain the optimum balance between their sports intake and their relationship with the women who love them? Or phrased differently, how many hours of sports can you watch without her getting supremely pissed at you?

And let's be honest here - this issue isn't just limited to late August now, is it?

Fortunately, Geek Logik's Garth Sundem considers questions just like these on a regular basis! And for the male sports fan, he's reduced it all down to a mathematical formula, for which we've constructed the tool below. Want to find out the maximum amount of sports you can watch and sustain a healthy relationship? Just enter your personal data into the tool and we'll do the math for you!

The default numbers in the tool above came from a radio interview Garth Sundem did with the CBC's Cameron Phillips, who provided them off air. Here's how Garth described the outcome:

These numbers say he's in decent standing in a relationship with an only slightly vindictive girlfriend, he hasn't spent the last week glued to the tube, and today's sporting event is mildly important (curling?).

According to the equation, Cameron can spend 4.48 hours watching sports today!

Garth offers the following insights for sports fans doing the math for themselves:

Equation Note: The only complex variable in this equation is your standing in the relationship — good standing allows more sports (obviously), but as your standing gets into the basement, you might as well watch sports 'cause you're already sleeping on the couch anyway.

Equation Note II: You may feel this is chauvinistic. If so, feel free to flip the genders or mix and match as you see fit.

Labels: geek logik, sports, tool

There's a lot of speculation surrounding who's going to be each U.S. presidential candidate's pick to be Vice President this year, but it's time to end all that speculation and simply announce that apparently, it's me.

There's a lot of speculation surrounding who's going to be each U.S. presidential candidate's pick to be Vice President this year, but it's time to end all that speculation and simply announce that apparently, it's me.

If you're surprised to hear that, just think how surprising being asked to be Vice President is! The phone rings, an operator says to hold for the candidate, then suddenly they're desperately pleading with you to go on the bottom half of their ticket.

But the real truth is that nobody votes for Vice President. In fact, one strongly suspects that most Americans may not even know the name of the current Vice President. Or any Vice President. Heck, I'll even go one step further - it's pretty likely that a sizable percentage of Americans don't even realize that there really is such a thing as a Vice President. "Don't be silly," the parents who fall in this group tell their children, "the Vice President is like the Easter Bunny. No one ever sees them, except maybe once every four years."

As a result, it would seem that an anonymous individual like myself is well-positioned to fill the role. Being outside the political world, I don't have any real baggage that could be a drag on the ticket. The FBI's detailed background search and vetting process took all of about five minutes. They use Google. If that's good enough for them, it ought to be good enough for all you registered or likely voters! Try that with former Vice Presidential candidate John Edwards these days.

In my view, the Vice President of the United States should be virtually invisible. You shouldn't even know they're there. And of course, the best way to do that is to fill the job with an anonymous presence like myself. Stuff like taking up official residence at an undisclosed location poses absolutely no challenge. In fact, the Secret Service's job of protecting the Vice President would get a lot easier just because I could be anyone. Terrorists, political assassins, telemarketers - all of them would be absolutely stymied simply because they wouldn't know who to go after!

What's more, I'm experienced at being an anonymous presence. The next President of the United States of America won't have to worry about any of that "look at me, I really exist" crap that sabotages the true mystique of the Vice Presidency and eventually drags down the ambitions of so many previous Vice Presidents. Don't believe me? Look at the post-Vice Presidential careers of the people who have previously either held the job or actively campaigned for it. Believe me when I say that nothing good has come from any of it and the previous job holders and applicants can be safely ignored!

The way I see it, if you're destined for obscurity, why not start off with it and keep it that way?

So I'm pleased to accept the invitation to be the next Vice President of the United States of America. Just don't ask me to carry a swing state.

Update 21 August 2008: Don't think I sound too plausible as the next U.S. Vice President? Consider just what personal qualities 2008 Democratic Party presidential candidate Barack Obama is seeking in his running mate (HT: Amanda Carpenter):

Obama said he wants a VP who is "not about ego, self-aggrandizement, getting their name in the press."

Check, check and check!... And on the latter, I couldn't be more off the press' radar if I tried! Plus, what better way to divert attention away from one's lack of experience than to pick a running mate who's very existence is an open question?

