Aside from focusing upon what works and doesn't work in eliminating poverty, William Easterly's "Planners vs Searchers in Foreign Aid" (available as a 273KB PDF document) also has a neat graphic showing a positive correlation between per capita income for various nations and their combined economic freedom and democratic institution rankings:

Perhaps unsurprisingly, the wealthiest nations in the per capita income measure are those that promote the greatest economic freedom for individuals combined with strong democratic institutions. The nations at the other end of the scale are, to say the least, far from meeting their potential.

Labels: economics

Why doesn't foreign aid do more to eradicate poverty in the world? And what does it take to successfully overcome poverty? William Easterly, in "Planners vs Searchers in Foreign Aid" (available as a 273KB PDF document), offers his analysis of why foreign aid from wealthy nations fails the world's poor:

The current aid system is not working partly because the rich countries don’t care enough about making aid work for the poor, and are willing to settle for grand utopian Plans that don’t work. It is partly because nobody is actually held accountable for making THIS intervention work in THIS place at THIS time.

In other words, by focusing far too much on development projects that discount the role of individuals in favor of centralized plans, the bureaucrats of foreign aid programs only perpetuate the problems that they've been chartered to solve. Their incentive system only rewards them by continually channeling new aid money into questionable, if not outright wasteful expenditures that often generate little or no benefit to those most in need. In a nutshell, they're not being held accountable for the misuse of funding provided to the poorest nations of the world. Easterly provides a prescription for resolving these inherent deficiencies in foreign aid programs intended to relieve poverty:

(1) Have aid agents individually accountable for individual, feasible areas for action that help poor people lift themselves up.

(2) Let those agents search for what works, based on past experience in their area.

(3) Experiment with the results of the search...

(4) Evaluate, based on feedback from the intended beneficiaries and scientific testing, and learn what works.

(5) Reward success and penalize failure. Get more money to interventions that are working, take money away from interventions that are not working. Each aid agent should explore and specialize further in the direction of what they prove good at doing.

(6) Make sure incentives in (5) are strong enough to do more of what works, then repeat steps (4) on. If action fails, make sure incentives in (5) are strong enough to send the agent back to step (1). If the agent keeps failing, get a new one.

Truly empowering individuals is the key to reducing poverty - neither bureacracy nor bureaucrat, however well-intdend, are capable of doing the job as they lack the incentives to succeed. Easterly concludes:

The main hope for ending poverty is the homegrown development based on the dynamism of individuals and firms in free markets. Shorn of the sweeping Planners’ task of general economic development, aid can achieve much more than it is achieving now to relieve the sufferings of the poor.

No, Political Calculations isn't going away, so much as we're going to be off doing other much more time-consuming things for a while! We'll still be posting semi-regularly, but the daily workday posting grind will be coming to an end soon, which we've first mentioned back on December 6th of last year.

In the meantime, we've shut down the comments since we won't be able to cut the wheat from the spamming chaff, and we'll be running through what's left of our now very small backlog of posts in the immediate days ahead.

The clock's definitely winding down, but we'll see if we can't keep the place lively in the meantime....

Here at Political Calculations, we celebrate anonymous wit! Being anonymous ourselves,... Hmmm. That's not exactly accurate. Let's try that again.

Being mostly anonymous here at Pol.... No? Somewhat anonymous?... Okay, we don't get recognized on the street by strangers that often, but.... Oh, that's right, I keep forgetting about those pictures on the milk cartons. But I can still celebrate anonymous wit, right? Okay, one more time....

Here at Political Calculations, we celebrate anonymous wit! All those stories that get passed around endlessly by e-mail, so much so that the original authorship is lost and no-one has any idea who wrote the things in the first place. Today's contribution to our ongoing series of keeping anonymous humor alive follows a legal claim being filed against the Acme Company.

Product Liability Suit

In The United States District Court, Southwestern District, Tempe, Arizona Case No. B19293, Judge Joan Kujava, Presiding

Wile E. Coyote, Plaintiff vs. Acme Company, Defendant

Opening statement of Mr. Harold Schoff, attorney for Mr. Coyote:

My client, Mr. Wile E. Coyote, a resident of Arizona and contiguous states, does hearby bring suit for damages against the Acme Company, manufacturer and retail distributor of assorted merchandise, incorporated in Delaware and doing business in every state, district, and territory. Mr. Coyote seeks compensation for personal injuries, loss of business income, and mental suffering caused as a direct result of the actions and/or gross negligence of said company, under Title 15 of the United States Code Chapter 47, section 2072, subsection (a), relating to product liability.

Mr. Coyote states that on eighty-five separate occasions, he has purchased of the Acme Company (hereinafter, "Defendant"), through that company's mail order department, certain products which did cause him bodily injury due to defects in manufacture or improper cautionary labelling. Sales slips made out to Mr. Coyote as proof of purchase are at present in the possession of the Court, marked Exhibit A. Such injuries sustained by Mr. Coyote have temporarily restricted his ability to make a living in the profession of predator. Mr. Coyote is self-employed and thus not eligible for Workmen's Compensation.

Mr. Coyote states that on December 13th, he received of Defendant via parcel post one Acme Rocket Sled. The intention of Mr. Coyote was to use the Rocket sled to aid him in pursuit of his prey. Upon receipt of the Rocket Sled, Mr. Coyote removed it from its wooden shipping crate and sighting his prey in the distance, activated the ignition. As Mr. Coyote gripped the handlebars, the Rocket Sled accelerated with such sudden and precipitate force as to stretch Mr. Coyote's forelimbs to a length of fifteen feet. Subsequently, the rest of Mr. Coyote's body shot forward with a violent jolt, causing severe strain to his back and neck and placing him unexpectedly astride the Rocket Sled. Disappearing over the horizon at such speed as to leave a diminishing jet trail along its path, the Rocket Sled soon brought Mr. Coyote abreast of his prey. At that moment, the animal he was pursuing veered sharply to the right. Mr. Coyote vigorously attempted to follow this maneuver but was unable to, due to poor design and engineering on the Rocket Sled and a faulty or nonexistent steering system. Shortly thereafter, the unchecked progress of the Rocket Sled led it and Mr. Coyote into collision with the side of a mesa.

Paragraph One of the Report of Attending Physician (Exhibit B), prepared by Dr. Ernst Grosscup, M.D., D.O., details the multiple fractures, contusions, and tissue damage suffered by Mr. Coyote as a result of this collision. Repair of the injuries required a full bandage around the head (excluding the ears), a neck brace, and full or partial casts on all four legs. Hampered by these injuries, Mr. Coyote was nevertheless obliged to support himself. With this in mind, he purchased of Defendant as an aid to mobility one pair of Acme Rocket Skates. When he attempted to use this product, however, he became involved in an accident remarkably similar to that which occurred with the Rocket Sled. Again, Defendant sold over the counter, without caveat, a product which attached powerful jet engines (in this case, two) to inadequate vehicles, with little or no provision for passenger safety.

