If we had put money on our sentiments yesterday! We're not normally pessimistic, but we have to admit that the combination of bad economic news dominating this election year and what we feel to have been an overstated level of economic growth recorded for the third quarter of 2007 would have led us to put money on the GDP growth rate for the fourth quarter of 2007 showing up in negative territory.

If we had put money on our sentiments yesterday! We're not normally pessimistic, but we have to admit that the combination of bad economic news dominating this election year and what we feel to have been an overstated level of economic growth recorded for the third quarter of 2007 would have led us to put money on the GDP growth rate for the fourth quarter of 2007 showing up in negative territory.

As it happened, the one-quarter annualized Real GDP growth rate came in at a low 0.6% for the BEA's advance release of this figure for final quarter of 2007, and at 2.7% over the much less volatile two-quarter period ending in the final quarter of 2007. Our GDP bullet charts show these figures alongside where both sets of growth rate date were at the end of the two previous economic quarters, and against the backdrop of historic economic growth performance since 1980 (the "temperature" scale):

The lousy track record of sentiment however is why we trust our impartial numbers when it comes to peering into the economic future. The following chart shows where we expect GDP to be through the first quarter of 2008 for our Modified Limo GDP forecasting method, as well as where it would be through the third quarter of 2008 using the Skeptical Optimist's Climbing Limo forecasting method:

The climbing limo GDP forecasting method, which looks three quarters ahead in time, would anticipate 2008Q1's Real GDP to be 11,709.6 billion in chained 2000 U.S. dollars. Meanwhile, our modified limo GDP forecasting method, which looks just one quarter ahead in time, would anticipate that Real GDP will be 11,757.4 billion chained 2000 U.S. dollars. Both figures would suggest a low, yet positive increase from the 11,677.4 billion chained 2000 U.S. dollars that the BEA has set for the level of Real GDP in its advance release for 2007Q4.

Isn't it cool that we can have an economy that the media screams about being especially volatile, yet we can still pretty reliably anticipate where GDP will be some three to nine months in advance? And all we have to do is learn to ignore the screaming media....

Labels: gdp, gdp forecast

How much does it cost U.S. employers to provide health insurance to their employees?

How much does it cost U.S. employers to provide health insurance to their employees?

As it happens, the answer depends on what kind of health insurance that employers make available to their employees, the number of people who are covered by the employee's insurance and also the size of the company for which they work.

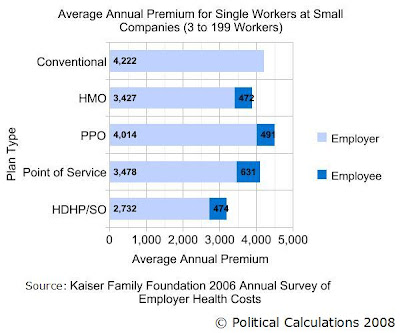

Our first two charts revealing how much the average annual premiums are by health insurance plan type presents how much it costs both employees and employers for covered Single workers, at both small companies (those between 3 and 199 workers):

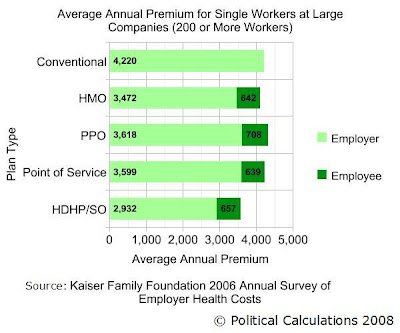

and large companies (those with more than 200 workers):

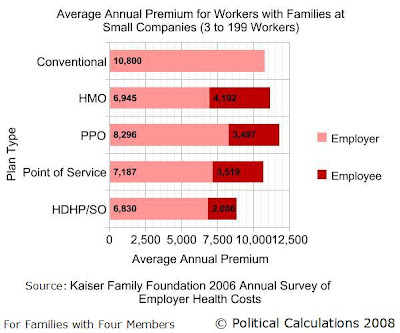

The next two charts present similar data for workers whose families are also covered by the various employer-provided health insurance plan types, first for those working at small companies (data is for a family of four):

and now for those working for companies with more than 200 employees:

The tables we're presenting below are drawn from the Kaiser Family Foundation's 2006 Annual Survey of Employer Health Benefits, provide the average annual costs according to these factors and also break down how much of the total cost is paid by the employer and how much is paid by the employee. We've used our dynamic table sorting technology in creating the tables, which allows you to rank the date in the tables by clicking the appropriate column heading so you can find which types of plans are the most or least costly. The first table provides data for covered single workers:

| 2006 Average Annual Premiums for Covered Single Workers by Plan Type |

|---|

| Plan Type | Firm Size (Number of Workers) | Total Annual Cost [$USD] | Employer Annual Contribution [$USD] | Employer's Percentage of Total Cost | Employee Annual Contribution [$USD] | Employee's Percentage of Total Cost |

|---|---|---|---|---|---|---|

| Conventional | Small (3-199) | 4,222 | 4,222 | 100.0% | 0 | 0.0% |

| Conventional | Large (200+) | 4,020 | 4,020 | 100.0% | 0 | 0.0% |

| HMO | Small (3-199) | 3,899 | 3,427 | 87.9% | 472 | 12.1% |

| HMO | Large (200+) | 4,114 | 3,472 | 84.4% | 642 | 15.6% |

| PPO | Small (3-199) | 4,505 | 4,014 | 89.1% | 491 | 10.9% |

| PPO | Large (200+) | 4,326 | 3,618 | 83.6% | 708 | 16.4% |

| POS | Small (3-199) | 4,109 | 3,478 | 84.6% | 631 | 15.4% |

| POS | Large (200+) | 4,238 | 3,599 | 84.9% | 639 | 14.8% |

| HDHP/SO | Small (3-199) | 3,206 | 2,732 | 85.2% | 474 | 14.8% |

| HDHP/SO | Large (200+) | 3,589 | 2,932 | 81.7% | 657 | 18.3% |

The next table provides data for covered workers with families consisting of four members. Note that for many of the plans, while the employer's portion is less than four times their cost for a single worker, the employee's portion of the total premium cost for each type of plan is approximately four times that of a single worker, or even more:

| 2006 Average Annual Premiums for Covered Workers with Families by Plan Type |

|---|

| Plan Type | Firm Size (Number of Workers) | Total Annual Cost [$USD] | Employer Annual Contribution [$USD] | Employer's Percentage of Total Cost | Employee Annual Contribution [$USD] | Employee's Percentage of Total Cost |

