Here's a problem from real life in early 2024. Let's say you're thinking about taking the plunge and getting an electric-powered vehicle. Whether it's because you want to be seen as someone who cares about the environment or it's because you really like the idea of having the power of instantaneous torque when you step on the accelerator, getting an EV is something you've decided to do.

But because the technology is changing so quickly and because electric vehicle prices are falling, you don't want to lock yourself into owning an electric vehicle. You're looking to lease one for a few years instead.

Sound plausible so far? Okay, let's get really specific. Let's say you've narrowed your options and are thinking about leasing a $38,990 Tesla Model 3, which has a down payment of $2,999. The lease payment is $299 a month for three years, and at the end of the lease term the car’s market value is projected to be about 67% of its original value. What is the effective interest rate you'll pay for this leasing deal?

That's not so easy a question to answer because even if you have the right formula to plug all these numbers into, because there's no straightforward way to rearrange that equation to simply solve it for the interest rate. You'll either have to use trial and error to get to that answer or you'll need to apply some advanced math and run through a series of calculations to get to a precise approximation.

Unless you're willing to trade a little accuracy to get to a still reasonably accurate result. There is a relatively simple equation that can calculate an approximate value for the interest rate, which we've built the following tool to do. If you've accessing this article on a site that republishes our RSS news feed, please click through to our site to access a working version of the tool.

The result of the tool should give you a reasonable estimate of the effective interest rate you're paying to take out this lease. For the default values in our leasing scenario, that result is 5.73%.

But if you have other numbers, by all means, take the tool for a test drive with them! And if you can get the actual lease interest rate, compare your results to see how close the approximation behind this got to the exact result!

Image credit: Tesla Model 3 (2023) by Kazyakurumaon Wikimedia Commons. Creative Commons CCO 1.0 DEED CC0 1.0 Universal .

Labels: personal finance, tool

Later this week, on Thursday, 25 April 2024, the Bureau of Economic Analysis will publish its first estimate of the United States' Gross Domestic Product during the first quarter of 2024.