Encumbered by his heavy casts, Mr. Coyote lost control of the Rocket Skates soon after strapping them on, and collided with a roadside billboard so violently as to leave a hole in the shape of his full silhouette.

Mr. Coyote states that on occasions too numerous to list in this document he has suffered mishaps with explosives purchased of Defendant: the Acme "Little Giant" Firecracker, the Acme Self-Guided Aerial Bomb, etc. (For a full listing, see the Acme Mail Order Explosives Catalog and attached deposition, entered in evidence as Exhibit C.) Indeed, it is safe to say that not once has an explosive purchased of Defendant by Mr. Coyote performed in an expected manner.

To cite just one example: At the expense of much time and personal effort, Mr. Coyote constructed around the outer rim of a butte a wooden trough beginning at the top of the butte and spiralling downward around it to some few feet above a black X painted on the desert floor. The trough was designed in such a way that a spherical explosive of the type sold by Defendant would roll easily and swiftly down to the point of detonation indicated by the X. Mr. Coyote placed a generous pile of birdseed directly on the X, and then, carrying the spherical Acme Bomb (Catalog #78) climbed to the top of the butte. Mr. Coyote's prey, seeing the birdseed, approached, and Mr. Coyote proceeded to light the fuse. In an instant, the fuse burned down to the stem, causing the bomb to detonate. In addition to reducing all Mr. Coyote's careful preparations to naught, the premature detonation of Defendant's product resulted in the following disfigurements to Mr. Coyote:

- Severe singeing of the hair on the head, neck, and muzzle.

- Sooty discoloration.

- Fracture of the left ear at the stem, causing the ear to dangle in the aftershock with a creaking noise.

- Full or partial combustion of whiskers, producing kinking, frazzling, and ashy disintegration.

- Radical widening of the eyes, due to brow and lid charring.

We come now to the Acme Spring-Powered Shoes. The remains of a pair of these purchased by Mr. Coyote on June 23rd are Plaintiff's Exhibit D. Selected fragments have been shipped to the metallurgical laboratories of the University of California at Santa Barbara for analysis, but to date, no explanation has been found for this product's sudden and extreme malfunction.

As advertised by Defendant, this product is simplicity itself: two wood-and- metal sandals, each attached to milled-steel springs of high tensile strength and compressed in a tightly coiled position by a cocking device with a lanyard release. Mr. Coyote believed that this product would enable him to pounce upon his prey in the initial moments of the chase, when swift reflexes are at a premium.

To increase the shoes' thrusting power still further, Mr. Coyote affixed them by their bottoms to the side of a large boulder. Adjacent to the boulder was a path which Mr. Coyote's prey was known to frequent. Mr. Coyote put his hind feet in the wood-and-metal sandals and crouched in readiness, his right forepaw holding firmly to the lanyard release. Within a short time, Mr. Coyote's prey did indeed appear on the path coming toward him.

Unsuspecting, the prey stopped near Mr. Coyote, well within range of the springs at full extension. Mr. Coyote gauged the distance with care and proceeded to pull the lanyard release. At this point, Defendant's product should have thrust Mr. Coyote forward and away from the boulder. Instead, for reasons yet unknown, the Acme Spring-Powered Shoes thrust the boulder away from Mr. Coyote.

As the intended prey looked on unharmed, Mr. Coyote hung suspended in the air. Then the twin springs recoiled, bringing Mr. Coyote to a violent feet-first collision with the boulder, the full weight of his head and forequarters falling upon his lower extremities. The force of this impact then caused the springs to rebound, whereupon Mr. Coyote was thrust skyward. A second recoil and collision followed. The boulder, meanwhile, which was roughly ovoid in shape, had begun to bounce down a hillside, the coiling and recoiling of the springs adding to its velocity. At each bounce, Mr. Coyote came into contact with the boulder, or the boulder came into contact with Mr. Coyote, or both came into contact with the ground. As the grade was a long one, this process continued for some time.

The sequence of collisions resulted in systemic physical damage to Mr. Coyote, viz, flattening of the cranium, sideways displacement of the tongue, reduction of length of legs and upper body, and compression of vertebrae from base of tail to head. Repetition of blows along a vertical axis produced a series of regular horizontal folds in Mr. Coyote's body tissues, a rare and painful condition which caused Mr. Coyote to expand upward and contract downward alternately as he walked, and to emit an offkey, accordion-like wheezing with every step. The distracting and embarrassing nature of this symptom has been a major impediment to Mr. Coyote's pursuit of a normal social life.

As the court is no doubt aware, Defendant has a virtual monopoly of manufacture and sale of goods required by Mr. Coyote's work. It is our contention that Defendant has used its market advantage to the detriment of the consumer of such specialized products as itching powder, giant kites, Burmese tiger traps, anvils, and two-hundred-foot-long rubber bands. Much as he has come to mistrust Defendant's products, Mr. Coyote has no other domestic source of supply to which to turn. One can only wonder what our trading partners in Western Europe and Japan would make of such a situation, where a giant company is allowed to victimize the consumer in the most reckless and wrongful manner over and over again.

Mr. Coyote respectfully requests that the Court regard these larger economic implications and assess punitive damages in the amount of seventeen million dollars. In addition, Mr. Coyote seeks actual damages (missed meals, medical expenses, days lost from professional occupation) of one million dollars; general damages (mental suffering, injury to reputation) of twenty million dollars; and attorney's fees of seven hundred and fifty thousand dollars. By awarding Mr. Coyote the full amount, this Court will censure Defendant, its directors, officers, shareholders, successors, and assigns, in the only language they understand, and reaffirm the right of the individual predator to equal protection under the law.

Update, 27 January 2006: An intrepid reader has informed me that the author of this piece hasn't been lost to anonymity at all. As it happens, in the reader's words, "Coyote vs. Acme is the very funny title story in a very funny collection by Ian Frazier."

One of the reasons the U.S. federal tax code is so freaking large and complicated is that it has often been revised and extended for the sake of attempting to achieve public policy goals through positive and negative incentives. "Desired" behavior is often rewarded through tax credits. Meanwhile, "undesired" behaviors are punished by exposing individual tax payers to higher tax rates than would otherwise be needed, largely to subsidize the tax breaks that the "lucky" few are receiving.

That, in a nutshell, is the system we've got. The questions now become: "How can we cash in on stuff like this?" and "How much cash are we talking about?"

If you're one of the "lucky few" who have kids under the age of 14, you might consider taking advantage of the incentive our hard-working federal tax code writers have provided to reward you for setting up investment income accounts for your children. Here's how it works:

- Set up an investment account for your child, or each of your children, where they are able to accumulate interest or dividend income.

- The first $800 they earn for 2005 (or $850 for 2006) is exempt from being taxed.

- The second $800 they earn (or $850 for 2006) is taxed at a flat tax rate of 10%.

- Any amount over $1600 (or $1700 for 2006) is taxed at the parent's tax rate.