|---|---|---|---|---|---|---|

| Conventional | Small (3-199) | 10,800 | 10,800 | 100.0% | 0 | 0.0% |

| Conventional | Large (200+) | 10,829 | 10,829 | 100.0% | 0 | 0.0% |

| HMO | Small (3-199) | 11,137 | 6,945 | 62.4% | 4,192 | 37.6% |

| HMO | Large (200+) | 11,339 | 8,741 | 77.1% | 2,598 | 22.9% |

| PPO | Small (3-199) | 11,793 | 8,296 | 70.3% | 3,497 | 29.7% |

| PPO | Large (200+) | 11,752 | 9,124 | 77.6% | 2,628 | 22.4% |

| POS | Small (3-199) | 10,706 | 7,187 | 67.1% | 3,519 | 32.9% |

| POS | Large (200+) | 11,573 | 8,688 | 75.1% | 2,885 | 24.9% |

| HDHP/SO | Small (3-199) | 8,896 | 6,830 | 76.8% | 2,006 | 23.2% |

| HDHP/SO | Large (200+) | 10,013 | 7,604 | 75.9% | 2,409 | 24.1% |

Descriptions of the various types of health insurance plans are available through our post showing which types of plans were the most commonly used in the United States in 2006!

Where are we going with all this? Not necessarily where you might think, although we're aiming to get there next week!

Update (31 January 2008): Added charts showing the data in the tables!

Labels: health care

A lot of people talk about health insurance plans, but have you ever noticed that no one really knows what kind of health insurance people actually have?

We've been mining the data presented in the Kaiser Family Foundation's 2006 Annual Survey of Employer Health Benefits for another project, so we'd thought we'd extract the latest available data for U.S. employer-provided health insurance plans and present it in the following chart:

For the sake of reference, here's a bit of discussion about each type of health insurance plan:

Conventional: The least common type of employer-provided insurance plan today, in which the employer covers 100% of health insurance plan costs. Called "conventional" since it used to be the dominant form of employer-provided health coverage in the U.S. as recently as two decades ago, before becoming far too expensive for employers to provide.

HMO: Health Maintenance Organization, which also includes Exclusive Provider Organizations (EPO). HMOs were the first serious alternative to "conventional" health care plans, but were soon overtaken by PPOs.

PPO: Preferred Provider Organization, the most common employer provided health insurance plan today, by a more than 3-to-1 margin to the next most common plan type, HMOs.

POS: Point Of Service health insurance plans are a kind of hybrid between PPOs and HMOs, and may sometimes be classified as an "enhanced-HMO." These plans combine the standard HMO access to a pre-approved network of health providers with the ability for individuals to select certain kinds of specialists outside the network without having to go through their Primary Care Provider (PCP) first. Not quite as popular as PPOs, which offer greater flexibility.

HDHP/SO: High Deductible Health Plan with Savings Option, such as a Health Reimbursement Account (HRA) or a Health Savings Account (HSA). This is the newest available option for employer-provided health insurance which has only really existed since 2005. Even in that short time, HDHP/SO type plans have already surpassed "conventional" plans in popularity, even though the wide majority of U.S. employers have yet to adopt or offer the option to their employees.

Labels: health care

Now that we've taken on a Nobel-prize winner's take on what should be in an economic stimulus package, and double-underlined why government-legislated economic stimulus packages are always too late to be genuinely effective, we thought we might consider what should be on the Congress' list of things to do for the next time when the economy takes a turn for the worse.

Now that we've taken on a Nobel-prize winner's take on what should be in an economic stimulus package, and double-underlined why government-legislated economic stimulus packages are always too late to be genuinely effective, we thought we might consider what should be on the Congress' list of things to do for the next time when the economy takes a turn for the worse.

In fact, we'll do more than that. We'll also tell you what might keep the handful of things we're about to suggest from working! Did Joseph Stiglitz do that for you? Heck no! We do economics with two hands around here, the way it's meant to be done, so you don't have to go trolling for those fancy journal peer reviews or snarky critiques on anonymously written blogs. Or maybe at least on other anonymously written blogs!

| Political Calculations' Guide to Fiscal Stimulus | ||

|---|---|---|

| Our Suggestion | Why It Should Be Done | Why it May Not Work |

| Arrange the economic stimulus in advance with data-driven triggers to put into effect. | We already know what an economic stimulus package looks like: tax cuts or rebates for individuals, increases in unemployment insurance, food stamp and other welfare benefits that benefit those who experience economic distress, such as additional resources for retraining displaced workers, etc. We also have a pretty good handle on what events often precede or coincide with recessions: extended yield curve inversions, declining stock dividends, etc. The combination of these things means that we can have the basic parts of any economic stimulus package go into effect automatically without requiring a single additional act of Congress. | We might increase spending unnecessarily in the case of false alarms. A fiscal stimulus package on autopilot may not address unique concerns that apply to the economic conditions of the day, such as the actual size and seriousness of the pending recession. Bureaucratic government agencies may not be capable of implementing changes rapidly enough to be effective. Some politicians and bureaucratic agencies would have the negative incentive to prolong a recession, as they might provide increased funding for politician or lobbyist-preferred programs and recipients. |

| Focus fiscal policies on removing obstacles preventing the Federal Reserve from being able to take stronger action sooner. | A good example for 2008 is inflation. Here, the Fed is constrained by how much it can cut interest rates by the high rate of inflation in the economy. The government could help reduce inflation by curtailing the fiscal policies that exist that contribute to creating higher levels of inflation, such as ethanol subsidies. These subsidies have created higher costs for both raw crops and have generally increased the cost of food products. An interesting side benefit is that the savings from cutting such inflationary subsidy programs could be redirected to fund the automatic economic stimulus programs without adding to a potential fiscal crisis on top of a worsening economy. | The government doesn't subsidize anything because it's a good idea that will provide substantial benefits for the country's population. Instead, politicians seek to subsidize the very special interests of those who fund their political campaigns. Those campaign contributors are the kind of people who are often incapable of recognizing the economically destructive nature of having the government fund their self interest, while the politicians are often the kind of people who care more about their power base and ego than acting in the best interest of those they pretend to represent. That both are the kinds of people who deserve to be the designated losers in this situation is absolutely lost upon them and they'll do everything they can to undermine any such desubsidation. |