Labels: none really

Big Brown, the horse that dominated the 2008 Kentucky Derby and the 2008 Preakness Stakes before being blown away by the field at the 2008 Belmont Stakes in a devastating loss, is racing again.

Big Brown, the horse that dominated the 2008 Kentucky Derby and the 2008 Preakness Stakes before being blown away by the field at the 2008 Belmont Stakes in a devastating loss, is racing again.

The question is why.

The Rail's Alex Brown explains why continuing to race Big Brown doesn't make economic sense back on 20 May 2008, before Big Brown's blowup:

Big Brown is off to Three Chimneys with a $50 million valuation.Let us explore the economics of the deal. Investors and breeders want a decent return on their investment in four years, before the progeny of the stallion starts to run. Once the progeny starts running, the value of the stallion is tied to its record as a producer. Before they run, the value is dictated by the economy and the initial deal. Getting the majority of the money back before the progeny starts running limits the risks associated with standing a stallion whose runners may not be too fast.

Assume Big Brown stands for $100,000 and covers 112 mares a year. The latter number is conservative. I chose it because that is the number the Three Chimney’s stallion Smarty Jones covered in 2006. In 2007, Stormy Atlantic led the way with the most mares covered in the northern hemisphere, with 199. Johannesburg covered 195. Johannesburg also covered 139 mares in the southern hemisphere, for a total of 334 in one year. So the numbers can go much higher.

Based on Smarty Jones’s numbers of 2006, each year Big Brown will earn $100,000 x 112, $11.2 million. In four years, he will have earned $44.8 million before his progeny starts running. With interest, he will then need to earn perhaps another $15 million or so through his stallion career to make the $50 million valuation appropriate for all involved. Of course, I use the numbers loosely, but they are a close approximation and illustrate the reality of breeding economics.

From an investment standpoint — and Big Brown’s owners are investors — to keep Big Brown in racing beyond his 3-year-old career, he would need to earn more than $11.2 million a year plus the additional costs of insurance as a racehorse versus insurance as a stallion. Obviously the economic decision has to be to retire Big Brown.

Meanwhile, Big Brown's owners were stating at the time that they would indeed race Big Brown after the Belmont, as The Rail's Joe Drape reported, also back on 20 May 2008:

Rick Dutrow says he’d like to see Big Brown race beyond the Belmont and in the Travers Stakes, or the Midsummer Derby, and the Breeders’ Cup Classic, where the reigning Horse of the Year Curlin could await.

While the colt's co-owner, Michael Iavarone, has said Big Brown will not race next year, he has indicated that the colt may run in the summer and the fall. Iavarone’s International Equine Acquisitions Holdings struck a deal for Big Brown's stallion rights for more than $50 million with Three Chimneys Farm in Midway, Ky.

"We have the right to race him through the end of the year and make decisions as he goes," Iavarone told the Thoroughbred Times.

"As far as Big Brown is concerned, as long as he keeps coming out of his races well, we'll sit down and discuss each race with Three Chimneys on a race-by-race basis. We don’t intend to race him after he's 3."

Note those races in which Big Brown's owners were targeting back before Big Brown's upset loss at Belmont: the Travers Stakes and the Breeder's Cup Classic. Today, we know that Big Brown will not run in the Travers Stakes/Midsummer Derby and while perhaps still intent on running in the 2008 Breeder's Cup, Big Brown's owners have gone out of their way to avoid racing 2007's horse of the year, Curlin.

Now consider the races being discussed for Big Brown instead of these large purse races:

Dutrow wouldn't commit to where Big Brown will make his next start -- assuming he isn't retired. The Pennsylvania Derby, Mass Handicap and Jockey Club Gold Cup have been mentioned as possibilities."

These potential future races were mentioned in the aftermath of Big Brown's victory at the Haskell Invitational on 3 August 2008, his first race after the devastating loss at Belmont. Even so, Big Brown's win at the Haskell Invitational was best described as a disappointing performance as it came against a comparatively inferior field.

The takeaway is that it would appear that Big Brown's owners don't have anywhere near the confidence they had prior to the Belmont Stakes. Otherwise, why not pursue bigger purses in bigger races?

From our standpoint, it would seem that Big Brown's owners may be pursuing a strategy similar to one used by boxing champions who are past their prime. Here, after climbing to the top ranks of the profession, a top boxer's manager seeks to pit his fighter against much lesser opponents, seeking to guarantee a continued winning streak rather than face a potentially equal or better competitor, who might jeopardize the boxer's status and income-earning potential as a top draw.