That's pretty much it, although there's a bit of paperwork to be able to realize the tax advantage. The following tool we've created below estimates the amount of the tax break you might realize from exploiting this option by comparing it to what you would otherwise have to pay out of your pocket if you had invested it yourself and had to pay the full tax on the unearned income. Credit for the idea behind this tool belongs to the Early Riser, who first described how the credit works in 2005 and recently updated the information for 2006. The tool below uses the revised data for 2006 to calculate the tax savings, but your tax data for 2005 to estimate the parent's marginal tax rate:

You will need to repeat this exercise for each of your children who qualify for this particular tax savings technique. Those with more children get more tax savings.

And yes, it does occur to me that this particularly tax credit is set up to benefit the proverbial "trust-fund" baby (whose parents, after all, have the money to lobby the U.S. Congress to write things like this into the tax code.) But, as long as it's there, there's no reason that otherwise unassuming middle-class folk can't exploit this particular legal tax-avoidance scheme too....

Labels: investing, taxes, tool

InstaPundit Glenn Reynolds pointed to this article from the BBC, which reports recent polling results that the people of both Afghanistan and Iraq are turning out to be very optimistic where their economic future is concerned.

Perhaps a brief glimpse at the recent economic performance of both countries might help explain their optimism, with data taken from the Country Report for each by the Economist Intelligence Unit (subscription required):

| GDP and Real Economic Growth Rate for Afghanistan and Iraq, 2001-2005 |

|||||

|---|---|---|---|---|---|

| Afghanistan | |||||

| Economic Statistic | 2001 | 2002 | 2003 | 2004 | 2005 |

| GDP ($USD billions) | 2.5 | 4.1 | 4.6 | 6.0 | 7.1 |

| Real GDP Growth (%) | N/A | 28.6 | 15.7 | 8.0 | 13.6 |

| Iraq | |||||

| Economic Statistic | 2001 | 2002 | 2003 | 2004 | 2005 |

| GDP ($USD billions) | 18.9 | 19.0 | 12.7 | 25.5 | 29.2 |

| Real GDP Growth (%) | -8.2 | -14.2 | -35.3 | 46.5 | -3.0 |

The BBC reports this analysis from the polling firm that conducted the optimism survey:

In Afghanistan, 70% say their own circumstances are improving, and 57% believe that the country overall is on the way up.

In Iraq, 65% believe their personal life is getting better, and 56% are upbeat about the country's economy.

The experts at polling firm Globescan, who conducted the survey, venture the guess that war may have created a "year zero" experience of collectively starting again.

From the data in the table above, I would say it's pretty clear that the "year zero" experience began for the people of Afghanistan between 2001 and 2002, while for the Iraqis, "year zero" began between 2003 and 2004, coinciding with their respective liberations from repressive regimes by the United States.

What effect does the institution of democracy have upon the economic growth and development of a nation?

If you look around the world today, you can find that the wealthiest countries are typically democratic, while the most non-democratic nations of the world rank among the world's poorest. But why is that? Does the presence of democratic government promote the growth of a nation's income? And what difference does democracy make in the economic growth of a nation?

Many of these questions were recently addressed in a working paper by Daron Acemoglu (MIT), Simon Johnson (MIT), James A. Robinson (Harvard) and Pierre Yared (MIT): "Income and Democracy?" (summary available via Smart Economist - free, registration required.) In the paper, the authors examine a variety of economic (GDP per capita, trade, savings, etc.), demographic (population, education, etc.), political (various democracy measures) and historic (date of independence, data for 143 countries over 500 years of their history, and a smaller set of 28 countries over 160 years of their history, seeking to correlate their economic growth and development with the development of democratic institutions. Their key findings:

- A nation's economic growth has little to no effect in promoting the development of democratic institutions within the nation.

- The development of democracy and a nation's economic growth are positively correlated over the longer term (500 years), but not over the shorter periods of time (160 years.) In other words, the presence of democratic institutions promotes greater economic growth over the long term.

One example of the first finding may be found in the example of the nation of Saudi Arabia. Here, while having become one of the wealthiest nations in the world as a result of the value of its major natural resource (oil), Saudi Arabia has not developed any significant democratic institutions as a result of its increasing income, at least, over the comparatively short term.

Over the Long Term

To understand how the development of democratic institutions can affect a nation's economic growth and development over time, let's look at the example of the development of banks in the United States and Mexico from the nineteenth century onward. The following is excerpted from the World Bank's Development Report on Equity Development (links and emphasis added):

Banking in the nineteenth century, Mexico and the United States

Much recent work on growth and development has focused on financial and capital markets. A central issue is to understand why financial systems differ. For example, studies of the development of banking in the United States in the nineteenth century demonstrate a rapid expansion of financial intermediation, which most scholars see as a crucial facilitator of the economy’s rapid growth and industrialization. Haber (2001) investigated the development of banks in the nineteenth century in Mexico and the United States. He shows that “Mexico had a series of segmented monopolies that were awarded to a group of insiders” (24). In 1910 “the United States had roughly 25,000 banks and a highly competitive market structure; Mexico had 42 banks, two of which controlled 60 percent of total banking assets, and virtually none of which actually competed with another bank.”

Why this huge difference? The relevant technology was certainly widely available, and it is difficult to see why the various types of moral hazard or adverse selection connected with financial intermediation should have limited the expansion of banks in Mexico but not the United States. Indeed, Haber shows when the U.S. Constitution was put into effect in 1789, the structure of U.S. banking looked remarkably like that arising later in Mexico. State governments, stripped of revenues by the Constitution, started banks as a way to generate tax revenues and restricted entry to generate rents. Yet this system did not last because states began competing among themselves for investment and migrants. As Haber (2001) puts it,

The pressure to hold population and business in the state was reinforced by a second, related, factor: the broadening of the suffrage. By the 1840s, most states had dropped all property and literacy requirements, and by 1850 virtually all states ... had done so. The broadening of the suffrage, however, served to undermine the political coalitions that supported restrictions on the number of bank charters. That is, it created a second source of political competition — competition within states over who would hold office and the policies they would enact (10).

The situation was very different in Mexico. After 50 years of endemic political instability, the country became unified under the highly centralized 40-year dictatorship of Porfirio Díaz until the revolution in 1910.

In Haber’s argument, political institutions in the United States allocated political power to people who wanted access to credit and loans. As a result, they forced state governments to allow free competitive entry into banking. In Mexico, political institutions were very different. There were no competing federal states, and suffrage was highly restrictive. As a result, the central government granted monopoly rights to banks, which restricted credit to maximize profits. The granting of monopolies turned out to be a rational way for the government to raise revenue and redistribute rents to political supporters (North 1981).

Haber (2001) documents that market regulation was not aimed at solving market failures, and it is precisely during this period that the huge economic gap between the United States and Mexico opened (on which see Coatsworth 1993, Engerman and Sokoloff 1997).