| Make government go faster to support new businesses and expanding businesses. | Government can do a lot to speed up the process of licensing new businesses and to accelerate any regulatory review associated with expanding existing businesses. The government can do both at relatively low cost by having the government bureaucrats responsible for processing these activities work longer hours in the short term and by adding additional resources ranging from more people to automation technology to increase the productivity of government bureaucrats performing these tasks in the medium to long term. | The high rate of unionization of government employees guarantees that union leaders will attempt to prevent both longer hours in the short term and higher productivity gained through automating the work of government employees as both measures would fail to increase the amount of dues they receive from the workers they "represent." See previous example for a description of the rent-seeking dynamics. They will support adding more people, but new people take time to train and become truly effective, making this aspect the least likely to achieve the aim of accelerating the business expansion needed to counteract a deepening recession. |

| Make government go way faster to support businesses going out of business. | When a business goes out of business, it can take months if not years to unwind all the claims of the parties associated with the business, even if its going out of business has nothing to do with the state of the economy. That's time in which the resources owned by the business are tied up and cannot really be redirected into other new productive economic activity. If the economy is entering a period in which higher rates of businesses can be expected to go out of business, accelerating the process of closing businesses and bankruptcy proceedings can only a good thing, which the government can achieve by devoting additional resources to support these activities. | Conflicts among the parties involved in the closing of a business or a bankruptcy may drag out the proceedings independently of any action the government takes to speed the process. The rate of businesses closing or closing by going through bankruptcy proceedings can be politically sensitive. Politicians may have a perverse incentive to delay the process of closing a business to keep the numbers low to be able to claim things aren't as bad as they might appear if the process were capable of moving more quickly to meet the true needs of business. |

The last point regarding the politically sensitive reporting of the number of business closings is similar to how politicians and bureaucrats in countries with universal health care programs champion the high utilization rates and "efficiency" with which certain medical procedures are performed. In reality, this situation represents the illusion of efficiency since these apparently high rates really only exist because the health care system has a major shortage of people or equipment needed to perform these procedures and is actually incapable of meeting the nation's true health care needs. See: Cuba, Canada, United Kingdom, etc....

Labels: economics, ideas, politics

Welcome to the Friday, January 25, 2008 edition of On the Moneyed Midways, featuring the best posts from best of the past week's major business and money-related blog carnivals!

Welcome to the Friday, January 25, 2008 edition of On the Moneyed Midways, featuring the best posts from best of the past week's major business and money-related blog carnivals!

The big news this week is that the venerable Carnival of the Capitalists, the second oldest blog carnival and the only one with continuous editions since being founded, has unveiled its new format! The CotC now focuses much more strongly on the quality of the contributed posts while sliding into its new permanent home at Jay Solo's bizosphere.com. As an additional bonus, the new version of the CotC is also willing to pull occasional articles from well-established media outlets that might be considered exceptional - as it does this week with an article on the most and least profitable businesses for an entrepreneur to launch from Forbes.

We should also note that the Carnival of Small Business Issues, which had no edition this week, is also going to go through its own reboot cycle, promising to differentiate the CoSBI from all the other blog carnivals out there.

As for us here at OMM, we're going to keep bringing you the best posts we find in the best of the blogosphere's business and money-related blog carnivals from the past week. We figure that's why you're here, so let's get right to it!

| On the Moneyed Midways for January 25, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Do Not Fall for Rent to Buy Mortgage Loan Schemes | 2MortgageLoanCalculator.com | There are four reasons why renters should avoid "rent to buy" offers: the non-refundable option deposit, if you choose not to buy you lose your "equity", you'll end up paying higher rent than you might otherwise, and you have to wait to buy until the purchase option time arrives. |

| Carnival of HR | Proposed Microsoft Package Would Take Employee Monitoring to a New Level | WorkplaceHorizons.com | What evil hath Microsoft wrought, now?! Richard Hankins reveals that a 2007 patent by Microsoft for monitoring an individual's health condition using the technologicial devices in their office could open the door to extreme levels of personal scrutiny by their employer. |

| Carnival of Money Stories | Carnival of Money Stories: Bedtime Story Edition | Plonkee Money | Themed blog carnivals are hard to execute, especially those that attempt to weave regular carnival contributions into a readable story. Plonkee has pulled it off, producing a story that you could read to your children (or perhaps that a British parent could read to theirs) while providing just enough relevant information to decide whether or not following the contributed links might be worthwhile. And who knew people actually blog about goats?! |

| Carnival of Personal Finance | Lessons Learned from the Used Forklift | Me vs. Debt | Amanda's work recently bought a used forklift via Ebay, which provided the opportunity to learn how to get the most out of the stuff you own or the things you can salvage. Absolutely essential reading! |

| Carnival of Real Estate | Fast Equity? Think Commercial | Real Estate Investing, with Tony John | Just because the market for real estate has turned downward doesn't mean real estate investors still aren't looking to make money. Tony John provides insight into the kind of deals that the landed investor set is seeking to make today. |

| Carnival of the Capitalists | How to Manage a Deadbeat Employee | About.com: Human Resources | How do you deal with an employee who's not really cutting it? Susan Heathfield looks at the impact of having a deadbeat on the payroll, considers your responsibility as a manager and discusses how to approach the deadbeat employee and what to do next to turn their barely marginal performance into solid performance. |

| Festival of Frugality | Can I Live Without a Microwave? | Stop the Ride! | Stephanie finds that it's not so much whether she could, but rather, does she want to? Especially after going through three microwave ovens in just three years…. |

| Festival of Stocks | Reliance Power: An Indian IPO | Living Off Dividends | Indian energy company Reliance Power (RELFF) just went public on the Bombay Stock Exchange, but the enthusiasm for the stock is reminscent of that for Enron in 1999, making Living Off Dividends' fan of passive investing think it might be better to sell short. |

| Odysseus Medal | Theology, Postmodernism, and a Different Kind of Buyer | Blue Collar Agents | Trevor Smith on what homebuyers are looking for from their agents today that they weren't seeking before. The Best Post of the Week, Anywhere! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

As long as we're talking about the so-called "stimulus" package the Congress is considering today, we should also consider why what the government is considering may be ineffective at achieving its goals in fighting off a recession.

Fortunately, for us, Doc Palmer is on the case! Here's our quick list version of the reasons he's outlinked for why fiscal policy that requires acts of Congress to enact are less than effective at staving off recessions:

- Recognition Lag - politicians are slow to recognize a developing recession.

- Decision Lag - deciding what to do slows politicians down even more.

- Implementation Lag - making what the politicians have decided to do actually happen takes more time.

- Effect Lag - Once the stimulus is in the economy, it takes time for it to work.