From our standpoint, it would seem that Big Brown's owners may be pursuing a strategy similar to one used by boxing champions who are past their prime. Here, after climbing to the top ranks of the profession, a top boxer's manager seeks to pit his fighter against much lesser opponents, seeking to guarantee a continued winning streak rather than face a potentially equal or better competitor, who might jeopardize the boxer's status and income-earning potential as a top draw.

By following this strategy, the boxer's manager seeks to maximize the amount of revenue that might be gained before the boxer's career inevitably declines.

For racehorses, the situation is somewhat different. Most of the money that stands to be gained from their racing prowess comes after their racing days are past and they are put out for stud. So what possible reason could there be for extending Big Brown's racing career by matching the thoroughbred up against the horse racing world's equivalent of a bunch of palookas?

The answer lies in Big Brown's extremely poor performance at the Belmont Stakes. Already committed to a $50 million USD stallion career, Big Brown's last place finish at Belmont very likely seriously damaged the horse's stud income-earning potential. As a result, it may be that the only way Big Brown's owners have of generating this level of income within the available window of time is to incrementally build up the Big Brown's winning record as a way to increase their stud fees.

The strategy may only produce a marginal improvement in those stud fees, but multiplied by hundreds of mares, the strategy makes sense. They stand make more money by adopting it than they might without it.

And in the world of horseconomics, that would appear to mean racing palookas.

Labels: sports

How much is that idea of yours really worth?

How much is that idea of yours really worth?

Yes, it's a question that we've addressed before, but one that we treated very generally. Metaphorically speaking, we could put you in the metropolitan area for your idea, but not necessarily within the ballpark!

Today, we're going to get a bit more precise! To do that, we're going to steal the math presented by The Shark Investor in considering how to profit from ideas. As we'll see, execution, or rather, the ability to implement an idea, is still the driving factor behind how much a given idea is worth, but now, we can put a more precise value on how much that idea is really worth:

If you want to invest in ideas, you must tell the good ones from the bad ones. You need to appraise the value of the ideas - and more important, the value of their future implementation. It's easy to think that an idea is great if you look only at the final outcome that it could produce some day. But there is very little use of such appraisal if you don't take in mind its implementation.

Implementation simply means how you can turn the idea into something real.

The good ideas are the ideas that can be implemented with reasonable resources and that you know how to implement. You may not need to know all the technical details of the idea's implementation, but you must know well who can take care for them and how much resources is it going to take.

So, let's say for example you have the idea to create a flying car. When considering the final outcome, it seems the idea is quite valuable. A flying car must interest a lot of people and probably will sell well. Of course, "probably" is not the best thing to rely on, but at this very early stage of brainstorming it is ok to rely on your guesswork. The idea of a flying car would be great if you could implement it. Maybe you are not an engineer and cannot invent it yourself. Do you know who could do it, how much is it going to cost and how much time is it going to take? Are you sure there is not someone else who is working on the same idea and could implement it faster than you?

The real value of the idea is an equation. On the left side you have the wealth/profits that the idea can generate. On the right side you have the costs of it's implementation. The more you have at left, the better the idea is.

But even this appraisal is way too simple. Because you need also to consider the probability to turn the business idea into action and to do it better and faster than the competition. So finally the very simplified equation looks like this:

Value = (Possible profit value * Probability to be implemented) - Costs of implementation

Needless to say, we just can't pass that kind of math up! Just enter the data for the right hand side of the equation in the tool below, and our tool will find out how valuable that idea really is:

For our default scenario, we find that the value of an idea that has an even-money probability of being successfully executed and that could generate a million dollars in potential profits, but that also comes with a $500,000 price tag, really isn't even worth a single cent.

At least, given these parameter. The Shark Investor discusses some of the dynamics revealed by the math:

If you play with few numbers in the above equation, you will see that the probability factor plays much bigger role in estimating the idea value rather than the costs of implementation.

Let's get for example a software project that could bring you a million dollars in sales. If you hire a cheap team to develop it, the chances for successful idea implementation yet on the development stage are quite poor. This means that no matter how great the idea is, you will probably not see any profits. On the other hand, hiring a more experienced and talented team will cost you more, but will increase the chances of success and you may actually see the profits.