And so, the early expansion of effective democratic institutions led to the divergence in economic growth between Mexico and the United States. Likewise, the democratic nations of the world have outpaced all others in their economic growth. As the research findings contained in "Income and Democracy?" suggests, it's not an accident.

Today, Political Calculations is repeating it's previous exercise in examining the GDP rankings of the nations surrounding the Pacific Ocean, but updating the data for 2004! One unique wrinkle - instead of adding the U.S. and Canada as whole nations, we're only looking at the equivalent GSP and GDP data for the Pacific Ocean bordering states of Alaska, California, Hawaii, Oregon and Washington, as well as the Canadian province of British Columbia!

The data in the table below has been adjusted for each country's Purchasing Power Parity, which takes into account how much an individual can buy within a country along with the currency exchange rate between the individual country's currency and the U.S. dollar. This allows for a more direct comparison between countries with different rates of exchange in their currencies, as well as what their currencies are capable of buying within their own countries. As a final note, the individual U.S. state GSP data has not been adjusted this way.

| 2004 Pacific Rim GDP-PPP, Population and GDP-PPP per Capita |

|---|

| Country/Territory | GDP-PPP ($USD billions) | Population (2004 est.) | GDP-PPP per Capita |

|---|---|---|---|

| Australia | 611.7 | 19913144 | 30718 |

| Bangladesh | 275.7 | 141340476 | 1951 |

| Bhutan | 2.9 | 2185569 | 1327 |

| Brunei | 6.8 | 365251 | 18732 |

| Cambodia | 27.0 | 13363421 | 2020 |

| Canada - British Columbia | 124.7 | 4201867 | 29672 |

| Chile | 169.1 | 15823957 | 10686 |

| China | 7262.0 | 1298847624 | 5591 |

| Colombia | 281.1 | 42310775 | 6644 |

| Cook Islands | 0.1 | 21200 | 4953 |

| Costa Rica | 38.0 | 3956507 | 9597 |

| East Timor | 0.4 | 1019252 | 363 |

| Ecuador | 49.5 | 13212742 | 3747 |

| El Salvador | 32.4 | 6587541 | 4911 |

| Fiji | 5.2 | 880874 | 5873 |

| French Polynesia | 4.6 | 266339 | 17196 |

| Guam | 3.2 | 166090 | 19267 |

| Guatemala | 59.5 | 14280596 | 4164 |

| Honduras | 18.8 | 6823568 | 2754 |

| Hong Kong | 234.5 | 6855125 | 34208 |

| India | 3319.0 | 1065070607 | 3116 |

| Indonesia | 827.4 | 238452952 | 3470 |

| Japan | 3745.0 | 127333002 | 29411 |

| Kiribati | 0.1 | 100798 | 784 |

| Korea, North | 40.0 | 22697553 | 1762 |

| Korea, South | 925.1 | 48598175 | 19036 |

| Laos | 11.3 | 6068117 | 1859 |

| Macau | 9.1 | 445286 | 20436 |

| Malaysia | 229.3 | 23522482 | 9748 |

| Maldives | 1.3 | 339330 | 3684 |

| Marshall Islands | 0.1 | 57738 | 1992 |

| Mexico | 1006.0 | 104959594 | 9585 |

| Micronesia, Federated States of | 0.3 | 108155 | 2561 |

| Nauru | 0.1 | 12809 | 4684 |

| New Caledonia | 3.2 | 213679 | 14779 |

| New Zealand | 92.5 | 3993817 | 23163 |

| Niue | 0.0 | 2156 | 3525 |

| Northern Mariana Islands | 0.9 | 78252 | 11501 |

| Pakistan | 347.3 | 159196336 | 2182 |

| Palau | 0.2 | 20016 | 8693 |

| Panama | 20.6 | 3000463 | 6856 |

| Papua New Guinea | 12.0 | 5420280 | 2212 |

| Peru | 155.3 | 27544305 | 5638 |

| Philippines | 430.6 | 86241697 | 4993 |

| Russia | 1408.0 | 143782338 | 9793 |

| Samoa | 1.0 | 177714 | 5627 |

| Singapore | 120.9 | 4353893 | 27768 |

| Solomon Islands | 0.8 | 523617 | 1528 |

| Sri Lanka | 80.6 | 19905165 | 4048 |

| Taiwan | 576.2 | 22749838 | 25328 |

| Thailand | 524.8 | 64965523 | 8078 |

| Tokelau | 0.0 | 1405 | 1068 |

| Tonga | 0.2 | 110237 | 2213 |

| Tuvalu | 0.0 | 11468 | 1064 |

| US - Alaska | 34.0 | 655435 | 51874 |

| US - California | 1550.8 | 35893799 | 43205 |

| US - Hawaii | 50.3 | 1262840 | 39848 |

| US - Oregon | 128.1 | 3594586 | 35637 |

| US - Washington | 261.5 | 6203788 | 42152 |

| Vanuatu | 0.6 | 202609 | 2863 |

| Vietnam | 227.2 | 82689518 | 2748 |

| Wallis and Futuna | 0.1 | 15880 | 3778 |

| Pacific Rim (All) | 25348.6 | 3902999170 | 6495 |

The Richest and Poorest Nations Around the Pacific Rim

The west coast U.S. states of Alaska, California, Washington, Hawaii and Oregon top the list, followed by Hong Kong, Australia, the Canadian province of British Columbia, Japan and Singapore. If the U.S. and Canada are taken as whole nations, the top of the list as measured by GDP-PPP per Capita would be the United States ($40099), Hong Kong, Canada ($31469), Australia, Japan and Singapore.

The poorest nation in the Pacific Rim is the recently independent East Timor, followed by tiny nation of Kiribati (formerly, and perhaps better known as the Gilbert Islands.)

Data Sources:

GDP-PPP Data: 2004 GDP-PPP Data for Individual Nations

U.S. Individual GSP Data: 2004 GSP for U.S. States

Canada Individual Province GDP Data: Statistics Canada Releases Revised 2001-2004 GDP Data (170KB PDF document). Note: The GDP data for British Columbia was presented in raw 2004 Canadian dollars. It was converted to GDP-PPP (in 2004 US dollars) in the table above by multiplying the raw GDP figure by 79.29%, which was derived by dividing the GDP-PPP figure for Canada ($1.023 trillion USD) by the nation's raw GDP ($1.290 trillion CAD).

Population Data: July 2004 Population Estimates

GSP and GDP per Capita: This data was calculated by simply dividing the published GDP-PPP data by each nation's, state's or territory's population estimate for July 2004.

Previously on Political Calculations

2004 Economic and Population Data

- GDP Rankings in Muslim Nations

- 2004 GDP Rankings for Asia

- European Union 2004 GDP Rankings

- GDP in Africa: 2004

- GDP Rankings of the Americas: 2004 Edition

- EU vs US: Two Years of Economic Data Later....