Let's cover the first two together. Here is our electronic version of a chart that Bruce Bartlett recently used in an op-ed to demonstrate how slow elected politicians have been historically in recognizing that they might need to respond to a slowing economy and deciding what to do about it. You can sort the dynamic table below according to the various column headings by clicking on them:

| Dates of Recessions and Antirecession Programs |

|---|

| Recession Begins | Recession Ends | "Stimulus" Legislation Enacted | Months After Recession Begins | Months After Recession Ends | Antirecession "Stimulus Package" Legislation Details |

|---|---|---|---|---|---|

| 1948-Nov | 1949-Oct | 1949-Oct | 11 | 0 | Advance Planning for Public Works Act, 13 October 1949 |

| 1957-Aug | 1958-Apr | 1958-Apr | 8 | 0 | Federal Aid Highway Act, 16 April 1958 |

| 1957-Aug | 1958-Apr | 1958-Jul | 11 | 3 | River and Harbor Act, Flood Control Act and Water Supply Act, 3 July 1958 |

| 1960-Apr | 1961-Feb | 1961-May | 13 | 3 | Area Redevelopment Act, 1 May 1961 |

| 1960-Apr | 1961-Feb | 1962-Sep | 29 | 19 | Public Works Acceleration Act, 14 Sep 1962 |

| 1969-Dec | 1970-Nov | 1971-Aug | 32 | 9 | Public Works and Economic Development Act Amendments, 5 Aug 1971 |

| 1973-Nov | 1975-Mar | 1975-Mar | 16 | 0 | Tax Reduction Act, 29 Mar 1975 |

| 1973-Nov | 1975-Mar | 1976-Jul | 32 | 16 | Public Works Employment Act, 22 Jul 1976 |

| 1973-Nov | 1975-Mar | 1977-May | 42 | 26 | Local Public Works Capital Development and Investment Act, 13 May 1977 |

| 1981-Jul | 1982-Nov | 1983-Jan | 18 | 2 | Surface Transportation Assistance Act, 6 Jan 1983 |

| 1981-Jul | 1982-Nov | 1983-Mar | 20 | 4 | Emergency Jobs Appropriations Act, 24 March 1983 |

| 1990-Jul | 1991-Mar | 1991-Dec | 17 | 9 | Intermodal Surface Transportation Efficiency Act, 18 Dec 1991 |

| 1990-Jul | 1991-Mar | 1993-Apr | 33 | 25 | Emergency Supplemental Appropriations Act, 23 Apr 1993 |

| 2001-Mar | 2001-Nov | 2001-Jun | 3 | -5 | Economic Growth and Tax Relief Reconcilation Act, 7 Jun 2001 |

The only time the government was ever ahead of the game was in 2001, when it enacted a stimulus package some 5 months before the end of a recession. But that doesn't mean that the stimulus package enacted in that year was particularly effective at making the recession end any sooner.

Of all the things that delay an effective fiscal response to an economic recession, implementation lag is perhaps the greatest problem. Governments are bureaucratic organizations that are not capable of implementing rapid change effectively. Doc Palmer estimates that implementation lag prevents fiscal policy from taking effect for anywhere from 1 to 8 months.

Beyond that, there's also the question of how long it takes for positive results to appear as a result of the "stimulative" fiscal policy. Doc Palmer suggests that three months to a year may pass before a stimulus package can fully take effect in the economy. And then there's also the question of the effectiveness of the economic fiscal "stimulus", which we'll leave alone as others have capably covered that territory.

Assuming the very best case by adding the best case implementation and effect lag times together, one month for implementagion lag and three months for effect lag, or rather, four months combined, would mean that the stimulus package of 2001 became effective just one month before the recession ended in November of that year.

We strongly doubt anyone noticed....

Labels: economics, politics, recession forecast

Calculated Risk has launched a competition to see just what the worst ideas being floated about are with respect to the "economic stimulus" package that politicians in Washington DC are tripping over themselves to assemble so they can show how much they "care" about

Calculated Risk has launched a competition to see just what the worst ideas being floated about are with respect to the "economic stimulus" package that politicians in Washington DC are tripping over themselves to assemble so they can show how much they "care" about their re-election people worried about the state of the U.S. economy.

While we think the lead idea that CR has nominated is a strong contender for winning outright, we'd like to enter the economic stimulus ideas of Nobel prize winning economist Joseph Stiglitz, who has recently prescribed a number of policies (HT: Mark Thoma) intended to "stimulate" the economy. We thought we'd summarize Stiglitz' main policy prescriptions in the table below and identify why they might not really qualify as being Nobel-prize winning ideas:

| Fiscal Stimulus Suggestion | Why It Might Work, According to Stiglitz | Why It Will Not Work, Based on Reality |

|---|---|---|

| Strengthen unemployment insurance. | Money received by those who lose their jobs will be spent immediately. | Worthwhile for softening blow of unemployment. Doesn't do anything to grow economy, or get the unemployed back to work at anything approaching their previous level any faster. |

| Increase funding for crucial local and state government infrastructure projects. | Stabilizes total government spending levels, which might otherwise be reduced. | Definition of "crucial" ultimately decided by political campaign contributors and lobbyists, such as sports team owners and the developers of light rail systems, who pay for local and state politicians to get elected. Unlikely to do much to grow economy, ever. |

| More support for state education budgets. | "Strengthen economy in short run, promote growth in long run." | Not really any different from what's been going on in education since the U.S. Department of Education was established a few decades ago to provide ever-increasing, yet ineffective support for state education budgets. Has anybody noticed any real, sustained improvement in U.S. public schools, in either the short or the long run? Unlikely to achieve aims, ever. |

| Increase spending to promote energy conservation and lower emissions. | "Strengthen economy in short run, promote growth in long run." | The reduction in productive activity that comes with economic slowdowns achieves both aims at costs nobody would be willing to pay if they had the choice. Spending more here will only provide economic growth benefits in the long run as it frees up money to be spent elsewhere. In the short run, high costs of technological transition and time needed for implementation will delay economic recovery. |

| A tax rebate aimed at lower and middle income households. | Fast-acting. | Very short term effect. Several studies indicate significant portion of money from previous tax rebates or advances used to pay down debt or saved as windfall, not spent. Poor bang for the buck, economic impact not helped by small tax rebate amounts per household. Unlikely to do much to grow economy. |

| Appropriately designed legislation to allow victims of predatory lending to stay in homes. | Stimulate economy. | Current 110th U.S. Congress has proven to be singularly incapable of crafting either well-designed legislation or even needed legislation. Or for that matter, timely legislation. Unlikely to achieve desired goal as a result. Doesn't stimulate economy - even if "well-designed," would only maintain status quo, which would be worthwhile for those affected, but only those affected, and would not significantly impact the health of the economy at large. |

Maybe we can get a special sub-category for the competition: worst economic stimulus ideas proposed by the most prestigious economist!