However, if you simply can not afford to hire the expensive team, then you have only the first option. Which makes the idea much less valuable. If exactly the same idea was owned by someone who could afford hiring a good team, it would have bigger value.

And so we once again confirm that in the world of ideas, execution is everything.

Welcome to the Friday, August 15, 2008 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts found in the best of the past week's money and business-related blog carnivals!

Welcome to the Friday, August 15, 2008 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts found in the best of the past week's money and business-related blog carnivals!

How will you respond when the roaches invade? Why does the devil think it's a good idea to charge patrons a dollar to use a public restroom - and why would only charging a quarter be more evil? Could diversifying into just 15 stocks be a better investment strategy than diversifying into 150?

These are just a few of the questions asked by the authors of this week's top selections from among all the blog carnivals we surveyed - those posts, and the rest of the best posts from the week are waiting for you below....

| On the Moneyed Midways for August 15, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Order of Debt Repayment | My Debt Blog | If you owe money, who should you pay off first? Jim organizes a strategy based upon the potential nastiness of those to whom you might owe the money, but we can't help note that the list is organized so debts covering depreciating assets come before assets that appreciate. |

| Carnival of Personal Finance | Taste the Rainbow… Globally | Thornton Wealth Management | Russ Thornton uses "Skittles" charts to demonstrate why diversification into non-U.S. stock markets might be a very smart thing to do for your portfolio. |

| Carnival of Real Estate | 3 Bogus Real Estate Statistics - Know Them Or Be Burned By Them | Really Better Real Estate | Joe Manausa has a bone to pick with the National Association of Realtors and bad real estate agents on the numbers they throw around at clients! Absolutely essential reading! |

| Carnival of Taxes | How to Choose an Accountant | The Business Lounge | Ian Cunningham provides sound advice for how to go about selecting an accountant. His advice is oriented for the U.K., but much of it translates to other parts of the world! |

| Cavalcade of Risk | Consider the Total Cost of Jerks to Your Organization | Risk Management for the 21st Century | How much does bad behavior by either employees or the boss cost a business? Nancy Germond considers the costs and the steps several large companies are taking to avoid jerk-driven expenses in Absolutely essential reading! |

| Cavalcade of Risk | Credit Card Rental Car Insurance Is Secondary Coverage?! | Blueprint for Financial Prosperity | Jim reads the fine print for auto rental insurance from a major credit card issuer and discovers that it doesn't cover what he thought it did! |

| Festival of Stocks | 150 Stocks - The Secret to Proper Diversification? | Qovax | Ye is unimpressed by the story of Anurag Gupta, an average investor who beat the stock market with his 150 stock portfolio, arguing that he could have done better with a diversified portfolio of 15 stocks of companies he knows better! |

| Money Hacks Carnival | How to Kill Roaches and Get Rid of a Home Cockroach Invasion | Money Blue Book | There are problems we normally just talk about, and then there are problems that you have to do something about. Raymond relates how he dealt with a roach invasion in The Best Post of the Week, Anywhere! |

| Carnival of Money Stories | Paying $1 to Use Public Bathrooms Is Good. Paying 25c Is Bad | Budgets Are Sexy | J. Money says it might make sense to turn your business' public facilities into a serious profit center. We think J. Money is the devil. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We would hypothesize that the answer to both questions is yes, and we would caution that it's not quite as simple as it sounds.

To understand why, we'll take a closer look at Vitamin D's role in the human body, how it applies to the chronic diseases that disproportionately affect the black population of the U.S., and how the greater incidence of the deficiency among the black population would appear to account for the unusual features we've observed in the percentage of survivors of the black population for each 100,000 born alive. We'll also explain why the steps the U.S. government has instituted in mandating the fortification of dairy products with Vitamin D would appear to be largely ineffective for the adult African American population and ultimately discuss how the deficiency can be addressed more effectively.

Background Information on Vitamin D

The Role of Vitamin D in Human Physiology

The primary role of Vitamin D in the body is to help regulate the level of calcium in the bloodstream. It does this by facilitating the absorption of calcium from dietary sources in the digestive system and by promoting normal bone growth and mineralization. As the tuberculosis study we've previously cited demonstrates, Vitamin D also plays a key role in facilitating the production of cathelicidin, an antimicrobial peptide that play a vital role in the immune system's ability to resist infectious diseases.