2002 Economic and Population Data

- EU vs USA

- Cool Tools and GSP

- GDP of the Americas

- GDP in the Muslim World

- GDP in Europe

- GDP: Africa

- GDP Along the Pacific Rim

- GDP in Asia

- GDP: And the rest...

Wow! Who knew FIAR at Radioactive Liberty had such high standards (for anything, much less comedy?!) Well, I still hope you enjoy the following contribution. Despite the cognitive dissonance of seeing "FIAR" and "high standards" in the same sentence above and the utter lack of originality below, it's still pretty entertaining and might honestly be considered a classic (although one suspects that a good part of FIAR's issues with the following might come from being an English major....)

At the risk of being stereotyped, we here at Political Calculations are not, and never have been, English majors. Most people automatically assume that our decision to not pursue a degree in English literature has something to do with our love of careers that make money, and perhaps our very low tolerance of pretentious crap, both things that we've found over the years to be values that most English majors do not share. Well, that's true, but it's also because of having to do assignments like this:

This assignment was actually turned in by two English students:

Rebecca (last name deleted) and Gary (last name deleted)

English 44A

SMU

Creative Writing

Prof MillerIn-class Assignment for Wednesday

"Today we will experiment with a new form called the tandem story. The process is simple. Each person will pair off with the person sitting to his or her immediate right. One of you will then write the first paragraph of a short story. The partner will read the first paragraph and then add another paragraph to the story. The first person will then add a third paragraph, and so on back and forth. Remember to reread what has been written each time in order to keep the story coherent. The story is over when both agree a conclusion has been reached."

The story begins ...At first, Laurie couldn't decide which kind of tea she wanted. The camomile, which used to be her favorite for lazy evenings at home, now reminded her too much of Carl, who once said, in happier times, that he liked camomile. But she felt she must now, at all costs, keep her mind off Carl. His possessiveness was suffocating, and if she thought about him too much her asthma started acting up again. So camomile was out of the question.

Meanwhile, Advance Sergeant Carl Harris, leader of the attack squadron now in orbit over Skylon 4, had more important things to think about than the neuroses of an air-headed asthmatic bimbo named Laurie with whom he had spent one sweaty night over a year ago. "A.S. Harris to eostation 17," he said into his transgalactic communicator. "Polar orbit established. No sign of resistance so far..." But before he could sign off, a bluish particle beam flashed out of nowhere and blasted a hole through his ship's cargo bay. The jolt from the direct hit sent him flying out of his seat and across the cockpit.

He bumped his head and died almost immediately, but not before he felt one last pang of regret for psychically brutalizing the one woman who had ever had feelings for him. Soon afterward, Earth stopped its pointless hostilities toward the peaceful farmers of Skylon 4. "Congress Passes Law Permanently Abolishing War and Space Travel," Laurie read in her newspaper one morning. The news simultaneously excited her and bored her. She stared out the window, dreaming of her youth -- when the days had passed unhurriedly and carefree, with no newspapers to read, no television to distract her from her sense of innocent wonder at all the beautiful things around her. "Why must one lose one's innocence to become a woman?" she pondered wistfully.

Little did she know, but she has less than 10 seconds to live. Thousands of miles above the city, the Anu'udrian mothership launched the first of its lithium fusion missiles. The dim-witted wimpy peaceniks who pushed the Unilateral Aerospace Disarmament Treaty through Congress had left Earth a defenseless target for the hostile alien empires who were determined to destroy the human race. Within two hours after the passage of the treaty the Anu'udrian ships were on course for Earth, carrying enough firepower to pulverize the entire planet. With no one to stop them they swiftly initiated their diabolical plan. The lithium fusion missile entered the atmosphere unimpeded. The President, in his top-secret mobile submarine headquarters on the ocean floor off the coast of Guam, felt the inconceivably massive explosion which vaporized Laurie and 85 million other Americans. The President slammed his fist on the conference table. "We can't allow this! I'm going to veto that treaty! Let's blow'em out of the sky!"

This is absurd. I refuse to continue this mockery of literature. My writing partner is a violent, chauvinistic, semi-literate adolescent.

Yeah? Well, you're a self-centered tedious neurotic whose attempts at writing are the literary equivalent of Valium.

You total $*&.

Stupid %&#$!

Source: http://www.autographsystems.com/humor/TandemWriting.html

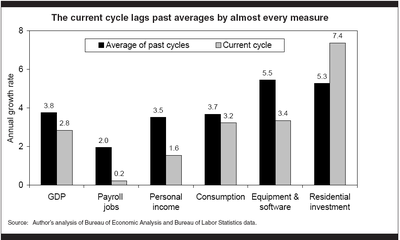

One of our personal pet peeves in looking at historical economic data is that often, information that could easily be presented on a graph to provide greater insight, isn't. Here's an example of what I mean, using a chart that recently appeared at Barry Ritholtz's The Big Picture:

Now, the chart itself is the product of the folks at EPI who, aside from their left-wing partisan bias, also have a history of excessive myopia when it comes to presenting economic data (most likely because correcting their "myopia" would tend to significantly weaken their arguments.)

So, what useful information could have been presented with this particular chart to provide greater context to EPI's arguments, or potential lack thereof? Well, since the chart is comparing the current performance of the most recent economic recovery to the averages of dozens of others, it would be really, really useful if we could get a sense of the range for each of the various statistics for the previous recoveries. To provide proper context, we should, at the very least, be able to see what the previous best performance and worst performance were for each statistic on the chart.

In other words, we want to see something like a box and whiskers bar chart, the following example of which provides substantially more information in context than the previous example produced by EPI. In the chart below, we're looking at the number of days that the temperature in the indicated cities exceeds 100 degrees Fahrenheit:

In this example, we can see at a glance the maximum for each range, the minimum, the average and even the upper and lower quartiles that show us where at least 50% of the data occurs for each of the cities listed. Is the relevant data available to EPI to produce a chart showing the full spectrum of economic recovery performance? You bet! They couldn't calculate the averages they show otherwise! Are they going to improve their presentation of information anytime soon? We'll see. I suppose it's always possible that someone will send them a copy of Edward Tufte's new book (HT: The New Economist), although whether they would read and use it is another open question....

Should you invest your hard earned money in taxable or tax-free investments in 2006? This year, Political Calculations decided to get ahead of the game and post our tool to help you decide early while your completing your 2005 Income Tax returns instead of much later in the year, giving you the opportunity to earn more from your investment choices.

The tool below is based upon math outlined by columnist Bruce Bartlett in his March 2005 column Tax Rates. Since the input data uses information that you'll have to record in your 2005 Form 1040 U.S. Individual Income Tax Return (available as a 200KB PDF document), I'll give you a few minutes to complete your return, if you haven't already, to have it ready to use with the tool below....