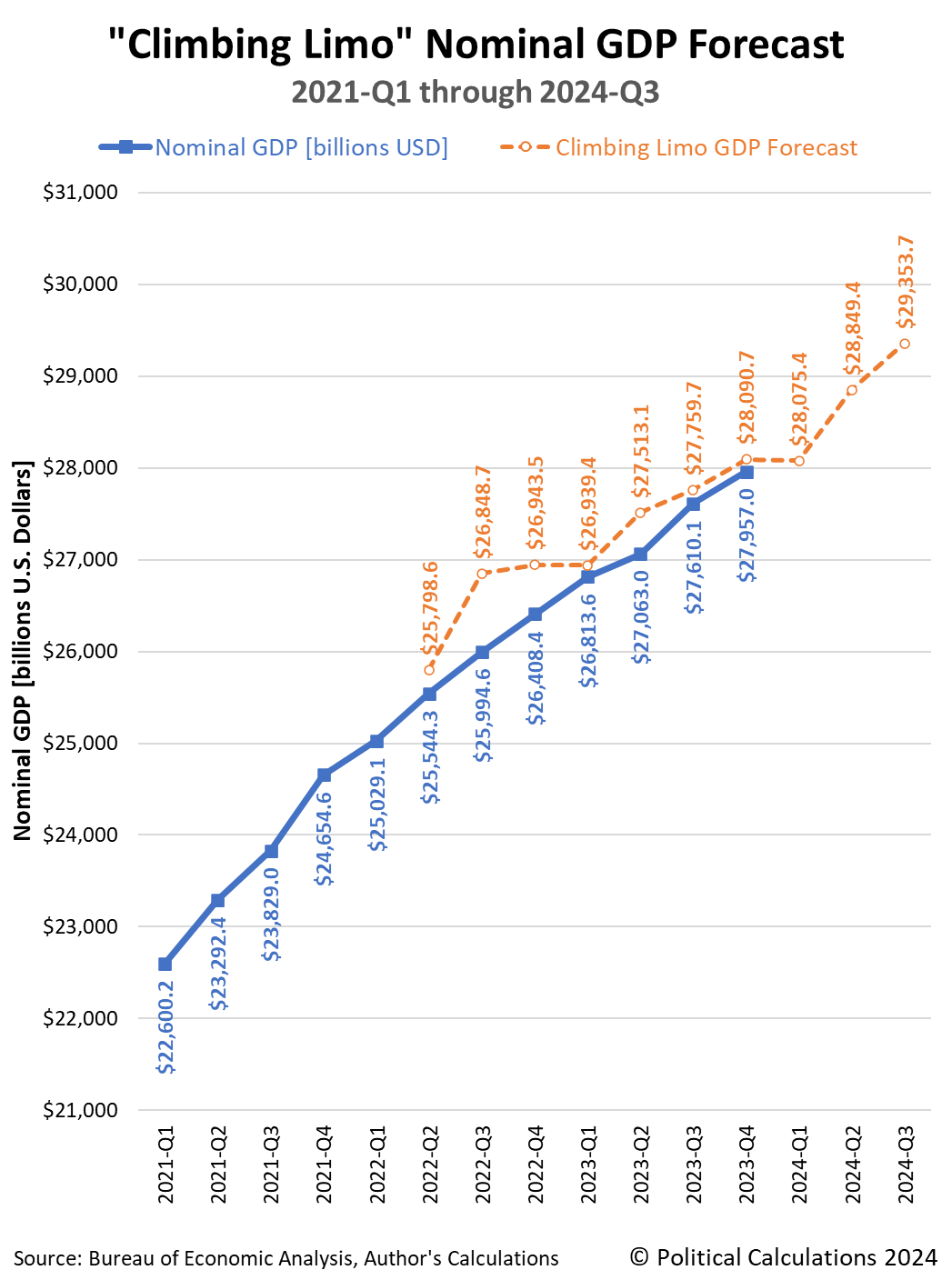

Because that date is so close, it's a good opportunity to check in with how 2024-Q1's GDP tracks with what a momentum-based forecasting method projected it would be for this quarter over seven months ago. That simple method, called the "Climbing Limo", uses nominal GDP data that was available back in September 2023 in its projections.

The following chart reveals how closely that method worked for anticipating the final GDP estimate for the fourth quarter of 2023 (2023-Q4), which only became available last month. As you can see, there's only a half-percent difference between the forecast for 2023-Q4's nominal GDP and the BEA's official estimate for the quarter.

If the Atlanta Fed's GDPNow forecast for 2024-Q1 is right, this quarter could be the first in which actual GDP exceeds the climbing limo's momentum-based forecast in the period covered by the chart.

Which means nearly nothing. That's because when economic growth is relatively stable, it's common for forecast and actual GDP data series to periodically cross over each other just based on variation in the data. For the period shown on the chart, which presents the Climbing Limo forecast using only the actual GDP data shown on the chart, it has been unusual for actual GDP to have so consistently underperformed the momentum-based forecast.

That could be because inflation, which is built into the nominal GDP estimates, has been slowing over this period. But there are other potential explanations that could account for that pattern as well, including slowing momentum in the U.S. economy after the initial phase of the post-Coronavirus Recession recovery.

Regardless, it will be another two months before we get the BEA's final GDP estimate for the first quarter of 2024 to see how good the Climbing Limo's forecast for 2024-Q1 turned out to be.

Looking much further forward, since the GDP data for 2023-Q4 has been finalized, the Climbing Limo method projection using that data point suggests some rather robust GDP growth through the third quarter of 2024. Unfortunately, it will be months before we find out how good that forecast is. As a general rule of thumb, it's usually within a few percentage points of the actual GDP estimate, but that can change if the economy turns a proverbial corner, either for the better or for the worse. In either of these cases, a comparison with the Climbing Limo forecast provides a useful confirmation of which situation applies.

References

U.S. Bureau of Economic Analysis. National Income and Product Accounts. Table 1.1.5. Gross Domestic Product. [Online Database]. Accessed 21 April 2024.

Political Calculations. Forecasting GDP Using the Climbing Limo. [Online Tool]. 10 May 2005.

Image Credit: Microsoft Copilot Designer. Prompt: "A limousine with the letters 'GDP' driving upward to the top of a hill on a very rocky road, with the limousine driving on the rocks".