Where Vitamin D May Be Obtained

Vitamin D may be obtained from two key sources. The first is from natural sunlight exposure, where ultraviolet rays (UV-B) penetrate into the skin and is synthesized through natural biochemical reactions. The second is from foods or dietary supplements that either contain or have been fortified with Vitamin D. Like Vitamin B, there are several different kinds of Vitamin D. Sunlight exposure creates Vitamin D3, while many food supplements contain Vitamin D2 or D3. The most recommended form for dietary supplementation is Vitamin D3.

How Much Vitamin D Do People Need?

For adults between the ages of 19 and 50 years old, the U.S. Food Nutrition Board recommends a daily Vitamin D intake from food or dietary supplements of 200 IU (International Units), which is equivalent to 5 mcg (micrograms). The American Academy of Pediatrics will be publishing new guidelines for Vitamin D intake this fall, which will recommend that infants, children and adolescents should receive 400 IU (or 10 mcg) This same level is recommended by the Food Nutrition Board for people Age 51-70 years old. People over the age of 70 are recommended to take in 600 IU (or 15 mcg).

These levels are recommended as the level of ultraviolet light exposure that individuals receive on their skin from direct sunlight is difficult to anticipate and varies by prevailing weather conditions and geographic latitude, with people living in northern latitudes especially disadvantaged. Other factors, such as clothing, sunblock application and the amount of melanin skin pigmentation by individual also negatively affect the level of Vitamin D production from UV-B exposure.

It is possible to overdose on Vitamin D dietary supplements. Ingesting more than 2000 IU (50 mcg) a day on a sustained basis may produce a toxic effect, initially indicated by nausea, but possibly leading to kidney damage, kidney stones, muscle weakness or excessive bleeding. Higher amounts may be taken without negative impact for limited periods of time.

How Vitamin D Deficiency Contributes to Shorter Lifespans

With higher levels of melanin in their skin, which absorbs high quantities of the UV-B radiation that stimulates natural Vitamin D production, the black population of the United States is much more likely than the white population to suffer the effects of Vitamin D deficiency, as well as the very closely related conditions associated with calcium levels, which Vitamin D regulates within the body.

In the table below, we've outlined the chronic diseases and health conditions that disproportionately affect the black population, above and beyond those already well-linked to Vitamin D or calcium deficiency, and linked to research supporting the connection if one has been established.

| Chronic Diseases Linked with Incidence of Vitamin D Deficiency | ||

|---|---|---|

| Category | Chronic Disease or Condition | Linked to Vitamin D Deficency? |

| Infant Mortality | Premature Birth/Pre-eclampsia | Yes |

| Low Birth Weight | Yes | |

| Heart Disease | Cardiovascular Disease | Yes |

| Cancer | Breast Cancer | Yes |

| Lung Cancer | No | |

| Colorectal Cancer | Yes | |

| Cerebrovascular Disease | Hypertension | Yes |

| Atherosclerosis | Potentially | |

| Infectious Diseases and Conditions | HIV/AIDS | No |

| Tuberculosis | Yes | |

| Septicemia | Unknown | |

| Kidney Disease | Yes | |

| Negative Health Contributors | Overweight and Obesity | Yes |

| Diabetes | Yes | |

We observe that the increased incidence of Vitamin D deficiency among African Americans would appear to contribute to the increased incidence of the chronic conditions that negatively affects the health the black population of the United States, which in turn shortens their longevity with respect to that of the white population.

Accounting for Disparities Between Black and White Life Expectancy

Now that we've identified the chronic diseases that act to disproportionately shorten the lives of the black population of the United States and confirmed that a deficiency of Vitamin D is a major contributing factor to nearly all of them, let's look again at our chart showing the difference in the percentage of survivors of every 100,000 born between the white and black population of the United States as we begin to hypothesize on why the disparities between races exists:

The grand hypothesis we're going to offer is that a deficiency of Vitamin D within the black population accounts for nearly all of the difference observed between the black and white population. Let's take a closer look to see how that might work:

- We see that the difference in the percentage of survivors begins immediately in the first year of life. With black mothers far more likely than whites to have a deficiency in Vitamin D, we hypothesize that a large portion of this difference may be attributed to the resulting conditions of pre-eclampsia, which is the leading cause of premature birth, and low birth weight, both of which contribute to the increased rate of infant mortality observed in the black population.