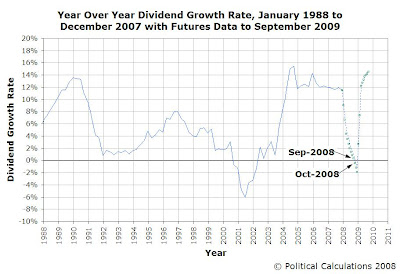

Now that we've established that the Price-Dividend Growth Ratio we invented last December is capable of providing a near real-time indication of the level of distress in the stock market, a logical question to ask is: How does the level of distress present in the stock market correspond to the bottoms of the market during recessions?

We figure that particular question has to be pretty interesting to anybody who has money in the market, or is trying to figure out when to put money into the market!

To find out the answer to that question, we took our chart showing the correlation of stock market distress and economic recessions in the U.S. and mapped out where the stock market bottomed out during the periods of recession. The resulting chart is below:

The values shown on the chart above are the average monthly index value of the S&P 500 in the month in which the index reached its lowest value after the U.S. economy entered a period of recession. We also limited our initial analysis to the years from January 1952 through December 2007, the most recently completed month for which we have full data for the S&P 500. This period also corresponds with what we've previously identified as the modern era of the U.S. stock market.

As a general rule of thumb for this modern era, stock market bottoms would appear to coincide with peaks in the absolute value of distress indicated by the Price-Dividend Growth Ratio. As we've noted previously, this ratio spikes when the year-over-year rate of growth in S&P 500 dividends per share approaches a value of zero.

Update 18 February 2008: The analysis below is flawed. While the analysis would be valid if we were using the correct total estimate for dividends per share for the first quarter of 2008, we erred in not incorporating the value of dividends already paid in the first quarter into our calculations, as these are not included in the dividend futures data that we did use. More details....

As of the futures data we have that applies from 23 January 2008 onward, the S&P 500's dividend futures indicate that this rate will reach a value of zero sometime in either September or October 2008, continuing into negative territory through December 2008, with a recovery in the dividend growth rate occurring rapidly afterward:

This data would seem to suggest that the stock market will be a much nicer place for investors after the peak of distress in the market has passed, potentially as early as November 2008, as our chart showing market bottoms with the Price-Dividend Growth Ratio indicates that market bottoms typically, but not always, follow the peak of market distress in the modern era.

The Future Isn't Certain

In our dividend growth rate chart above, we've shown the change in dividend futures data from when we first noted it for 15 January 2008 (the blue dashed line) to the latest data we now have available through 23 January 2008 (the green square datapoints.) In just that week-long period, the dividend futures data shifted to indicated a steeper and deeper decline in the year-over-year dividend growth rate for 2008. Where the previous data had suggested the dividend growth rate would pass through the zero level in October or November, the newer data now indicates that this will occur a month earlier. Unsurprisingly, the futures data can be volatile, so anyone looking to make their own investing decisions based on the data we've presented above should take that fully into account.

We'll revisit all this data again on 20 February 2008, when we will next update our tool for finding the rates of return for investments in the S&P 500 between any two months from January 1871 through January 2008!

Previously on Political Calculations

- Mapping S&P 500 Performance, Since 1871

- The S&P 500 at Your Fingertips

- Visualizing the Worst Case Real Returns for the S&P 500

- The Worst Returns Ever for the S&P 500

- Visualizing the Best Case Real Returns for the S&P 500

- The S&P 500's Golden Years

- The Worst Returns of the S&P 500 vs The Safest Investment in the World

- The Five Worst Bear Markets Since 1871

- The Five Worst Months in S&P 500 History

- The Five Best Months in S&P 500 History

- The Problem with Earnings

- Do Drops in Corporate Earnings Lead to Recession?

- The History of S&P 500 Dividends in Pictures

- The Sun, in the Center

- Deriving the Price-Dividend Growth Ratio

- Retrograde Earnings

- The Beating Heart of the Stock Market

- Update: The S&P 500 at Your Fingertips

- All Our Posts Tagged with "SP 500"

- All our Posts Tagged with "recession forecast"

Labels: recession forecast, SP 500, stock market

... and then some, cutting the target Federal Funds Rate by 0.75% to 3.50% in an emergency move this morning. European stock markets up on the news, reversing what had been significant losses....

Labels: none really

Sometimes, the projects we take on come about in the weirdest ways. After we reviewed the tool that highlights Rudy Giuliani's simpler income tax proposal, we received an e-mail from an avid Fred Thompson supporter asking if we were ever going to review Fred's even simpler income tax proposal.

Sometimes, the projects we take on come about in the weirdest ways. After we reviewed the tool that highlights Rudy Giuliani's simpler income tax proposal, we received an e-mail from an avid Fred Thompson supporter asking if we were ever going to review Fred's even simpler income tax proposal.

Since our expertise revolves around creating web-based tools, we replied that unless Fred had a tool to go along with his proposal, we wouldn't be reviewing it. But, as it turns out, there was a tool, in the form of an Excel spreadsheet (more details here.) But no actual made-for-the-web version which, in this day and age, just won't fly.

So we offered to take it on as a project, which happens to turn out to be pretty timely as the Wall Street Journal really likes Fred's plan. A lot. So here we go!

Key Features of Fred Thompson's Simpler Income Tax Proposal

What Fred Thompson has proposed is a new, simpler option that taxpayers can use when filing and paying their income taxes. Taxpayers would have a choice of filing their taxes under the plan outlined below or filing their taxes using one of the familiar income tax return forms that already exist under the current tax code.

Standard Deduction

Fred Thompson's proposed tax reform includes sizable increases in the standard deduction available to both single and joint tax filers, which reduces the amount of income that will be subject to income taxes. Single income tax filers can reduce their taxable income by $12,500, while those filing joint income tax returns can reduct their taxable income by $25,000.

Personal Exemptions

Beyond the standard deductions outlined above, Fred Thompson's tax reform plan includes a $3,500 personal exemption for each individual covered by the filer's tax return, increasing the amount of income that will not be subject to income taxes. For example, a family of three people would be able to reduce the amount of their taxable income by $10,500 (3 X $3,500).