Okay, now that you've finished your return, let's put it to good use. We're going to calculate your average tax rate (the amount of taxes you paid relative to your income) and your marginal tax rate for 2005, or rather, the tax rate you paid on the highest dollar of your earnings last year. As noted in Bruce Bartlett's column, this latter information is really useful if you are planning to choose between a taxable versus a tax-exempt investment, since your marginal tax rate will determine which is more beneficial to you. Start by entering the indicated information from your 1040 form in the data input fields below, followed by your potential investment data:

This tool provides, at best, a good first approximation of your marginal tax rate, since other factors, such as the phase out of tax credits with higher income, may significantly affect the tax rate you pay on your income. Also, if you expect that your income will be significantly different this year, as compared to last year, you should re-run the calculator with new values to account for the expected difference since it may make a world of difference in your choice of investments!

Labels: investing, taxes, tool

What can we say about the state of education on the typical college campus today? Sure, the costs of getting a college education are soaring at more that twice the level of inflation, but did you know that one of the principal reasons for the never-ending cost increases is because modern U.S. universities have become less and less productive over the past decade?

Thomas Garrett and William Poole of the Federal Reserve Bank of St. Louis have noticed, finding that the rise in college costs may be attributed to the following factors:

- Universities have little economic pressure to adopt cost-saving policies and procedures, which result in inefficiencies. Examples include:

- Excessive staffing.

- Retaining low-demand, yet costly academic and research programs.

- Increased administrative expenditures.

- Public funding crises:

- Reduced public funding stemming from recent recession, coupled with lack of cost containment, led directly to tuition increases at public universities.

- Financial aid and student loans:

- Act to subsidize demand for higher education, increasing total enrollment.

- Increase costs associated with serving larger student population that are not matched by productivity improvements to accommodate increased student numbers at lower cost.

Garrett and Poole suggest several different means by which universities could reverse their dropping productivity:

- Privatization of certain services, such as food services, student housing, maintenance, and records management.

- Decentralization of administrative functions, such as clerical staffing.

- Improving student quality by emphasizing instruction over research and implementing or improving the quality of instruction through training.

- Increasing the flexibility of faculty staffing, adjusting faculty "capacity" or staffing levels to better match student-demanded education needs.

The decrease in the productivity of American colleges and universities is occurring in direct opposition to the increase in productivity of the U.S. economy at large over the same period. But why? This drop in academic productivity comes despite the highest concentrations of highly educated people anywhere in the U.S. In the private sector, there's no question that some of this intellectual potential would be dedicated to the improvement of the productivity behind a company's products or services. You'd think such a collection of smart people as you would find on campus ought to be able to figure out how to be more productive....

Update 1: Perhaps Michael Barone (via Powerline) might have put his finger on why - university administrators are too focused on the wrong things:

Our universities today have become our most intellectually corrupt institutions. University administrators must lie and deny that they use racial quotas and preferences in admissions, when they devote much of their energy to doing just that. They must pledge allegiance to diversity, when their campuses are among the least politically diverse parts of our society, with speech codes that penalize dissent and sometimes violent suppression of conservative opinion.

With such a corrosive environment on college campuses, it's hard to imagine any amount of proper attention will be paid to productivity improvements anytime soon.

Update 2: Gary Becker and Richard Posner look at the role of tenure in motivating (or rather, not motivating) professors to be more productive.

Related Tools on Political Calculations

Also on Political Calculations

- Your Education and Your Earnings

- Graduating to a Paycheck

- Free Economy, More Education, More Earnings

- Your Earnings: Education vs. Experience

- Education and Unemployment

- High Investment, Low Payoff Careers

We here at Political Calculations were wondering recently just who the biggest employers are in the U.S. among the Fortune 500 publicly-traded companies. The following list is what we were able to mine from Fortune's most recent annual listing, which presents data for 2004 (and also provides the rank in the table below):

| Top 10 U.S. Employers | |||

|---|---|---|---|

| Rank | Company | Revenue ($ millions USD) | Employees |

| 1 | Wal-Mart Stores | 288,189.00 | 1,600,000 |

| 116 | McDonald's | 19,064.70 | 438,000 |

| 42 | United Parcel Service | 36,582.00 | 384,000 |

| 332 | Interpublic Group | 6,077.40 | 329,001 |

| 13 | Home Depot | 73,094.00 | 325,000 |

| 4 | Ford Motor | 172,233.00 | 324,864 |

| 3 | General Motors | 193,517.00 | 324,000 |

| 5 | General Electric | 152,363.00 | 307,000 |

| 27 | Target | 49,934.00 | 300,000 |

| 8 | Citigroup | 108,276.00 | 290,500 |

Collectively, these ten companies account for the gainful employment of some 4,622,365 people. Going by the Bureau of Labor Statistics seasonally-adjusted total civilian labor force for December 2004 of 148,173,000, the employees of these 10 companies account for 3.1% of the entire civil workforce in the U.S.

More impressively, these 10 companies raked in $1,099,330,100,000 USD (that's $1.1 trillion US dollars) in 2004. That rounds up to 9.4% of the U.S. 2004 GDP and, if these 10 companies were their own country, would place them ahead of Canada (with a GDP-PPP of $1.023 trillion USD) and behind Russia (with at GDP-PPP of $1.408 trillion USD) in the world economic production rankings!

One of the great CEOs in the aerospace industry was Norman Augustine, who helmed Martin Marietta and later Lockheed after the companies merged to form the current Lockheed Martin in 1995. But beyond heading a major defense and space company, he's perhaps best known for his set of 52 laws regarding the nature of work and business in the aerospace industry, which he learned, accumulated and recorded in his great opus "Augustine's Laws". Here's a sampling, organized by category:

Source: Augustine's LawsGeneral Wisdom

Law Number II: If today were half as good as tomorrow is supposed to be, it would probably be twice as good as yesterday was.

Law Number IV: If you can afford to advertise, you don't need to.

Law Number X: Bulls do not win bullfights; people do. People do not win people fights; lawyers do.

Law Number XI: If the Earth could be made to rotate twice as fast, managers would get twice as much done. If the Earth could be made to rotate twenty times as fast, everyone else would get twice as much done since all the managers would fly off.

Law Number XII: It costs a lot to build bad products.

Law Number XIII: There are many highly successful businesses in the United States. There are also many highly paid executives. The policy is not to intermingle the two.

Law Number XXI: It's easy to get a loan unless you need it.

Law Number XXII: If stock market experts were so expert, they would be buying stock, not selling advice.

Law Number XXXVII: Ninety percent of the time things will turn out worse than you expect. The other 10 percent of the time you had no right to expect so much.

Law Number XXXVIII: The early bird gets the worm. The early worm....gets eaten.

Products

Law Number XVII: Software is like entropy. It is difficult to grasp, weighs nothing, and obeys the Second Law of Thermodynamics; i.e., it always increases.

Law Number XIX: Although most products will soon be too costly to purchase, there will be a thriving market in the sale of books on how to fix them.

Government

Law Number XX: In any given year, Congress will appropriate the amount of funding approved the prior year plus three-fourths of whatever change the administration requests, minus 4-percent tax.