Labels: gdp forecast

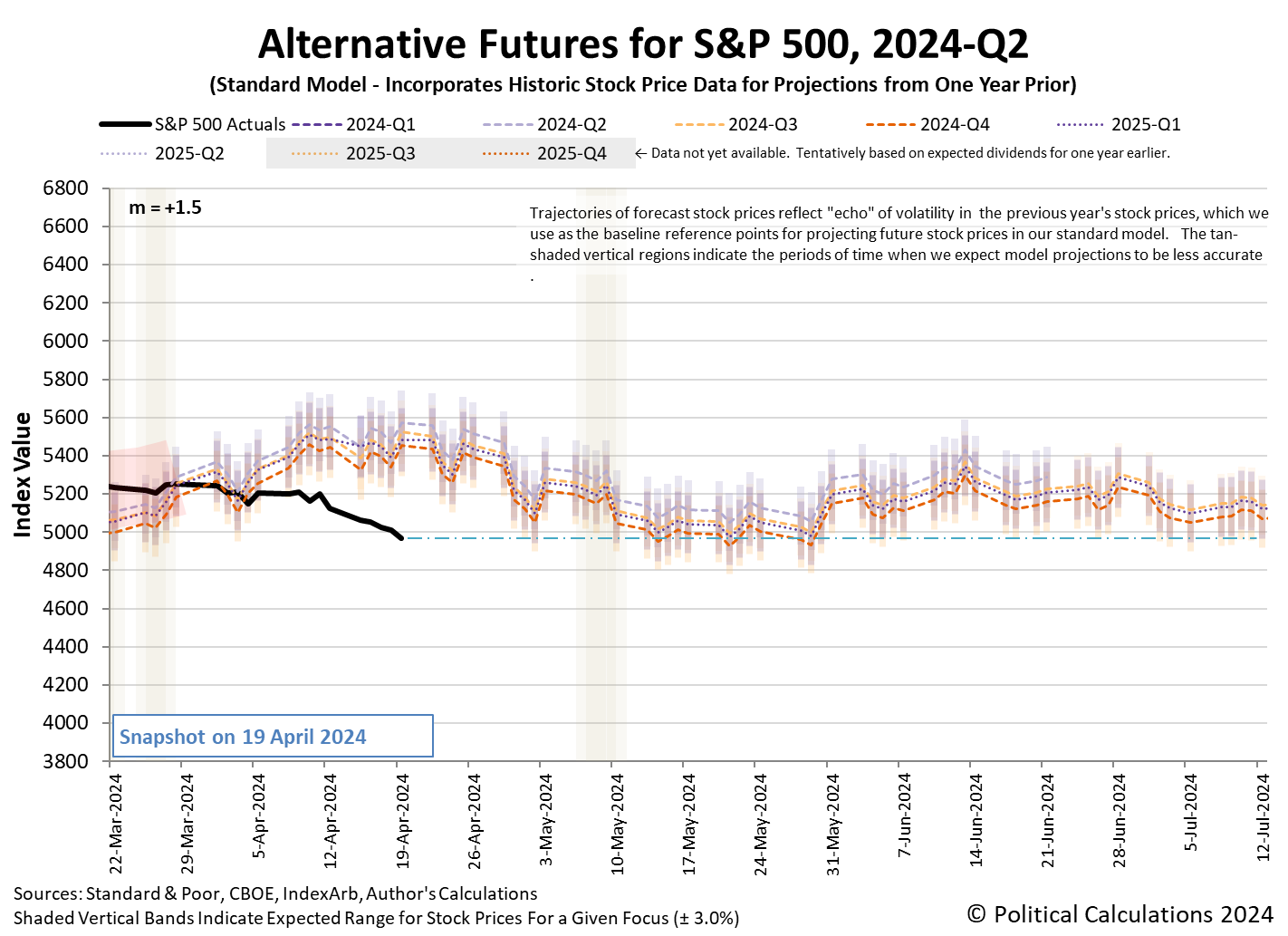

The S&P 500 (Index: SPX) fell again durin ghte third week of April 2024. The index closed out the week at 4,967.23, a little over three percent below the level it closed the second week. The index has dropped 5.5% below its record peak closing value from 28 March 2024.

The main driving force behind the falling level of stock prices are slipping expectations for when and by how much the Federal Reserve will cut interest rates during 2024. The CME Group's FedWatch Tool anticipates the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) when a quarter point reduction is expected, some twelve weeks longer than expected just a week earlier. The tool also projects only one rate cut in 2024, the timing of which is looking uncertain.

As we illustrated in a separate analysis, that slipping timing is reducing the expected level of dividends in future quarters. Right now, we think investors have been scared by the "no rate cut" bear into shifting their forward-looking focus to either 2024-Q3 or 2024-Q4, with their investment time horizon being affected by the sliding expectations for when the Fed might alter the level of short term interest rates in the U.S.