- There is little change in the years from 1 to 20 years old between the black and white population of the United States. We hypothesize that this is due to combination of increased exposure to natural sunlight for those in this age range as compared to either infants or adults and the effectiveness of the U.S. government's mandated Vitamin D fortification of dairy products for children. However, as we'll discuss shortly, we believe that the effectiveness of Vitamin D fortification of dairy products becomes ineffective for the black population with the onset of adult maturity.

- Once the members of the black population reach adulthood and no longer consume vitamin-fortified dairy products, we hypothesize that the comparatively reduced effectiveness of natural sunlight exposure results in widespread Vitamin D deficiency among the population. As a result, all the chronic conditions for which a deficiency of Vitamin D contributes to the incidence or the severity of these disease begins to claim the lives of the black population in disproportionately large numbers as compared to the white population.

- The greater incidence of Vitamin D deficiency among adult African Americans likely also explains why teenage mothers within this group are less likely to give birth to children prematurely or to have low birth weight babies as compared to older mothers. Since Vitamin D is fat-soluable, the teenage mothers, even if they've already stopped consuming dairy products, will have stores upon which their bodies can draw through their pregnancies. Older mothers will have long-since depleted their stores without supplementation through another dietary source.

- While higher levels of UV-B absorbing melanin reduces the amount of Vitamin D produced through direct sunlight exposure for the black population, those members of the population living in urban areas are much less likely to have direct sunlight exposure as compared to those who live in suburban or rural areas. We hypothesize that this difference largely accounts for the reduced life expectancy of urban-living blacks.

- We should also note that all blacks living in northern latitudes will be similarly negatively affected, as the curvature of the Earth reduces the intensity of the sunlight reaching these regions.

- We suspect that a good part of the difference between the native black population of the United States and black immigrants may in part be accounted for by the immigrant black population being more likely to have significantly longer sunlight exposure than the average native-born black, but perhaps comparable to the members of the black population who live in rural areas. Combined with a lower incidence of consumption of tobacco products, this factor likely accounts for much of the foreign-born black immigrants' greater life expectancy.

- Meanwhile, the longer lifespans for the members of the black population over the Age of 80 may in part be attributed to where they have primarily lived during the course of their lives, which we would anticipate to coincide with either suburban or rural regions of the United States, and suspect includes a dietary regimen that incorporates Vitamin D.

Why Dairy Doesn't Work For the Adult Black Population

We promised at the beginning that we'd figure out how to bring cattle herding into the picture, and here it is: the vast majority of the black population of the United States is descended from the peoples of western sub-Saharan Africa and, as a result, become lactose intolerant as they grow into adulthood as their genetic makeup doesn't permit the digestion of dairy products.

We promised at the beginning that we'd figure out how to bring cattle herding into the picture, and here it is: the vast majority of the black population of the United States is descended from the peoples of western sub-Saharan Africa and, as a result, become lactose intolerant as they grow into adulthood as their genetic makeup doesn't permit the digestion of dairy products.

Not all peoples of African descent are in that boat. The peoples of eastern Africa do have the ability to digest milk products. The difference between each comes down to a genetic adaptation that takes hundreds of generations to develop that coincides with the practice of cattle herding. The peoples of eastern Africa have a very long history of cattle domestication, beginning anywhere from 3,000 to 7,000 years ago. By contrast, the peoples of western Africa have a much shorter history with herding cattle and haven't developed a similar genetic adaptation.

And that's why the U.S. government's mandated fortification of dairy products with Vitamin D doesn't work for the adult black population! Except perhaps for black immigrants from eastern Africa, which may account for part of the observed greater life expectancy of foreign-born black immigrants to the U.S.

What Would Work Better

There are very few foods that naturally contain Vitamin D. The non-fortified dairy product portion of the menu includes items like: cod liver oil, salmon, mackerel, tuna, sardines, margerine, whole eggs, and beef liver. We know - except maybe for salmon, tuna, eggs and margerine, it's hard to look at that list and keep yourself from salivating! (Mmmm, cod liver oil....)

There are very few foods that naturally contain Vitamin D. The non-fortified dairy product portion of the menu includes items like: cod liver oil, salmon, mackerel, tuna, sardines, margerine, whole eggs, and beef liver. We know - except maybe for salmon, tuna, eggs and margerine, it's hard to look at that list and keep yourself from salivating! (Mmmm, cod liver oil....)