Law Number LI: By the time of the United States Tricentennial, there will be more government workers than there are workers.

Project Management

Law Number V: One-tenth of the participants produce over one-third of the output. Increasing the number of participants merely reduces the average output.

Law Number XV: The last 10 percent of performance generates one-third of the cost and two-thirds of the problems.

Law Number XXIII: Any task can be completed in only one-third more time than is currently estimated.

Law Number XXIV: The only thing more costly than stretching the schedule of an established project is accelerating it, which is itself the most costly action known to man.

Law Number XXV: A revised schedule is to business what a new season is to an athlete or a new canvas to an artist.

Law Number XXVI: If a sufficient number of management layers are superimposed on each other, it can be assured that disaster is not left to chance.

Law Number XXXI: The optimum committee has no members.

Law Number XXXVI: The thickness of the proposal required to win a multimillion dollar contract is about one millimeter per million dollars. If all the proposals conforming to this standard were piled on top of each other at the bottom of the Grand Canyon, it would probably be a good idea.

Law Number XL: Most projects start out slowly, and then sort of taper off.

Labels: none really

MyMoneyBlog had a very interesting post back in October 2005, which focused on the method one might use to predict what rate of return would be forthcoming when the I-bond Savings Bond rate would be adjusted later that month. Using the MyMoneyBlog method, the I-bond was predicted to have an annualized rate of return of 6.92%, plus or minus 0.2% depending upon where the fixed rate would be set (for a range between 6.72% and 7.13%.)

As it happened, the I-bond did have its fixed rate portion lowered from 1.2% to 1.0%, which in turn resulted in the I-bond's rate of return being set at the low end of MyMoneyBlog's prediction at an annualized rate of return of 6.73%.

We here at Political Calculations love it when a mathematical prediction pans out, so we've built a tool to do the math behind MyMoneyBlog's I-bond rate of return prediction method. All you need to do is to collect the following information and enter it in the table below, and the tool will take care of the rest:

Expected Range of I-Bond Fixed Rate

- Low End of Expected Range for I-bond Rate of Return

- High End of Expected Range for I-bond Rate of Return

Consumer Price Index for all Urban Consumers (CPI-U)

- CPI-U for the most recent March or September

- CPI-U for the next most recent of March (if the most recent CPI-U is available for September of the previous year) or September (if the most recent CPI-U is available for March of the same year).

The default values in the table are those from MyMoneyBlog's 14 October 2005 post, with the most recent CPI-U data from September 2005 and the next most recent CPI-U data from the next most recent March or September being from March 2005.

Political Calculations has finally brought the Muslim nations of the world together (at least those nations for which Muslims represent a plurality of the population) in the following dynamic table as part of our ongoing 2004 GDP ranking series. In the table below, you may rank the nations from most to least economic output (as measured by each nation's Gross Domestic Product adjusted for Purchasing Power Parity), most to least populous, and finally from richest to poorest (according to GDP-PPP per capita) and vice versa. Just select any of the column headings below to rank the presented data according to the category you select!

| 2004 GDP-PPP, Population and GDP-PPP per Capita for Muslim Nations |

|---|

| Country | GDP-PPP (billions $USD) | Population (2004 est.) | GDP-PPP per Capita |

|---|---|---|---|

| Afghanistan | 21.5 | 28513677 | 754 |

| Albania | 17.5 | 3544808 | 4926 |

| Algeria | 212.3 | 32129324 | 6608 |

| Azerbaijan | 30.0 | 7868385 | 3814 |

| Bahrain | 13.0 | 677886 | 19192 |

| Bangladesh | 275.7 | 141340476 | 1951 |

| Bosnia and Herzegovina | 26.2 | 4007608 | 6540 |

| Brunei | 6.8 | 365251 | 18732 |

| Burkina Faso | 15.7 | 13574820 | 1159 |

| Chad | 15.7 | 9538544 | 1642 |

| Comoros | 0.4 | 651901 | 676 |

| Cote d'Ivoire | 24.8 | 17327724 | 1430 |

| Djibouti | 0.6 | 466900 | 1326 |

| Egypt | 316.3 | 76117421 | 4155 |

| Eritrea | 4.2 | 4447307 | 934 |

| Ethiopia | 54.9 | 67851281 | 809 |

| Gambia, The | 2.8 | 1546848 | 1809 |

| Gaza Strip | 0.8 | 1324991 | 580 |

| Guinea | 19.5 | 9246462 | 2109 |

| Indonesia | 827.4 | 238452952 | 3470 |

| Iran | 516.7 | 69018924 | 7486 |

| Iraq | 54.4 | 25374691 | 2144 |

| Jordan | 25.5 | 5611202 | 4544 |

| Kazakhstan | 118.4 | 15143704 | 7818 |

| Kuwait | 48.0 | 2257549 | 21262 |

| Kyrgyzstan | 8.5 | 5081429 | 1672 |

| Lebanon | 18.8 | 3777218 | 4985 |

| Libya | 37.5 | 5631585 | 6655 |

| Maldives | 1.3 | 339330 | 3684 |

| Mali | 11.0 | 11956788 | 920 |

| Mauritania | 5.5 | 2998563 | 1846 |

| Mayotte | 0.5 | 186026 | 2509 |

| Malaysia | 229.3 | 23522482 | 9748 |

| Morocco | 134.6 | 32209101 | 4179 |

| Niger | 9.7 | 11360538 | 855 |

| Nigeria | 125.7 | 137253133 | 916 |

| Oman | 38.1 | 2903165 | 13120 |

| Pakistan | 347.3 | 159196336 | 2182 |

| Qatar | 19.5 | 840290 | 23194 |

| Saudi Arabia | 310.2 | 25795938 | 12025 |

| Senegal | 18.4 | 10852147 | 1692 |

| Somalia | 4.6 | 8304601 | 554 |

| Sudan | 76.2 | 39148162 | 1946 |

| Syria | 60.4 | 18016874 | 3355 |

| Tajikistan | 8.0 | 7011556 | 1134 |

| Tunisia | 70.9 | 9974722 | 7106 |

| Turkey | 508.7 | 68893918 | 7384 |

| Turkmenistan | 27.6 | 4863169 | 5675 |

| United Arab Emirates | 63.7 | 2523915 | 25227 |

| Uzbekistan | 47.6 | 26410416 | 1802 |

| West Bank | 1.8 | 2311204 | 779 |

| Yemen | 16.3 | 20024867 | 811 |

| Muslim Nations (All) | 4850.6 | 1417788109 | 3421 |

The Richest and Poorest Nations of the Muslim World

The richest nation among the Muslim nations of the world continues to be the United Arab Emirates, followed by Qatar, Kuwait and Bahrain in 2004. This marks a significant jump for Kuwait and Bahrain from 2002, since both had previously ranked behind the nation of Brunei, whose GDP-PPP per capita has not significantly changed.