We're basing that hypothesis on the level the dividend futures-based model is projecting the potential level of the S&P 500 will be a month from now as we're within the month-long window in which its projections have "locked in". The latest update for the alternative futures chart shows the current level of the index is consistent with the model's still-dynamic projections outside of the locked-in period:

An alternate explanation is the stock market is experiencing a regime change, in which the dividend futures-based model's basic multiplier has changed, but we would need several more weeks of data to confirm if that is the case. We're weighing these scenarios behind the scenes, where we haven't yet seen sufficient data to determine the established value of the multiplier has definitively broken from the level it has held since 9 March 2023.

In the meantime, the context provided by the market-moving headlines of the week points to that market regime still holding. The week's headlines point to the rapidly slipping expected timing of rate cuts in 2024, which continued in the past week, as the continuing culprit in the decline of stock prices during the last several weeks.

- Monday, 15 April 2024

-

- Signs and portents for the U.S. economy:

- US growth may be a global boon, but inflation could derail the train

- Oil slips as risk premium eases after Iran attack

- Fed minions say they won't rush to cut rates until they need to see data pointing to wage inflation:

- Fed should not act urgently to cut rates unless required, Daly says

- US workers seeking record wages to consider new jobs, New York Fed says

- Fed's reverse repo facility plummets to lowest level in nearly three years

- Bigger trouble, stimulus developing in China:

- China's Q1 GDP growth likely to slow, more stimulus on the cards

- China c.bank keeps policy rate unchanged, drains cash from banking system

- Economic growth signs in Japan:

- Nasdaq, S&P, and Dow ended notably lower while yields rallied once again

- Tuesday, 16 April 2024

-

- Signs and portents for the U.S. economy:

- US single-family housing starts plunge in March

- Oil slips as concern eases about Middle East supply risk

- US manufacturing output increases in March; February data revised higher

- In reversal, Fed minions claim they need more time to combat inflation before they can cut rates:

- Federal Reserve's restrictive policy needs more time to work, Jerome Powell says

- Fed could keep monetary policy tight for longer if needed, Jefferson says

- Bigger trouble, stimulus developing in China as Q1 growth better than expected:

- China's Q1 GDP grows 5.3% y/y, well above forecast

- China's cycle of dollar hoarding and weakening yuan gets vicious

- China's new home prices decline at fastest pace since 2015

- Chinese city Zhengzhou tells state-owned company to buy second-hand homes to reduce new housing inventories

- Nasdaq, S&P, Dow end mixed after hawkish Powell further clouds rate cut expectations

- Wednesday, 17 April 2024

-

- Signs and portents for the U.S. economy:

- US regional banks seen booking more commercial property losses, loan sales

- Oil dips as demand worries outweigh Middle East supply risks

- US wheat farmers face bleak crop economics as grain oversupply hits

- Fed minions say they're in "no hurry" to cut interest rates:

- Bigger trouble, stimulus developing in China:

- ECB minions looking forward to cutting Eurozone interest rates, don't want to review their inflation target anytime soon:

- ECB firmly behind June rate cut but views diverge on July

- ECB's Vasle sees rates much closer to 3% at year-end

- ECB's Centeno says policy would be tight even after two rate cuts

- ECB's Lagarde hints it is too early to review inflation target

- Nasdaq sheds more than 1%, S&P posts four-day losing streak, Dow slips slightly

- Thursday, 18 April 2024

-

- Signs and portents for the U.S. economy:

- Oil extends losses on easing Middle East tension, demand concerns

- Mortgage rates top 7% for the first time this year, Freddie Mac says

- Fed minions now saying they're in no "mad dash hurry" to cut interest rates:

- Fed's Bostic says he is not in a 'mad dash hurry' on rate cuts

- Fed's Williams doesn't see urgent need to cut interest rates

- BOJ minions promise future rate hikes will be slow:

- BOJ's Noguchi says future rate hikes likely to be slow

- BOJ's Ueda signals possible rate hike if weak yen boosts inflation

- ECB minions say they're "crystal clear" on cutting Eurozone interest rates in June:

- ECB 'crystal clear' on June rate cut, de Guindos says

- German home building permits tumble 18% in February, extending rout

- S&P posts five-day loss for first time since Oct, Nasdaq & Dow end mixed; eyes on Netflix

- Friday, 19 April 2024

-

- Signs and portents for the U.S. economy:

- Oil settles slightly higher as Iran plays down reported Israeli attack

- Fed says 1,804 banks and other institutions tapped emergency lending facility

- IMF minions getting mad at Fed minions; Fed minions say they're doing nothing because Bidenflation not going away:

- Fed's rate-cut foot-dragging grates on global peers at IMF meetings

- Fed policy on hold because of 'stalled' progress on inflation, Goolsbee says

- Bigger trouble, stimulus developing in China:

- BOJ minions say rate hikes are coming:

- ECB minions say inflation could go either way:

- Wall Street's April pullback intensifies as S&P 500 notches worst week in over a year

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) rose to +2.9% from the +2.4% growth forecast last week.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a bear with a sign that says 'NO RATE CUTS' scaring Wall Street traders"

What happens when you embed a miniature flying drone inside a ball? Or more precisely, when you mount a lightweight miniature drone inside a ball-shaped frame that allows air to pass through so the drone's rotors can work?

What you get is a bit of modern magic that lets you play catch with yourself. Meet the Flying Orb Ball Hover Toy, or "the boomerang ball", the concept of which is demonstrated in the following short video (HT: Core77):

Versions of this technological wonder are available at retailers like Amazon and Walmart. And like many modern tech-based toys, it has a rechargeable battery.

That brings us to the downside of this new technology. It takes 25 minutes to charge up one of these flying orbs to get about 10 minutes of play time from it. So for you and your kids to get maximum entertainment from these devices, you would have to buy several, as we suspect their makers and retailers are hoping you might.

If you take that plunge, you might also think about getting one of those ball bags that baseball umpires use, which of course, are sold separately.

Labels: technology

Nearly four weeks ago, we put down a marker for what lay ahead for the S&P 500 based on the index' quarterly dividend futures.

Looking beyond 2024-Q2, you'll see something unusual. There's projected drop-off in quarterly dividends between 2024-Q2 and 2024-Q3. It's unusual because we would ordinarily expect to see the third quarter's anticipated dividends fall in between the projected values for the second and fourth quarters. And since the outlook for the index' dividends in all quarters has been improving, we would have at least expected to see it close the gap between the second and fourth quarter's values.

But it hasn't. If anything, the projected drop-off in the dividends expected to be paid from 2024-Q2 to 2024-Q3 has been remarkably persistent in all the months we have been observing it and has increased in size. That persistence suggests investors have potentially built in expectations of turbulence ahead for dividend paying stocks.

That market turbulence would most likely take place during the upcoming quarter of 2024-Q2, which would subsequently show up in the dividends paid in the following quarter of 2024-Q3.

We're not even three full weeks into 2024-Q2 and the leading edge of that forecast market turbulence would appear to have arrived. The S&P 500 has dropped nearly four percent from the record high level it reached at the end of March 2024. Here's what the S&P 500's quarterly dividend futures look like as of Monday, 15 April 2024:

As expected, we've also had to reset the vertical scale of this chart to accommodate the dividends expected to be paid out in 2024-Q2, which has risen from $18.96 to $19.11 per share since our last snapshot.

Meanwhile, the amount of dividends expected to be paid out by S&P 500 firms during 2024-Q3 has decreased, falling from $17.82 to $17.72 during the last four weeks. The projected dividends for 2024-Q4 has likewise fallen, dropping from $18.45 to $18.31 during this interval.

The decline in expectations for the S&P 500's quarterly dividends in these future quarters is a consequence of a change in expectations for how the Federal Reserve will set short term interest rates in the U.S. Four weeks ago, the CME Group's FedWatch Tool indicated investors expected the Fed would launch a series of quarter point rate cuts at six-to-twelve week intervals before the end of 2024-Q2. As of 15 April 2024, the FedWatch Tool projects the Fed will only cut the Federal Funds Rate once during 2024. That cut is anticipated in September.

With U.S. interest rates being held higher for longer, the resulting higher cost of paying interest for borrowing money is expected to reduce the earnings of many of the companies whose stocks make up the S&P 500 index. Those lower earnings, in turn, mean lower dividend payouts.

There is a bright spot in this outlook, for which we also put down a marker with its own cautionary note:

Since quarterly dividends are projected to rise in 2024-Q4, that suggests investors expect this turbulence will be relatively short-lived.

At least, that's the implied expectation at this juncture. The most important thing to remember about the future is that it's subject to change with little notice.

A lot has changed in the last four weeks. Our next planned snapshot of S&P 500 quarterly dividend futures and what they indicate will be in five weeks.

Image Credit: Microsoft Copilot Designer. Prompt: "A fortune teller looking into a crystal ball to make a prediction about the S&P 500".

Labels: dividends, forecasting, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.