More seriously, there a number of ready-to-eat breakfast cereals are fortified with Vitamin D, which we would recommend be eaten as a dry snack. There are, of course, direct alternatives to dairy products. Of these, our first choice to see if it works would be those dairy products that have been formulated to accommodate those who are lactose intolerant. Other milk-substitutes such as soy milk (are you salivating again?) might work out, but we'll observe that it would work better for women than it would for men.

Meanwhile, there are always Vitamin D tablets. A quick trip to our local supermarket showed a 90-day supply of 400 IU Vitamin D tablets would cost about $4.00 (USD), which means that a year's supply for an individual might be purchased for anywhere from $12-$20 (USD) taking into account competition between stores, sale vs. non-sale prices, availability, etc.

All in all, a super-cheap way to potentially, and quite literally, add years to your life.

The trick would be to find what you wouldn't mind eating or consuming on a regular basis and go with it. Sooner or later, food producers will introduce improved, better tasting products that can meet the specific dietary needs of the black population.

Conclusion

Often, the toughest questions to answer are those that ask "why this, but why not this?"

Throughout this series of posts, that's been our challenge. Why do African Americans have higher infant mortality than whites, but then have a nearly equivalent todder-child-teenager mortality rates? Why do blacks then have a higher adult mortality rate, but then substantially lesser mortality for those over the age of 80 than the white population of the United States? Why do urban blacks, who have significantly greater access to health care facilities than their rural peers, have much lower life expectancies? Why are black teenage mothers less likely than older mothers to give birth either prematurely or to low birth weight babies, the leading cause of infant mortality? Why do black immigrants who statistics indicate would live much shorter lives in their native countries live longer than native-born African Americans if they immigrate to the U.S.?

To answer these questions, we asked and answered several of our own. What health conditions account for the disproportionate mortality of African Americans compared to whites at every stage of life? What factor or factors contribute to these disproportionate outcomes that might also answer "why this, but not this?"

That's how we came to this final post in this series, in which we've presented a single, unifying explanation that potentially accounts for what we observe in all the data we have and leads to our seemingly simple solution. In doing all this, we've linked to cutting edge medical research and breaking news covering some of the latest findings in genetic anthropology, spanning several millenniums of human history in the process.

And we have to note, it might not pan out as we see it. That's where we're at today, awaiting the results of scientific studies and research that confirms or rejects what we've hypothesized.

But we have to admit, it would be pretty cool if we turn out to be right!

All the Posts in the Series

For reference, here are all of the posts in the series:

- Blacks Living Longer Than Whites

The post that started the whole thing! We were surprised to find that blacks over the age of 80 had longer remaining life expectancies than whites of the same ages in the U.S. We also used the opportunity to ridicule some pretty blatant rent-seeking behavior on the part of researchers seeking funding for their work.

- Erasing the Gap in Racial Life Expectancies

We revisited the life expectancy figures between blacks and whites and took a closer look at the underlying data, which allowed us to reject racism as an explanation for what we observed. We also began asking "why this, but not this?" in comparing not just the survivorship of the black and white populations of the United States, but urban vs rural blacks, immigrant vs native-born blacks, and the effect of older vs younger mothers for African American infant mortality.

- The Disproportionate Killers

You can't address racial disparities in life expectancies unless you know what chronic health conditions disproportionately affect the black population of the United States compared to other racial or ethic groups.

- African Blessings, African Curses

Chronic diseases often have a very strong genetic or heredity component in determining who is vulnerable to them. In this post, we explored the idea that what doesn't kill you either softens you up for what will or makes you more vulnerable to other health hazards in comparing the black population of the United States to sub-Saharan Africans who share much the same genetic anthropology, while also discovering very recent research whose results potentially explain why all peoples of African descent are more vulnerable to the things that disproportionately kill African Americans.

- A Seemingly Simple Solution

Does a chronic vitamin deficiency explain why the disparities between black and white life expectancies in the U.S.? We explore this possibility and why it may not as easy to address as you might think on first glance, as well as how individual African Americans might do so successfully.

Update 18 August 2008: Added conclusion and reference links for series!

Labels: africa, health, health care, medicine

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.