Tax Rates

The tax rates that would apply to taxable income under Fred Thompson's simpler tax proposal, as well as the portion of taxable income to which they apply, are presented in the table below:

| Fred Thompson's Proposed Simplified Tax Rate Structure | ||

|---|---|---|

| Tax Rate | Taxable Income for a Single Filer | Taxable Income for a Joint Filer |

| 10% | $0 through $50,000 | $0 through $100,000 |

| 25% | Over $50,000 | Over $100,000 |

That's it! That's Fred Thompson's entire proposal for making income taxes much, much simpler to do!

Ready to See What Filing Your Taxes Would Be Like?

The next step is to see what might happen to your taxes if you filed what we're calling Form 1040-FRED. To make the best comparison between how your taxes come out under Fred Thompson's proposed reform and the currently available options under the existing income tax code, it wouldn't hurt to have your most recent tax return handy for reference, although it's definitely not required. To use the tool, just enter the indicated information below (any data you enter and results you get will stay entirely within your web browser):

In comparing your results with the current income tax filing options from the IRS, be sure to consider all costs you might have in filing your income tax returns, including your time, amount of record-keeping you might have to do and any fees for having your return prepared by a tax professional that you might have to pay on top of your annual tax bill.

Who Benefits with Fred Thompson's Simpler Income Tax Plan?

By sharply increasing the standard deduction to reduce the amount of a taxpayer's taxable income and significantly lowering the rates at which that income is taxed, Fred Thompson's proposed income tax reform would benefit a broad spectrum of lower and middle-class taxpayers compared to the option represented by the current tax code. The proposed reform is substantially better for those who are not eligible for many of the deductions and tax breaks that exist in the current tax code, while being on par to slightly better for those who are eligible for the most common of those available deductions.

Those eligible for the Earned Income Tax Credit (EITC) however may benefit more by filing their taxes using one of the existing IRS income tax forms, such as Form 1040-EZ. EITC beneficiaries receive a tax credit that allows them to offset a significant portion of their payroll taxes, such as Social Security and Medicare (or FICA), which often represents the largest component of federal income taxes that they pay. That benefit may be significant enough to justify using one of the more complex tax filing options available under the current tax law that would still exist if Fred Thompson's proposed tax reform becomes law.

Meanwhile, those at the highest incomes would likely benefit more by filing their taxes using the options available under current law to exploit the ever-growing complexity and highly selective special-interest provisions of the current tax code. The current tax code is, of course, carefully crafted by Congress so they can.

Other Fred Thompson Tax Facts

Finally, before we return to our regular programming, we thought we'd offer two tax-related facts for all the Fredheads out there, courtesy of Frank J:

Taxes get so depressed when they hear Fred Thompson is in charge that they cut themselves.

Source: Daily Fred Thompson Fact

Not only does Fred Thompson cut taxes, he cuts tax collectors.

Source: Frank Facts About Fred Thompson

No, we couldn't resist.... However, if you would like to know more about Fred Thompson's tax-related policy proposals, his web site has a white paper outlining them.

Disclaimer

To the best of our knowledge, we don't work for Fred Thompson, or his campaign, or anyone related to Fred Thompson or his campaign. We did this for fun and because we can! And please note, we haven't taken a position regarding whether we support, are on the fence with, or do not support Fred Thompson's simpler income tax proposal. The tool is here to help you decide what you think of it!

Other Tax-Related Stuff at Political Calculations

- Your 2008 Paycheck

- Our tool for finding out what's left of your paycheck after Uncle Sam has gotten his dirty, stinking ape paws all over it!

- Investing Choices and Income Taxes in 2008

- Should you invest in a taxable or tax-exempt investment? Our tool can help you choose which is better for you.

- Review: Rudy Giuliani's 1040-FAST Tax Form

- Our review of the tool demonstrating what filing taxes might be like if Rudy Giuliani were President....

- Bruce Bartlett on the Fair Tax, and Race

- Very few people know taxes like Bruce Bartlett - here, we summarized what he thinks is very wrong about the so-called "Fair Tax" proposal, advocated by Republican presidential candidate Mike Huckabee.

- The Business of Bootlegging

- How much money is there to be made from bootlegging products from a lower-tax state to a higher-tax state, and not paying the higher taxes? Our tool does the basic math to find out under what conditions bootlegging can be profitable.

- Income Tax: The Original Form 1040

- What was filing income taxes like back in 1913 after income taxes were made constitutional by the 16th Amendment? Our tool does the math!

- What if the Death Tax Were an Income Tax?

- How much would income taxes go up if instead of taxing estates after an individual dies, we made them pay higher income taxes when they were alive? Our tool takes on that question.

- Measuring the Growth of the U.S. Tax Code

- Way outdated, as the tax code is now well over 66,000 pages, but our 2005 post will give you an idea of the trend in recent years.

- Revisiting the Lottery

- How big does the jackpot need to be to justify the cost of buying a lottery ticket? And how much bigger does it need to be to take the taxes you'll have to pay on your winnings into account if you do win? One of our more popular tools!

- How Much Do you Pay in Gas Taxes?

- Our tool finds out how much of what you pay to fill your tank goes to taxes each year.

- A Brief Overview of Taxes for Social Security

- A straightforward look at where all the money comes from that goes to support Social Security.

Welcome to the Friday, January 18, 2008 edition of On the Moneyed Midways, featuring the best posts from the past week as found in the week's best business and money-related blog carnivals!

Welcome to the Friday, January 18, 2008 edition of On the Moneyed Midways, featuring the best posts from the past week as found in the week's best business and money-related blog carnivals!

The big news this week from the world of blog carnivals is that the oldest business and money-related blog carnival, the Carnival of the Capitalists is going to go through its second major reboot. Here's what blog carnival pioneer Jay Solo had to say about the new direction for the CotC in this week's edition:

Blog carnivals as a concept are dead. They have been for a while. Horse flesh seldom looked so tenderized. I had planned to write a post detailing why I say that, and still do. As such, it’s become clear that Carnival of the Capitalists cannot continue as it has; as a topical blog carnival in the traditional definition I largely originated.

Sure, now it’s a brand. Not as positive or well-known a brand as it ought to be, but worth keeping. So how do you create something called Carnival of the Capitalists, keep the best of what that was supposed to but couldn’t be as a more or less "crowd sourced" meme, then improve it and add value from there?