The poorest nation in the Muslim world is Somalia, followed by the Palestinian territory of the Gaza Strip, both of whose GDP-PPP per capita came in well behind the next lowest average economic output per person recorded by the island nation of Comoros.

The Biggest Change Since 2002

The undisputed economic growth champion of the Muslim regions of the world is the tiny island of Mayotte, which is under the jurisdiction of France. In 2002, Mayotte ranked at the very bottom of the Muslim world's GDP-PPP per capita, with an average economic output per person of $476 USD. In 2004, GDP-PPP per capita in Mayotte has surged to $2509 USD, an annualized growth rate of 129%! While the reasons for the increase of Mayotte's GDP-PPP per capita are unclear, the territory receives extensive financial aid from France and has been seeking to develop and diversify its agricultural economy.

Data Sources:

GDP-PPP Data: 2004 GDP-PPP Data for Individual Nations

Population Data: July 2004 Population Estimates

GSP and GDP per Capita: This data was calculated by simply dividing the published GDP-PPP data by each nation's population estimate for July 2004.

Previously on Political Calculations

2004 Economic and Population Data

- 2004 GDP Rankings for Asia

- European Union 2004 GDP Rankings

- GDP in Africa: 2004

- GDP Rankings of the Americas: 2004 Edition

- EU vs US: Two Years of Economic Data Later....

2002 Economic and Population Data

- EU vs USA

- Cool Tools and GSP

- GDP of the Americas

- GDP in the Muslim World

- GDP in Europe

- GDP: Africa

- GDP Along the Pacific Rim

- GDP in Asia

- GDP: And the rest...

Have you ever read through the business news and come across an article that trumpeted the upgrade of a company's corporate bond ratings from B+ to BB-? Come on now - what the heck does that mean and why on earth should anybody care about it?!

As it turns out, it is a big deal. What it means is that particular company's cost of borrowing money has just dropped - maybe substantially depending on how high it's new rating is. It also means that the company is going to be able to take the same money its making today and deliver more of it to its bottom line. Conversely, when a company's bond ratings are downgraded, it means that its cost of new borrowing has just increased, making it less able to deliver the kind of bottom line results it might have been able to do previously.

In either case, if you are an investor with holdings in the company or potentially looking at investing in the company, that's vital information that can affect your decision to buy, hold or sell your holdings.

That's why Political Calculations has decided to create the following tool, which you may use to guesstimate the relative cost of a company's credit. We call it "guesstimating" because it's not easy to come up with a company's total debt picture. You have to do some serious data mining going through the Moody's or Standard & Poor's debt rating services and even the footnotes in a company's annual report to get the details of how the company's top management team has structured its debt.

So, instead of going to all this trouble, we figured it would be easier to look at the relative spreads of composite corporate bond ratings in the recent past (30 June 2004), and assume that today's composite bond market comes close to looking something like it.

So that's how we created the tool below - we took the spreads for the composite corporate 30 year bond ratings linked above, created a polynomial expression that represents the historic data fairly well, then tied it to the easily obtainable current 20 year AAA corporate bond yield from Yahoo! Finance. Just enter the indicated information in the table below, and the tool will guesstimate the rest....

So, using the default values, that company that was upgraded from B+ (9.16%) to BB- (7.96%) really has the potential to save 1.20% on its debt. Compounded over 20 years, we're talking some serious money! Compare this change to the very small change a top ranked company would see if their bond rating increased from AA+ to AAA - given the magnitude of the positive change involved, investors of the lower rated company should expect to see a significantly higher jump in the price of its stock on the news.

In any case, please remember that the rates estimated by this tool are only estimates at best - the corporate bond market is always in flux, which means there's little likelihood that this tool will accurately estimate the actual value of a given credit rating. The best it can do is guesstimate the relative value of a given credit rating compared to another one.

Labels: business, investing, tool

In Political Calculations' year end post for 2005, we concluded that:

Given how relatively flat the National Debt per Capita has been in the last 5 years, I would almost argue that the amount of debt spending agreed to by the U.S. Congress each year takes something like the National Debt per Capita to Income Index into account. Now that the federal government is pushing the edge of the arbitrarily legislated nominal National Debt Limit, it will be interesting to see if this factor plays a role in setting the amount of the increase of this artificial limit.

Yesterday, the Skeptical Optimist forged into the U.S. National Debt Ceiling discussion by proposing that the nation's debt limit should be indexed to the U.S.' National Debt to Income (DTI) ratio, with the debt ceiling automatically set at 80% of the nation's annual Gross Domestic Product.

Using the December 2005 U.S. National Debt ($8,103 billion USD) and U.S. National Income (Nominal GDP = $12,497.8 billion USD) reported by the Skeptical Optimist, indexing the National Debt Ceiling to be 80% of the U.S.' Nominal GDP would place the debt limit at just under $10 trillion USD at $9,998 billion USD. At present, using the Skeptical Optimist's reported data, the U.S. DTI ratio is 64.8%.

But shouldn't we also take U.S. population growth into account in setting this limit? Since federal government spending is, in good part, apportioned according to the size of the U.S. population, I believe it would make more sense to automatically adjust the U.S. National Debt Ceiling to be in step with something like Political Calculations' National Debt per Capita to Income Index.

Here's what that would mean. Using December 2005's National Debt and Nominal GDP data, as well as today's estimate of the U.S. population of 297,855,637, the National Debt per Capita to Income Index is 2.18 (the current National Debt per Capita is $27,204). If we use the Skeptical Optimist's proposed 80% DTI level to cap the National Debt Ceiling, the National Debt per Capita to Income Index would be 2.69, corresponding to a National Debt per Capita of $33,567 USD. Now, here's the good news - setting the U.S. National Debt Ceiling according to the National Debt per Capita to Income Index would ensure that every individual's share of the U.S. National Debt would not rise above this figure, at least in the constant terms of December 2005's Nominal GDP.

In other words, by using the National Debt per Capita to Income Index, we get a solid debt cap (on a per Capita basis) that's flexible enough to accommodate both GDP growth and population growth.

And all that has to happen to make this possible is for the politicians to willingly give up their unlimited desire to demagogue the issue....

Labels: national debt

Don't you just hate it when your place of work has become the target of political protests? Not that we here at Political Calculations have much trouble in that regard, at least not since the incident involving the chicken cannon, but really, what can you do when you still have to show up every day and do what you have to do?

The truth is that dealing with protesters can be very problematic for companies whose business operations might be considered controversial - or it can be a real opportunity to build goodwill in the community by carefully listening to the real concerns of protestors. Here's a slightly modified version of how a company might seek to turn lemons into lemonade by reaching out to those passionate enough to organize a protest outside its offices....

Standard form #27B/j

Please take a few minutes to fill out this questionaire. All answers will be kept confidental and are used only for research purposes.

Thank you for your time. Your answers will help (this office) become more responsive to protester needs as part of our service goals.

If you think that's bad, just consider the forms the protest leaders must have to fill out as part of the annual performance review process for the individual protestors they lead!

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.