As it happens, Jay's solution is very similar to the one we adopted back in 2006 when we originally launched On the Moneyed Midways:

Carnival of the Capitalists will be a weekly post on bizosphere.com, where there may be some number of other posts, no longer mainly administrative. While retaining the name, there will be no pretense of being a blog carnival under the old definition, which many so-called carnivals didn’t adhere to in the first place.

It will seek to include a set of links to especially compelling recent blog posts on business and economics topics.

It will attempt to build on the idea there are good posts that few will ever see, out there on random blogs few will ever hear of, and that it's good for the blogosphere to bring them to the attention of more people, including people who might not do much blog reading. Not that posts from better known blogs will be excluded out of hand, but the same people being in CotC every week, with posts good, bad or indifferent, runs counter to Rob's original idea of discovery.

Jay goes on to outline the major reasons for the CotC changes, which we've largely validated through our own experience and deliberate experimentation over the course of the past couple of years, and concludes with the final edition of the CotC as we have known it.

For perhaps a preview of what to expect from the new vision of the CotC, we here at OMM are pleased to present the best posts from our survey of the best of the blogosphere's business and money-related blog carnivals from the past week that was, all waiting for you below....

| On the Moneyed Midways for January 18, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Cash Only Spending Experiment Analysis | The Happy Rock | Debt-guru Dave Ramsey says that you can save 12 to 18% by only spending cash, but The Happy Rock failed after a month because it was such a radical change in his spending habits (and a real hassle to track.) |

| Carnival of Personal Finance | True Diversification | brip blap | Have you ever really considered the full spectrum of ways in which you can diversify your investments? brip blap's intriguing post is Absolutely essential reading! |

| Carnival of Personal Finance | How I Taught My Preschooler the Value of a Dollar | BeingFrugal.net | Teaching young kids about money and the value of saving is a tough job - Being Frugal's post provides a practical guide to making it easier! |

| Carnival of Real Estate | How Much Will My Credit Score Cost Me on My Next Mortgage? | John Barker's Mortgage Blog | John Barker puts real numbers to the credit crunch coming down the pike for prospective homebuyers with low credit scores. The bad news? If your FICO score is under 680, you'll be paying more, and the lower you are, the more you'll pay. |

| Carnival of Taxes | Congress patches Alternative Minimum Tax | Fundmastery | Kurt Brouwer finds abundant irony in the machinations the U.S. Congress went through on its way to preventing upper middle class taxpayers from having to pay the Alternative Minimum Tax for another year. |

| Carnival of the Capitalists | Hire People that Are Better Than You | Small Business Essentials | Trust, quality, fresh perspectives, greater options, efficiency and cost savings are the reasons Nikole provides in explaining why you as the boss should seek out employees who exceed your abilities. The Best Post of the Week, Anywhere! |

| Cavalcade of Risk | Retail Clinics Versus Public Hospitals | The Physician Executive | Absolutely essential reading! Zagreus Ammon notes in a very multi-dimensional post that there are contradictory forces with regard to competition in providing health care in communities: "In the case of MinuteClinics, competition harms the public health. In the case of public and county hospitals, the lack of competition is at the root of the problem." |

| Economics and Social Policy | Barack Obama Has Most Sensible Housing Plan | Salt Lake Real Estate Blog | Nigel Swaby considers the actions taken by the government to date in dealing with the building housing crisis (pun intended on our part!), and the proposals put forth by the Democratic Party contenders for president, finding that Barack Obama is the only one headed in the right direction! |

| Festival of Frugality | The Line Between Frugal and Cheap | Little Dough Girl | The Little Dough Girl considers where to draw the line in writing the 10 commandments of being frugal (not cheap). Attention freegans: print this out and take this list, and the spirit behind it, with you everywhere! |

| Festival of Stocks | Roger That | Dividend Money | Tyler is excited that Toronto-based Rogers Communications (RCI) is doubling its annual dividend and buying back shares on increased strength of its business. |

| Odysseus Medal (Real Estate) | Zillow News: Upside-down and Dumb Like a Fox | The San Diego Home Blog | Kris Berg considers the implications of Zillow's revealed business model, in which they're effectively creating a MySpace for your home, focused on building trust with customers through social networking and transparency. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Based on all we're now hearing, the Federal Reserve is getting set to take an axe to its target Federal Funds Rate (FFR), the principal tool the Fed has at its disposal to regulate the supply of money in the economy, which is now set at a level of 4.25%.

Based on all we're now hearing, the Federal Reserve is getting set to take an axe to its target Federal Funds Rate (FFR), the principal tool the Fed has at its disposal to regulate the supply of money in the economy, which is now set at a level of 4.25%.

The Cleveland Fed's Federal Funds Rate Prediction (HT: Calculated Risk) and James Hamilton both find that a 50 basis point reduction in the target Federal Funds Rate with a new target rate of 3.75% is most likely. Meanwhile, serious market speculation hints at the possibility a larger 75 basis point cut in this month, which would lower Federal Funds Rate target to 3.50%.

Since we already have a tool that models the Fed's actions using something like a Taylor Rule, which incorporates the latest year-over-year change in seasonally-adjusted core inflation and the most recent month's seasonally-adjusted rate of unemployment (based upon a 2001 paper by Greg Mankiw), we thought we'd first see where those latest figures would put us today:

Leaving the values of the Mankiw Factor (at 1.6) and the Mankiw Constant (at 8.5) unchanged, which has produced results that have matched well with where the Federal Reserve's Open Market Committee has set the level of the Federal Funds Rate target since 1999, gives us a target FFR of 4.40%. With the target now at 4.25%, this result suggests that the Fed should actually be considering raising rates to head off inflationary pressures in the U.S. economy.

However, as Jim Hamilton has found, the market isn't anticipating higher rates of inflation for the U.S. economy, as measured by the yields and spread between nominal and inflation-adjusted 10-year treasuries, which opens the door for a rate cut.

Cutting the FFR target now would seem to be a sharp divergence between what the Taylor Rule would suggest the Fed should do and what the Fed will actually do. Fortunately, we've already have evidence for where this has happened in the recent past, which we've presented in the chart below:

The divergence when the Fed pushed its target FFR well below what would be expected using a Taylor Rule begins shortly after January 2001. Here, the Fed cranked up the money supply in response to a worsening economy, later aggravated by the fallout from the September 11, 2001 terrorist attacks. Stimulating the economy by cutting the Federal Funds Target Rate by way more than what the Taylor Rule would suggest is wise would be the Fed's version of taking its monetary policy dial and turning it up to eleven. Where our tool is concerned, the same effect can be obtained by cranking up the Mankiw Factor to correspond with a much looser monetary policy.

Doing just that, we find that increasing the Mankiw Factor to 1.85, leaving all other values unchanged, produces a target Federal Funds Rate of 3.76%, consistent with that half percentage point cut. Cranking the Mankiw Factor to 1.95 delivers a 3.51% target FFR, coinciding with a three-quarters percentage point cut in the current target rate. The following chart shows the effect of increasing the Mankiw Factor to 1.85:

No matter what this month, we'll soon find out how far the Fed is willing turn up the dial to stimulate the economy in 2008.

Labels: forecasting, tool

Before we get into the details of the latest update to our signature tool The S&P 500 at Your Fingertips incorporating the latest market data through December 2007, we'll begin by saying that as of January 2008, the stock market has entered what we would call a significant disruptive event. In fact, if any of you remember that prediction we made of where the market would be in December 2008 early on January 2nd, well, that's out the window as the order that had existed in the market since July 2003 has broken down.

The following chart shows the evidence of the breaking down of the established order:

Now that we have your attention, the driving factor behind the breakdown of the previous state of order in the market is not the relatively rapid decline of stock prices since the beginning of the year (for context, here are the worst five month-to-month periods for the S&P 500 since 1871 - January 2008 isn't in this league!), but rather the breakdown of the year-over-year growth rate of dividends. With a number of big financial and mortgage companies acting to cut their dividends (Citibank, MBIA, National City, Ambac), the future for dividends through 2008 is bleak.

Update 18 February 2008: The analysis below is flawed. While the analysis would be valid if we were using the correct total estimate for dividends per share for the first quarter of 2008, we erred in not incorporating the value of dividends already paid in the first quarter into our calculations, as these are not included in the dividend futures data that we did use. The values presented in the charts below aren't too far off from where they should be, but they're still off, which we're getting sorted out now. Also, the future for dividends through 2008 isn't as bad as described in the paragraph above, but we've learned a lot since we first posted this analysis! More details....

The following chart illustrates what we mean. Here, we've taken the dividend futures data through September 2009 (as of 15 January 2008) available at IndexArb (amazing data site, by the way!) and projected the year-over-year growth rate for dividends to then:

![S&P 500 Year-Over-Year Dividend Growth Rate, January 1975 to September 2009 [Projected]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgXj1m_P9yOb3qyhgUzHAYp8E0AHtCZJxng7aOKnZH_bpSoZzJi1piVzOaSeG8eQDlHq1hotYe-X7o0Pcau2FqUsTwMwWd-u_Bsg7lpxjyEQ1MAfBxm2AJjgA4-vvxXRwUQruop/s400/SP500-Dividend-YOY-Growth-Rate-Jan-1975-to-Sep-2009.JPG)

For clarity, the first point of the chart covers the period from January 1975 to January 1976 and the last point in the chart above covers the period from September 2008 to September 2009. We should also note that futures data is less reliable as you go further out into the future, as it becomes much more likely that actual dividends will come in at a different level from what the futures market is forecasting today. This is less of an issue in the short term.

Mathematically, the dip in the dividend growth rate to near-zero low levels is what creates the "spike" effect in the charts showing the Price-Dividend Growth Ratio over time and is consistent with an increased level of distress in the stock market. That's important because these spikes often coincide with recessions in the general economy. The following chart shows the level of the Price-Dividend Growth Ratio through December 2007, and projects into January 2008 based on the available data through 15 January 2008:

![S&P 500 Price-Dividend Growth Ratio with Recessions, January 1975 through January 2008 [Projected]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiPVuGpRCKZsXXQYxtSVKSF8e4BRfHOaYAwP3pBu85QDv5neNydWH6W_VL8iimvXkQSQ3qIQsoVx-dCi3YyQcqXWpsWdqrpvyngLirjy-0M9OWFv52VnqPiIKnY-ehH5M98KBZE/s400/SP500-Price-Dividend-Growth-Ratio-YOY-Jan-1975-to-Jan-2008.JPG)

The chart above shows that the level of distress in the stock market through December 2007 was low, which confirms that 2007 was recession free (sorry, Paul!) Assuming that the values we've projected for January 2008 hold through the rest of the month, the Price-Dividend Growth Ratio has moved into negative territory, which often leads periods of increased distress in the market.

What's not yet clear is whether the impending increased level of distress will coincide with a recession in the general economy. As you can see in the chart above, not every significant spike in the Price-Dividend Growth Ratio does so. For the odds of recession, we turn to our Recession Probability Track (in the right hand margin, or alternately, at this link) which shows the likelihood of a recession occurring within a one year period following the date of interest. Here, we'll note that the probability of recession peaked at 50% back on 4 April 2007, less than one-year ago. Since we're still in the one-year prediction period for that date, that's the odds that the U.S. will dip into a recession in 2008.

And now, for our monthly update of the S&P 500 at Your Fingertips! Here's the rates of return we find in the S&P 500 for investments covering the periods since January 1871, since December 2006 and since January 2007:

| Selected S&P 500 Performance Data, January 1871 through December 2007 | |||

|---|---|---|---|

| Annualized Rates | Nominal Rate of Return (%) | Rate of Inflation (%) | Real Rate of Return (%) |

| Since January 1871 | 9.14 | 2.08 | 7.06 |

| Year over Year | 6.31 | 4.08 | 2.23 |

| Year to Date | 6.10 | 4.11 | 1.99 |

We'll be including the track of the Price-Dividend Growth Ratio in our future monthly updates for the S&P 500 at Your Fingertips tool.

Previously on Political Calculations

- Mapping S&P 500 Performance, Since 1871

- The S&P 500 at Your Fingertips

- Visualizing the Worst Case Real Returns for the S&P 500

- The Worst Returns Ever for the S&P 500

- Visualizing the Best Case Real Returns for the S&P 500

- The S&P 500's Golden Years

- The Worst Returns of the S&P 500 vs The Safest Investment in the World

- The Five Worst Bear Markets Since 1871

- The Five Worst Months in S&P 500 History

- The Five Best Months in S&P 500 History

- The Problem with Earnings

- Do Drops in Corporate Earnings Lead to Recession?

- The History of S&P 500 Dividends in Pictures

- The Sun, in the Center

- Deriving the Price-Dividend Growth Ratio

- Retrograde Earnings

- The Beating Heart of the Stock Market

- All Our Posts Tagged with "SP 500"

- All our Posts Tagged with "recession forecast"

Labels: data visualization, forecasting, recession forecast, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.